Greenlight Company Presentation

iPrefs Impact the Common Stock

o iPref dividends reduce Apple net

income and EPS available to the

common stock

o Constant P/E multiple x Adjusted EPS =

Estimated price of Apple common

stock after Apple distributes iPrefs

Greenlight Capital, Inc.

Apple net income

Less: ¡Pref dividends

Pro forma net income

$ billions $ per share

Constant P/E multiple

New Apple price per share

Current price per share

Change in price per share

42.5 $45

(1.9)

40.6

($2)

$43

10.0x

$430

$450

($20)

37

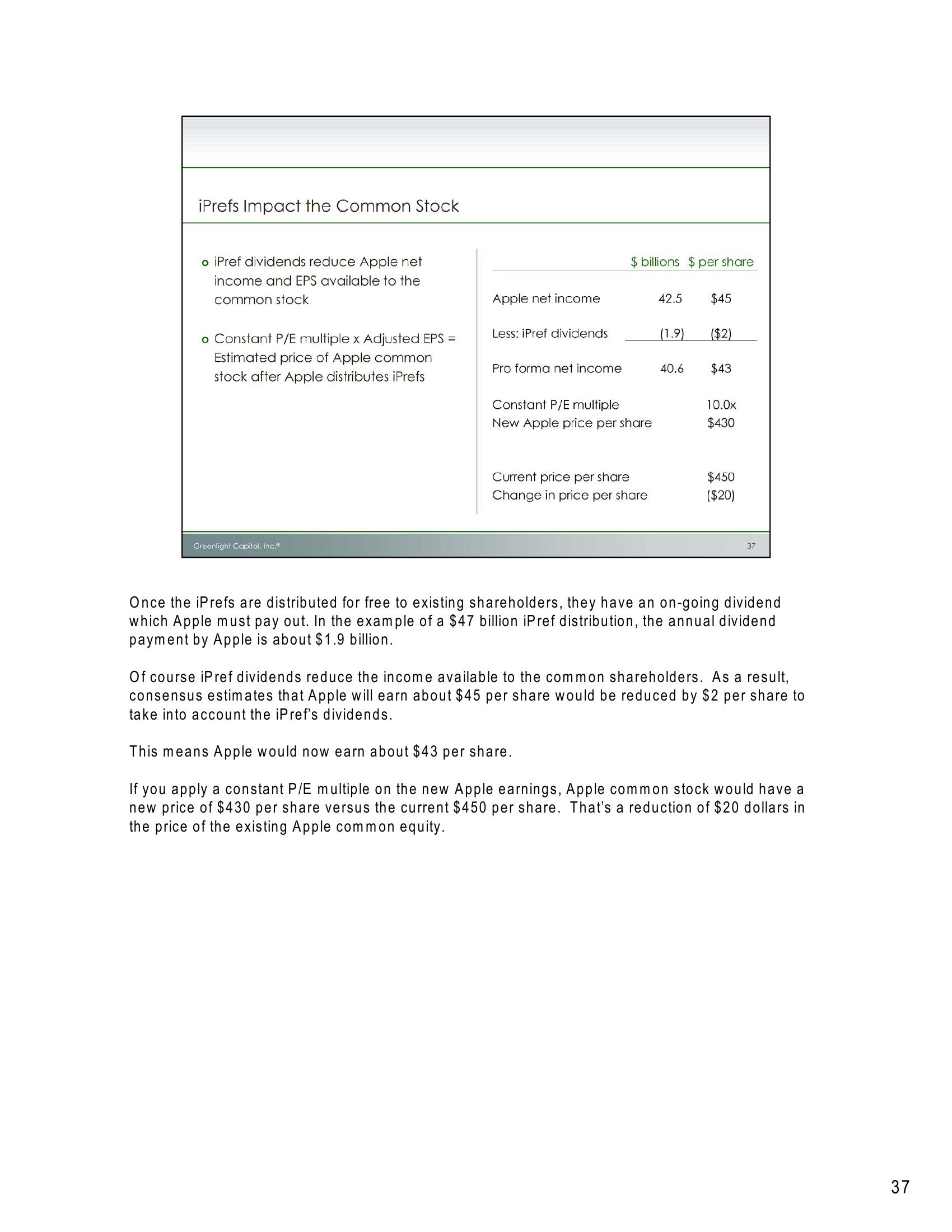

Once the iPrefs are distributed for free to existing shareholders, they have an on-going dividend

which Apple must pay out. In the example of a $47 billion iPref distribution, the annual dividend

payment by Apple is about $1.9 billion.

Of course iPref dividends reduce the income available to the common shareholders. As a result,

consensus estimates that Apple will earn about $45 per share would be reduced by $2 per share to

take into account the iPref's dividends.

This means Apple would now earn about $43 per share.

If you apply a constant P/E multiple on the new Apple earnings, Apple common stock would have a

new price of $430 per share versus the current $450 per share. That's a reduction of $20 dollars in

the price of the existing Apple common equity.

37View entire presentation