Main Street Capital Investor Day Presentation Deck

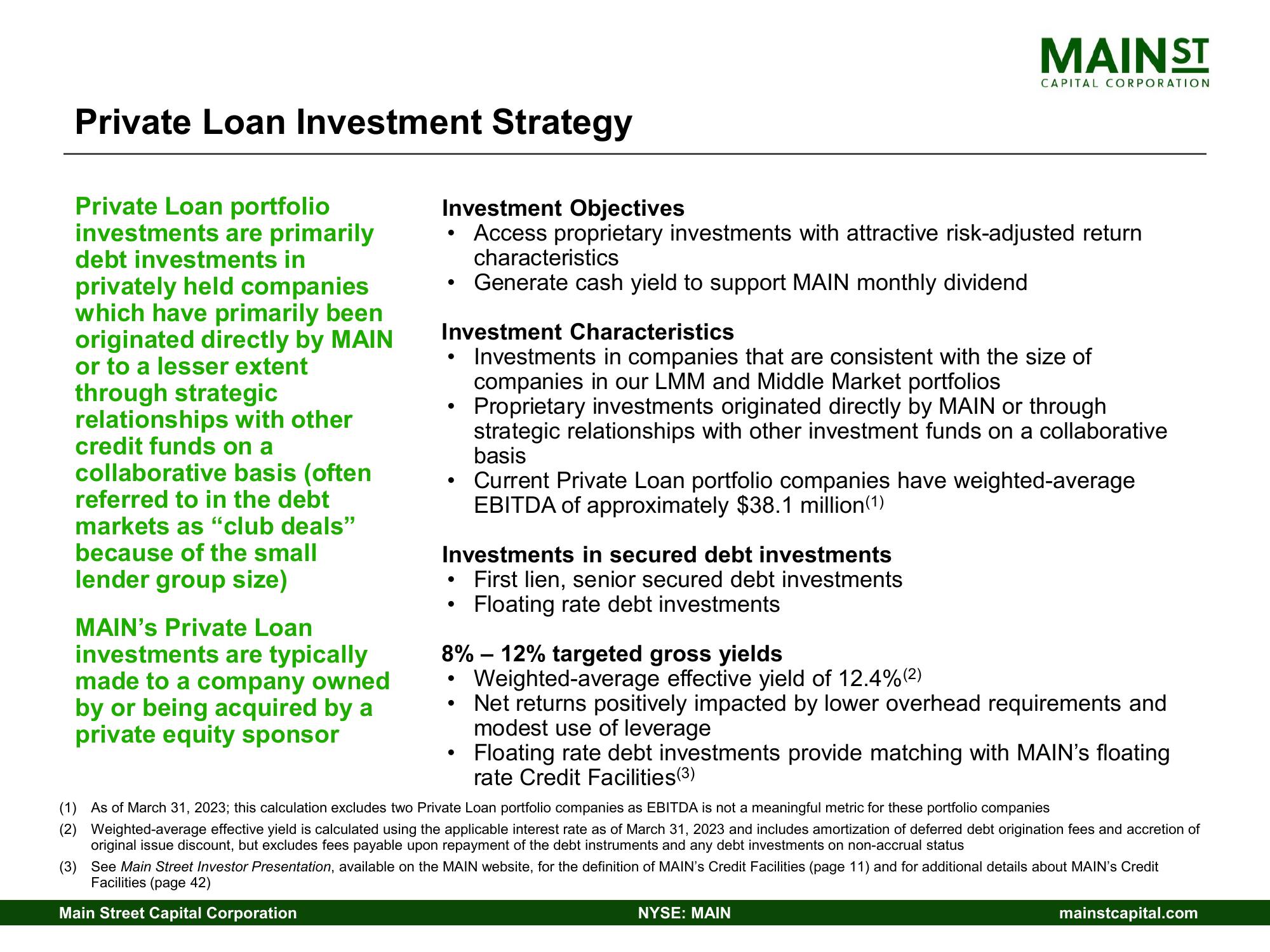

Private Loan Investment Strategy

Private Loan portfolio

investments are primarily

debt investments in

privately held companies

which have primarily been

originated directly by MAIN

or to a lesser extent

through strategic

relationships with other

credit funds on a

collaborative basis (often

referred to in the debt

markets as "club deals"

because of the small

lender group size)

MAIN's Private Loan

investments are typically

made to a company owned

by or being acquired by a

private equity sponsor

●

Investment Objectives

Access proprietary investments with attractive risk-adjusted return

characteristics

Generate cash yield to support MAIN monthly dividend

●

●

Investment Characteristics

Investments in companies that are consistent with the size of

companies in our LMM and Middle Market portfolios

●

Investments in secured debt investments

First lien, senior secured debt investments

Floating rate debt investments

●

●

8% -12% targeted gross yields

●

●

MAINST

●

CAPITAL CORPORATION

Proprietary investments originated directly by MAIN or through

strategic relationships with other investment funds on a collaborative

basis

Current Private Loan portfolio companies have weighted-average

EBITDA of approximately $38.1 million(1)

Weighted-average effective yield of 12.4% (2)

Net returns positively impacted by lower overhead requirements and

modest use of leverage

Floating rate debt investments provide matching with MAIN's floating

rate Credit Facilities (3)

(1) As of March 31, 2023; this calculation excludes two Private Loan portfolio companies as EBITDA is not a meaningful metric for these portfolio companies

(2) Weighted-average effective yield is calculated using the applicable interest rate as of March 31, 2023 and includes amortization of deferred debt origination fees and accretion of

original issue discount, but excludes fees payable upon repayment of the debt instruments and any debt investments on non-accrual status

NYSE: MAIN

(3) See Main Street Investor Presentation, available on the MAIN website, for the definition of MAIN's Credit Facilities (page 11) and for additional details about MAIN's Credit

Facilities (page 42)

Main Street Capital Corporation

mainstcapital.comView entire presentation