Pathward Financial Results Presentation Deck

INTEREST RATE RISK MANAGEMENT

MARCH 31, 2021

65%

50%

35%

20%

5%

-10%

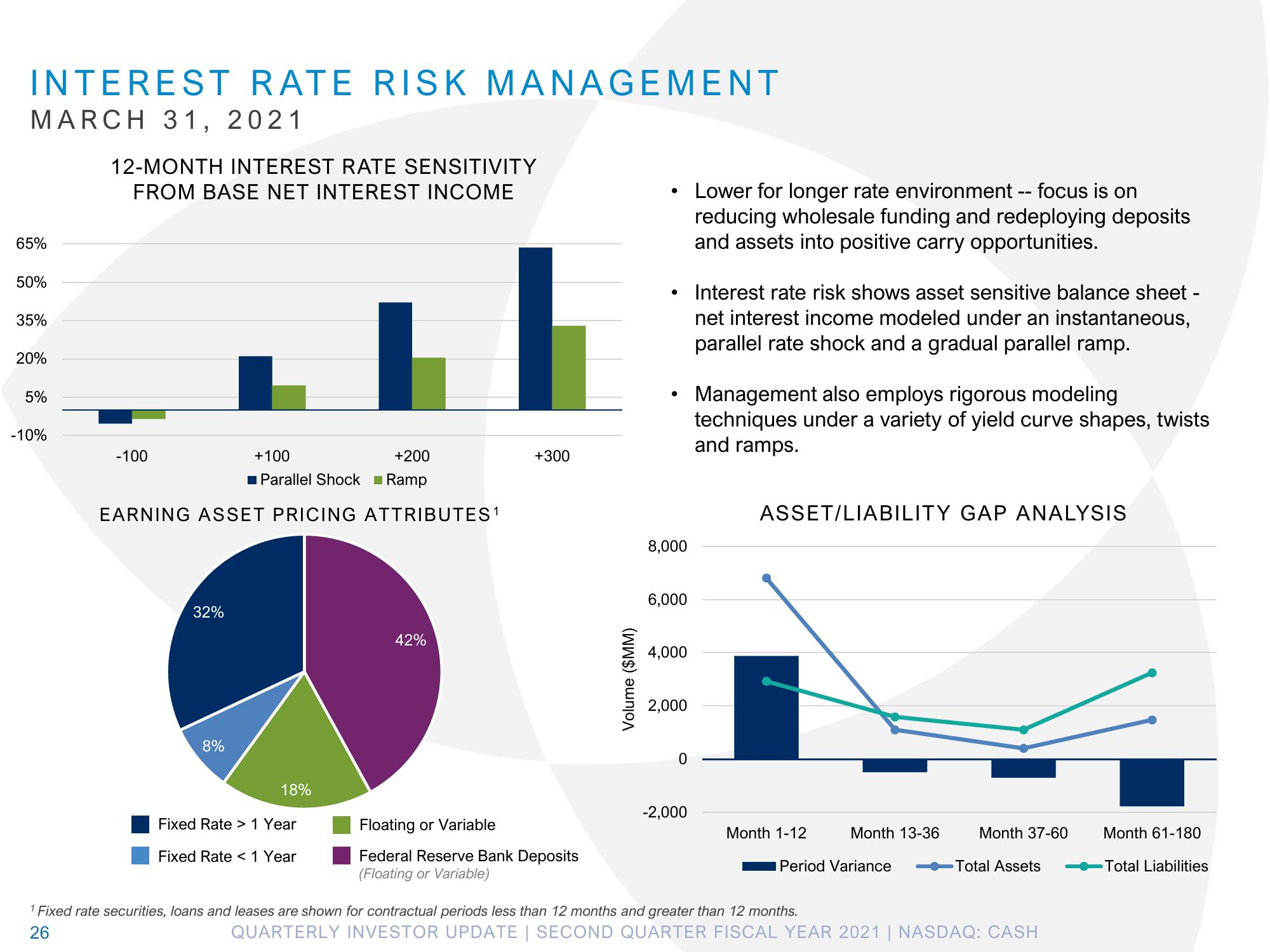

12-MONTH INTEREST RATE SENSITIVITY

FROM BASE NET INTEREST INCOME

+100

+200

Parallel Shock Ramp

EARNING ASSET PRICING ATTRIBUTES ¹

-100

32%

8%

18%

Fixed Rate > 1 Year

Fixed Rate < 1 Year

42%

+300

Floating or Variable

Federal Reserve Bank Deposits

(Floating or Variable)

Volume ($MM)

●

8,000

6,000

4,000

2,000

0

-2,000

Lower for longer rate environment -- focus is on

reducing wholesale funding and redeploying deposits

and assets into positive carry opportunities.

Interest rate risk shows asset sensitive balance sheet -

net interest income modeled under an instantaneous,

parallel rate shock and a gradual parallel ramp.

Management also employs rigorous modeling

techniques under a variety of yield curve shapes, twists

and ramps.

ASSET/LIABILITY GAP ANALYSIS

Month 1-12

Month 13-36

Period Variance

Month 37-60

Total Assets

¹ Fixed rate securities, loans and leases are shown for contractual periods less than 12 months and greater than 12 months.

26

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

Month 61-180

Total LiabilitiesView entire presentation