TPG Results Presentation Deck

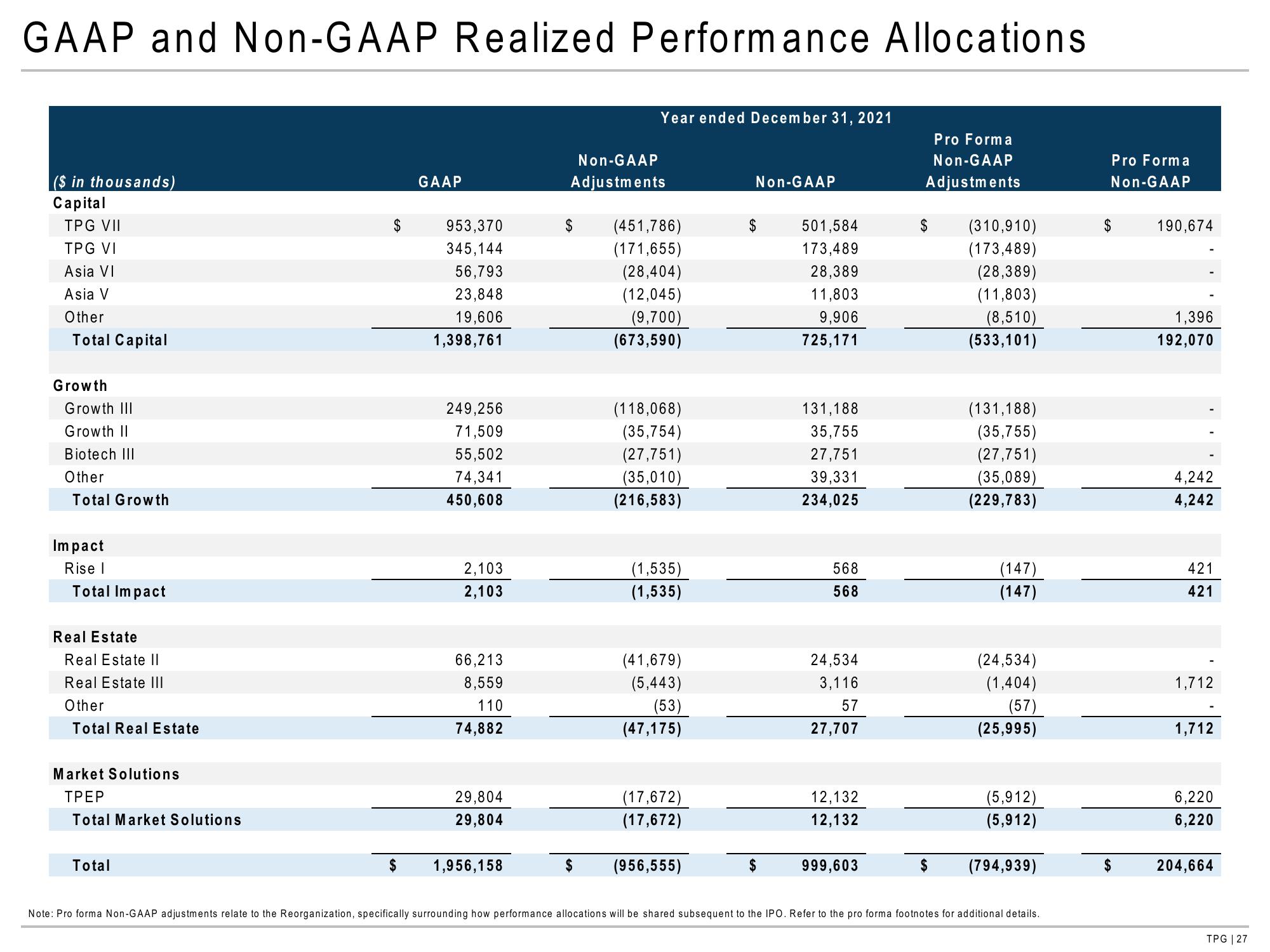

GAAP and Non-GAAP Realized Performance Allocations

($ in thousands)

Capital

TPG VII

TPG VI

Asia VI

Asia

Other

Total Capital

Growth

Growth III

Growth II

Biotech III

Other

Total Growth

Impact

Rise I

Total Impact

Real Estate

Real Estate II

Real Estate III

Other

Total Real Estate

Market Solutions

TPEP

Total Market Solutions

Total

$

$

GAAP

953,370

345,144

56,793

23,848

19,606

1,398,761

249,256

71,509

55,502

74,341

450,608

2,103

2,103

66,213

8,559

110

74,882

29,804

29,804

1,956,158

Year ended December 31, 2021

Non-GAAP

Adjustments

(451,786)

(171,655)

(28,404)

(12,045)

(9,700)

(673,590)

(118,068)

(35,754)

(27,751)

(35,010)

(216,583)

(1,535)

(1,535)

(41,679)

(5,443)

(53)

(47,175)

(17,672)

(17,672)

$ (956,555)

Non-GAAP

$

501,584

173,489

28,389

11,803

9,906

725,171

131,188

35,755

27,751

39,331

234,025

568

568

24,534

3,116

57

27,707

12,132

12,132

999,603

Pro Forma

Non-GAAP

Adjustments

$

$

(310,910)

(173,489)

(28,389)

(11,803)

(8,510)

(533,101)

(131,188)

(35,755)

(27,751)

(35,089)

(229,783)

(147)

(147)

(24,534)

(1,404)

(57)

(25,995)

(5,912)

(5,912)

(794,939)

Note: Pro forma Non-GAAP adjustments relate to the Reorganization, specifically surrounding how performance allocations will be shared subsequent to the IPO. Refer to the pro forma footnotes for additional details.

Pro Forma

Non-GAAP

$

190,674

1,396

192,070

4,242

4,242

421

421

1,712

1,712

6,220

6,220

204,664

TPG | 27View entire presentation