Bruker Corporation 2023 JP Morgan Healthcare Conference

YTD Q3 2022 FINANCIALS AND FY2023

YTD Q3 2022: Robust Organic Growth with Solid Margin Expansion

Solid Q4 2022 Organic Revenue Growth, Strong 2023 Outlook

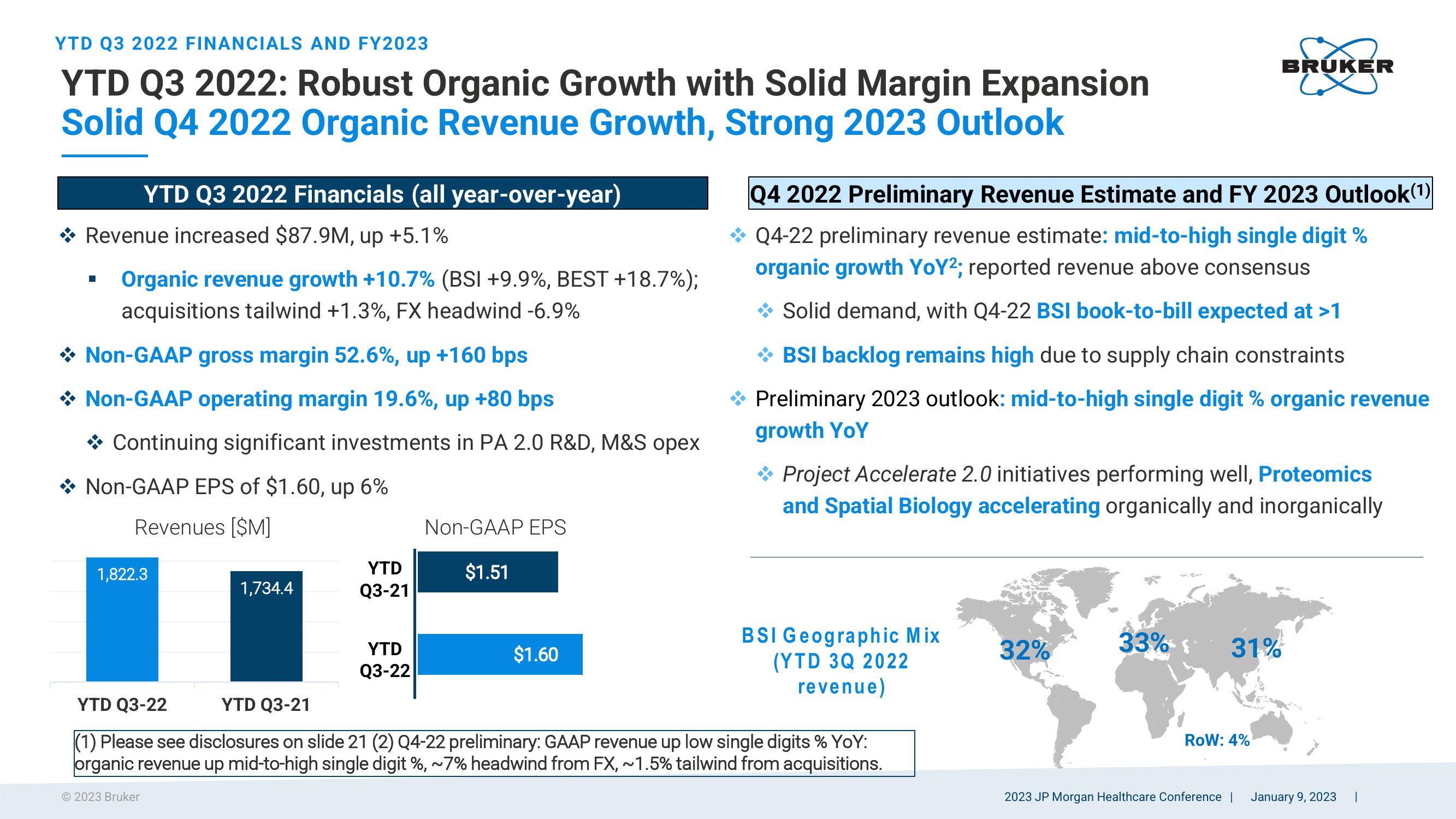

YTD Q3 2022 Financials (all year-over-year)

Revenue increased $87.9M, up +5.1%

Organic revenue growth +10.7% (BSI +9.9%, BEST +18.7%);

acquisitions tailwind +1.3%, FX headwind -6.9%

* Non-GAAP gross margin 52.6%, up +160 bps

* Non-GAAP operating margin 19.6%, up +80 bps

Continuing significant investments in PA 2.0 R&D, M&S opex

Non-GAAP EPS of $1.60, up 6%

Revenues [$M]

1,822.3

2023 Bruker

1,734.4

YTD

Q3-21

YTD

Q3-22

Non-GAAP EPS

$1.51

$1.60

-

E

I I

Q4 2022 Preliminary Revenue Estimate and FY 2023 Outlook(1)

Q4-22 preliminary revenue estimate: mid-to-high single digit %

organic growth YoY2; reported revenue above consensus

→ Solid demand, with Q4-22 BSI book-to-bill expected at >1

→ BSI backlog remains high due to supply chain constraints

Preliminary 2023 outlook: mid-to-high single digit % organic revenue

growth YoY

Project Accelerate 2.0 initiatives performing well, Proteomics

and Spatial Biology accelerating organically and inorganically

BSI Geographic Mix

(YTD 3Q 2022

revenue)

YTD Q3-22

YTD Q3-21

(1) Please see disclosures on slide 21 (2) Q4-22 preliminary: GAAP revenue up low single digits % YoY:

organic revenue up mid-to-high single digit %, ~7% headwind from FX, ~1.5% tailwind from acquisitions.

32%

33% {

31%

BRUKER

ROW: 4%

2023 JP Morgan Healthcare Conference |

January 9, 2023

IView entire presentation