jetBlue Mergers and Acquisitions Presentation Deck

jetBlue

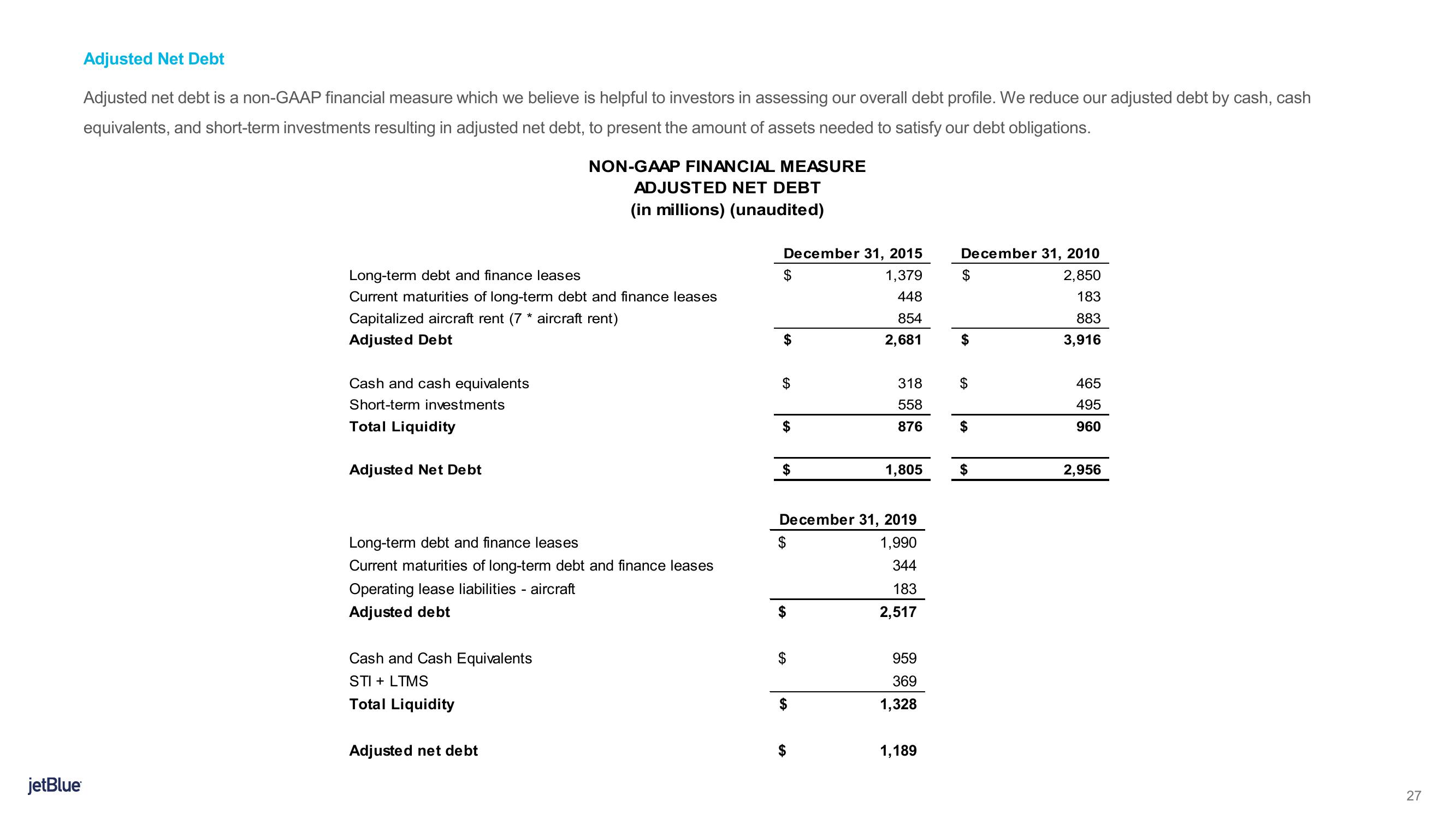

Adjusted Net Debt

Adjusted net debt is a non-GAAP financial measure which we believe is helpful to investors in assessing our overall debt profile. We reduce our adjusted debt by cash, cash

equivalents, and short-term investments resulting in adjusted net debt, to present the amount of assets needed to satisfy our debt obligations.

Long-term debt and finance leases

Current maturities of long-term debt and finance leases

Capitalized aircraft rent (7* aircraft rent)

Adjusted Debt

Cash and cash equivalents

Short-term investments

Total Liquidity

Adjusted Net Debt

NON-GAAP FINANCIAL MEASURE

ADJUSTED NET DEBT

(in millions) (unaudited)

Long-term debt and finance leases

Current maturities of long-term debt and finance leases

Operating lease liabilities - aircraft

Adjusted debt

Cash and Cash Equivalents

STI + LTMS

Total Liquidity

Adjusted net debt

December 31, 2015

1,379

448

854

2,681

$

$

$

$

$

December 31, 2019

1,990

344

183

2,517

$

318

558

876

LA

1,805

959

369

1,328

1,189

December 31, 2010

2,850

183

883

3,916

$

$

$

$

465

495

960

2,956

27View entire presentation