Affirm Investor Day Presentation Deck

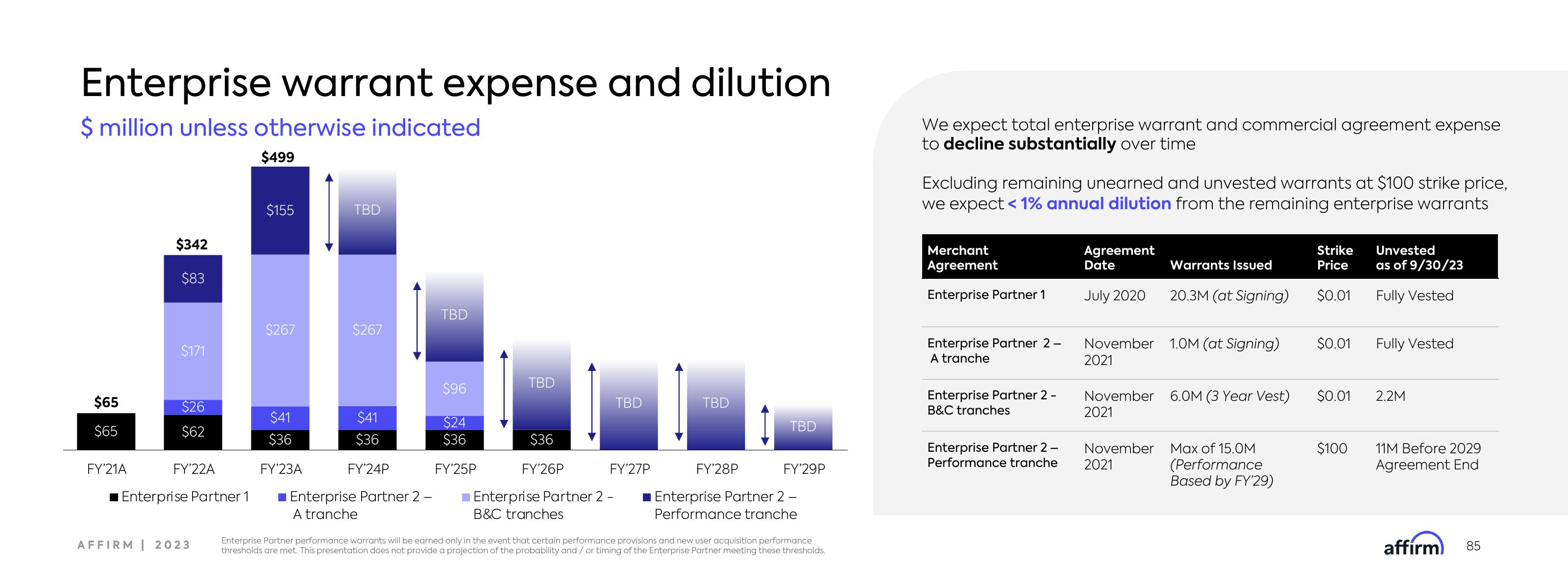

Enterprise warrant expense and dilution

$ million unless otherwise indicated

$65

$65

FY'21A

$342

$83

$171

$26

$62

FY'22A

Enterprise Partner 1

AFFIRM | 2023

$499

$155

$267

$41

$36

FY'23A

TBD

$267

$41

$36

FY'24P

■ Enterprise Partner 2 -

A tranche

TBD

$96

$24

$36

FY'25P

TBD

$36

FY'26P

TBD

FY'27P

Enterprise Partner 2 -

B&C tranches

TBD

FY'28P

TBD

FY'29P

Enterprise Partner 2 -

Performance tranche

Enterprise Partner performance warrants will be earned only in the event that certain performance provisions and new user acquisition performance

thresholds are met. This presentation does not provide a projection of the probability and / or timing of the Enterprise Partner meeting these thresholds.

We expect total enterprise warrant and commercial agreement expense

to decline substantially over time

Excluding remaining unearned and unvested warrants at $100 strike price,

we expect < 1% annual dilution from the remaining enterprise warrants

Merchant

Agreement

Enterprise Partner 1

Enterprise Partner 2 -

A tranche

Enterprise Partner 2 -

B&C tranches

Enterprise Partner 2 -

Performance tranche

Agreement

Date

July 2020

November

2021

November

2021

November

2021

Warrants Issued

20.3M (at Signing)

1.0M (at Signing)

6.0M (3 Year Vest)

Max of 15.0M

(Performance

Based by FY'29)

Strike

Price

$0.01

$0.01

$0.01

$100

Unvested

as of 9/30/23

Fully Vested

Fully Vested

2.2M

11M Before 2029

Agreement End

affirm

85View entire presentation