BenevolentAI SPAC Presentation Deck

Strong Financial Position

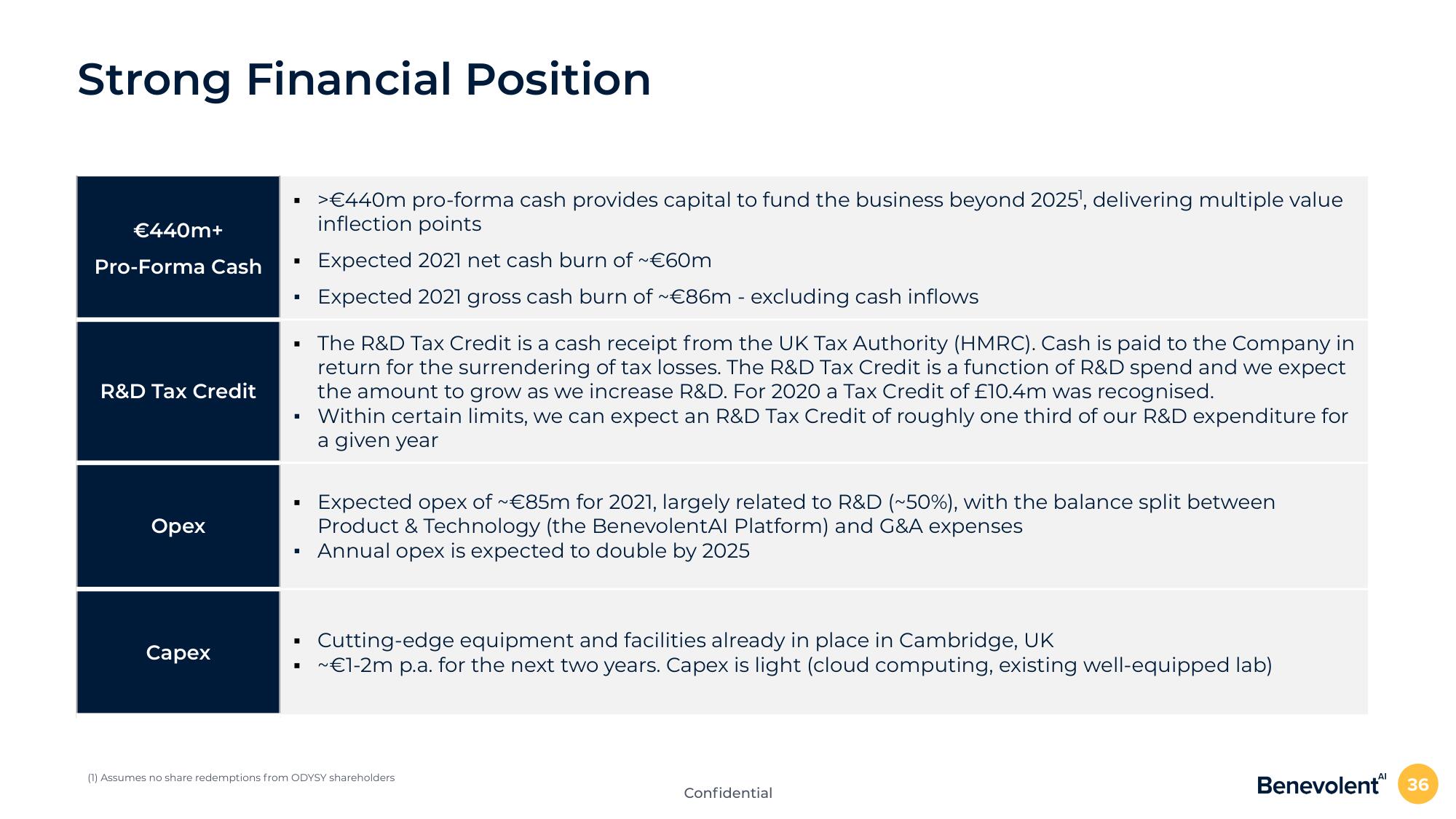

€440m+

Pro-Forma Cash

R&D Tax Credit

Opex

Capex

I

>€440m pro-forma cash provides capital to fund the business beyond 2025¹, delivering multiple value

inflection points

■

Expected 2021 net cash burn of ~€60m

Expected 2021 gross cash burn of ~€86m - excluding cash inflows

▪ The R&D Tax Credit is a cash receipt from the UK Tax Authority (HMRC). Cash is paid to the Company in

return for the surrendering of tax losses. The R&D Tax Credit is a function of R&D spend and we expect

the amount to grow as we increase R&D. For 2020 a Tax Credit of £10.4m was recognised.

Within certain limits, we can expect an R&D Tax Credit of roughly one third of our R&D expenditure for

a given year

Expected opex of ~€85m for 2021, largely related to R&D (~50%), with the balance split between

Product & Technology (the BenevolentAl Platform) and G&A expenses

Annual opex is expected to double by 2025

Cutting-edge equipment and facilities already in place in Cambridge, UK

~€1-2m p.a. for the next two years. Capex is light (cloud computing, existing well-equipped lab)

(1) Assumes no share redemptions from ODYSY shareholders

Confidential

Benevolent 36View entire presentation