Ares US Real Estate Opportunity Fund III

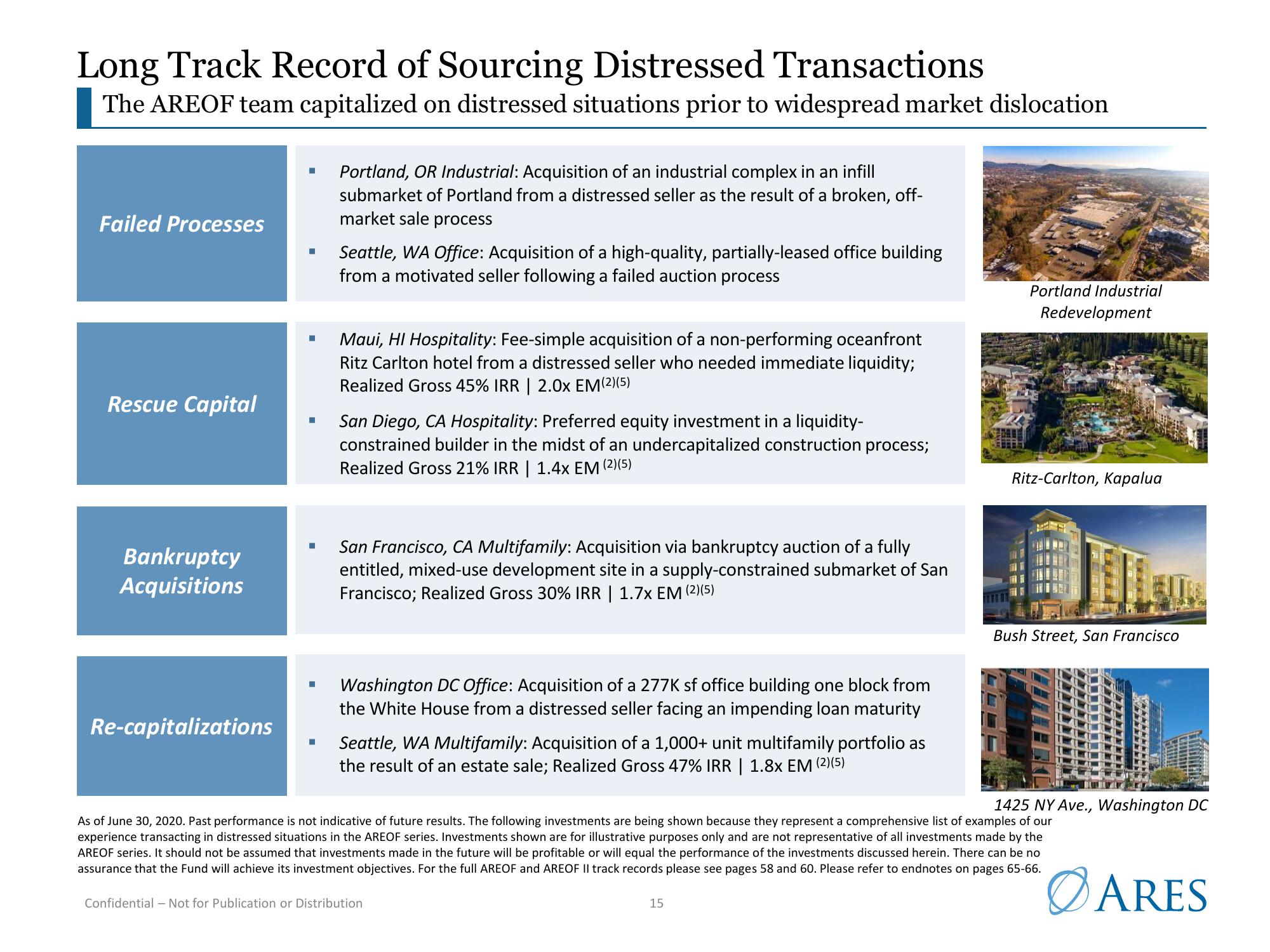

Long Track Record of Sourcing Distressed Transactions

The AREOF team capitalized on distressed situations prior to widespread market dislocation

Failed Processes

Rescue Capital

Bankruptcy

Acquisitions

Re-capitalizations

■

■

■

I

Portland, OR Industrial: Acquisition of an industrial complex in an infill

submarket of Portland from a distressed seller as the result of a broken, off-

market sale process

Seattle, WA Office: Acquisition of a high-quality, partially-leased office building

from a motivated seller following a failed auction process

Maui, HI Hospitality: Fee-simple acquisition of a non-performing oceanfront

Ritz Carlton hotel from a distressed seller who needed immediate liquidity;

Realized Gross 45% IRR | 2.0x EM(2)(5)

San Diego, CA Hospitality: Preferred equity investment in a liquidity-

constrained builder in the midst of an undercapitalized construction process;

Realized Gross 21% IRR | 1.4x EM (2)(5)

San Francisco, CA Multifamily: Acquisition via bankruptcy auction of a fully

entitled, mixed-use development site in a supply-constrained submarket of San

Francisco; Realized Gross 30% IRR | 1.7x EM (2)(5)

Washington DC Office: Acquisition of a 277K sf office building one block from

the White House from a distressed seller facing an impending loan maturity

Seattle, WA Multifamily: Acquisition of a 1,000+ unit multifamily portfolio as

the result of an estate sale; Realized Gross 47% IRR | 1.8x EM (2)(5)

Confidential - Not for Publication or Distribution

Portland Industrial

15

Redevelopment

Ritz-Carlton, Kapalua

Bush Street, San Francisco

As of June 30, 2020. Past performance is not indicative of future results. The following investments are being shown because they represent a comprehensive list of examples of our

experience transacting in distressed situations in the AREOF series. Investments shown are for illustrative purposes only and are not representative of all investments made by the

AREOF series. It should not be assumed that investments made in the future will be profitable or will equal the performance of the investments discussed herein. There can be no

assurance that the Fund will achieve its investment objectives. For the full AREOF and AREOF II track records please see pages 58 and 60. Please refer to endnotes on pages 65-66.

1425 NY Ave., Washington DC

ARESView entire presentation