Paysafe Results Presentation Deck

Summary

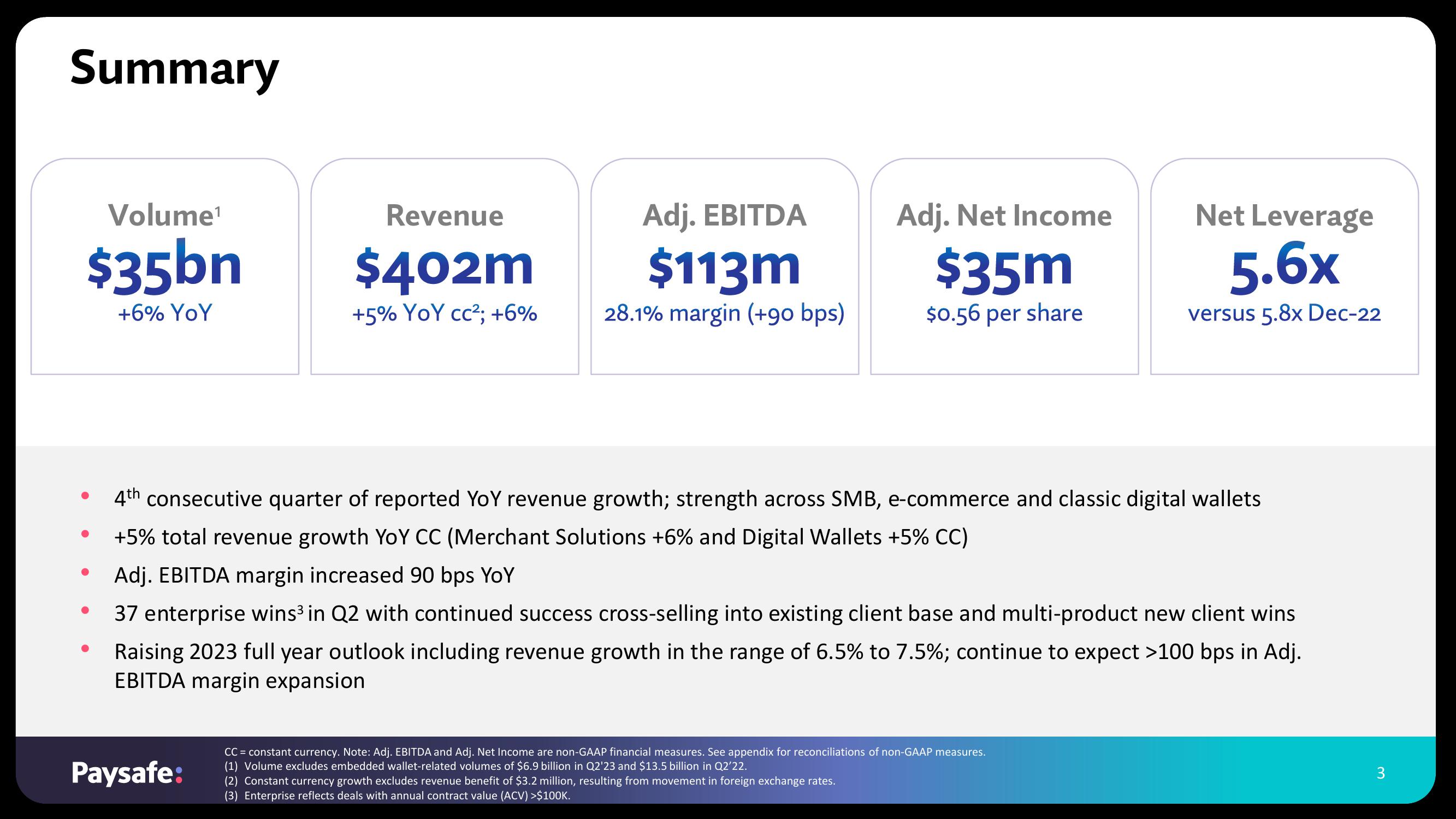

Volume¹

$35bn

+6% YoY

●

●

Revenue

$402m

+5% YoY cc²; +6%

Paysafe:

Adj. EBITDA

$113m

28.1% margin (+90 bps)

Adj. Net Income

$35m

$0.56 per share

4th consecutive quarter of reported YoY revenue growth; strength across SMB, e-commerce and classic digital wallets

+5% total revenue growth YoY CC (Merchant Solutions +6% and Digital Wallets +5% CC)

Adj. EBITDA margin increased 90 bps YoY

37 enterprise wins³ in Q2 with continued success cross-selling into existing client base and multi-product new client wins

Raising 2023 full year outlook including revenue growth in the range of 6.5% to 7.5%; continue to expect >100 bps in Adj.

EBITDA margin expansion

CC = constant currency. Note: Adj. EBITDA and Adj. Net Income are non-GAAP financial measures. See appendix for reconciliations of non-GAAP measures.

(1) Volume excludes embedded wallet-related volumes of $6.9 billion in Q2'23 and $13.5 billion in Q2'22.

(2) Constant currency growth excludes revenue benefit of $3.2 million, resulting from movement in foreign exchange rates.

(3) Enterprise reflects deals with annual contract value (ACV) >$100K.

Net Leverage

5.6x

versus 5.8x Dec-22

3View entire presentation