Whitebread Annual Update

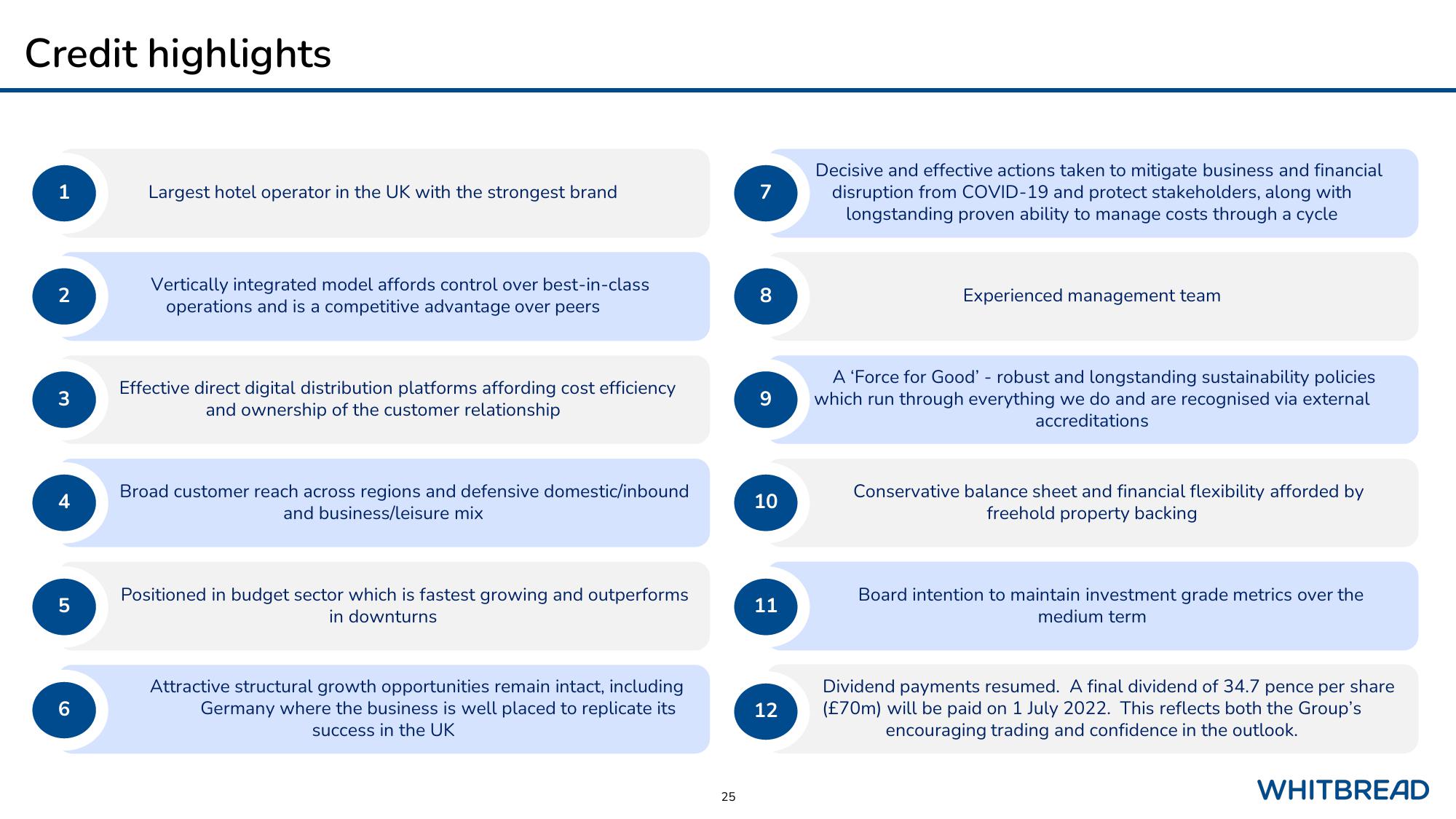

Credit highlights

1

2

3

4

5

6

Largest hotel operator in the UK with the strongest brand

Vertically integrated model affords control over best-in-class

operations and is a competitive advantage over peers

Effective direct digital distribution platforms affording cost efficiency

and ownership of the customer relationship

Broad customer reach across regions and defensive domestic/inbound

and business/leisure mix

Positioned in budget sector which is fastest growing and outperforms

in downturns

Attractive structural growth opportunities remain intact, including

Germany where the business is well placed to replicate its

success in the UK

25

7

8

9

10

11

12

Decisive and effective actions taken to mitigate business and financial

disruption from COVID-19 and protect stakeholders, along with

longstanding proven ability to manage costs through a cycle

Experienced management team

A 'Force for Good' - robust and longstanding sustainability policies

which run through everything we do and are recognised via external

accreditations

Conservative balance sheet and financial flexibility afforded by

freehold property backing

Board intention to maintain investment grade metrics over the

medium term

Dividend payments resumed. A final dividend of 34.7 pence per share

(£70m) will be paid on 1 July 2022. This reflects both the Group's

encouraging trading and confidence in the outlook.

WHITBREADView entire presentation