J.P.Morgan Results Presentation Deck

Corporate & Investment Bank1

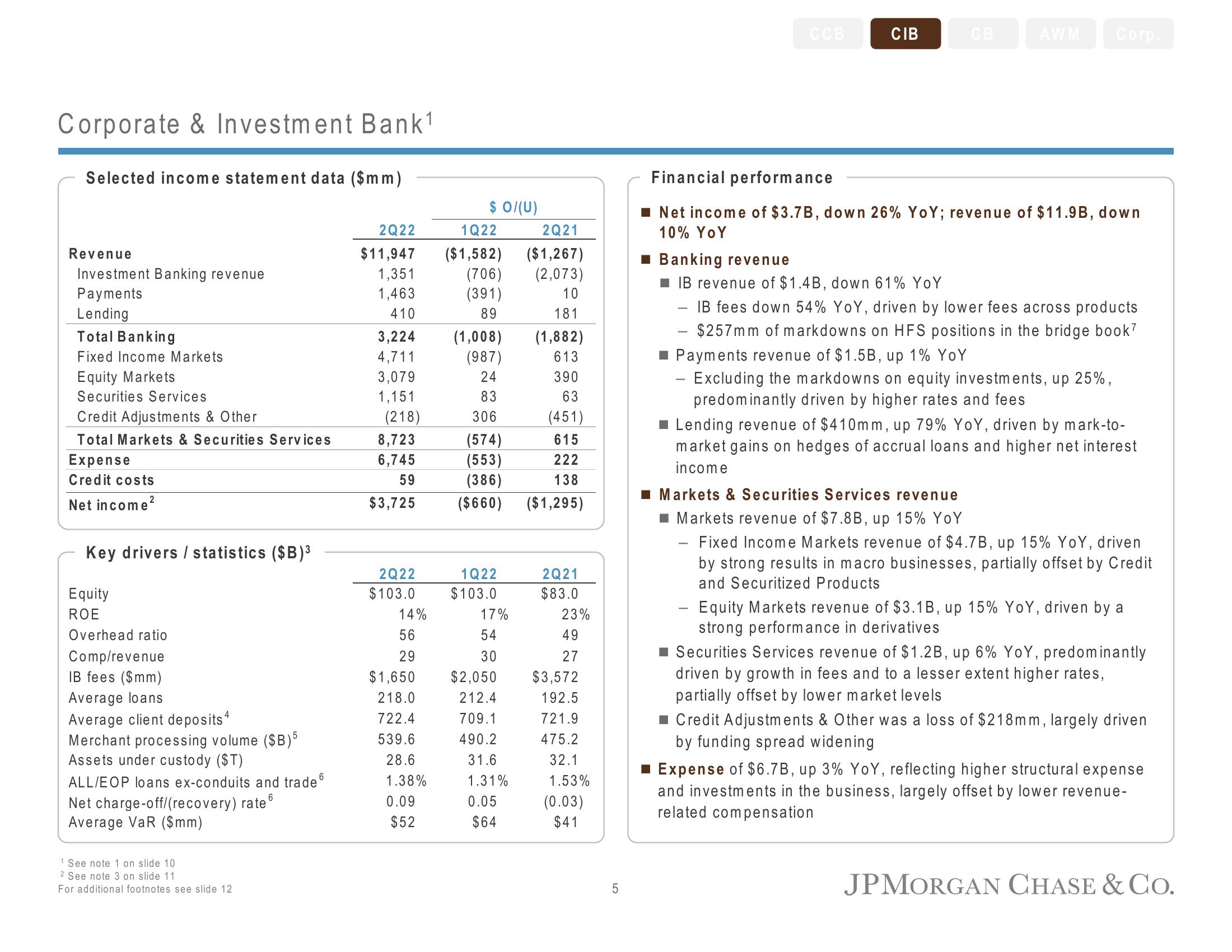

Selected income statement data ($mm)

Revenue

Investment Banking revenue

Payments

Lending

Total Banking

Fixed Income Markets

Equity Markets

Securities Services

Credit Adjustments & Other

Total Markets & Securities Services

Expense

Credit costs

Net income²

Key drivers / statistics ($B)³

Equity

ROE

Overhead ratio

Comp/revenue

IB fees ($mm)

Average loans

Average client deposits 4

Merchant processing volume ($B)5

Assets under custody ($T)

6

ALL/EOP loans ex-conduits and trade

6

Net charge-off/(recovery) rate

Average VaR ($mm)

1 See note 1 on slide 10

2 See note 3 on slide 11

For additional footnotes see slide 12

2Q22

$11,947

1,351

1,463

410

3,224

4,711

3,079

1,151

(218)

8,723

6,745

59

$3,725

2Q22

$103.0

14%

56

29

$1,650

218.0

722.4

539.6

28.6

1.38%

0.09

$52

$ 0/(U)

1Q22

($1,582)

(706)

(391)

89

(1,008)

(987)

24

83

306

(574)

(553)

(386)

($660) ($1,295)

1Q22

$103.0

17%

54

30

2Q21

($1,267)

(2,073)

10

181

(1,882)

613

390

63

(451)

615

$2,050

212.4

709.1

490.2

31.6

1.31%

0.05

$64

222

138

2Q21

$83.0

23%

49

27

$3,572

192.5

721.9

475.2

32.1

1.53%

(0.03)

$41

LO

5

CCB

CIB

CB

AWM Corp.

Financial performance

Net income of $3.7B, down 26% YoY; revenue of $11.9B, down

10% YoY

■ Banking revenue

■IB revenue of $1.4B, down 61% YoY

IB fees down 54% YoY, driven by lower fees across products

- $257mm of markdowns on HFS positions in the bridge book'

Payments revenue of $1.5B, up 1% YoY

Excluding the markdowns on equity investments, up 25%,

predominantly driven by higher rates and fees

■ Lending revenue of $410mm, up 79% YoY, driven by mark-to-

market gains on hedges of accrual loans and higher net interest

income

■ Markets & Securities Services revenue

■ Markets revenue of $7.8B, up 15% YoY

Fixed Income Markets revenue of $4.7B, up 15% YoY, driven

by strong results in macro businesses, partially offset by Credit

and Securitized Products

- Equity Markets revenue of $3.1B, up 15% YoY, driven by a

strong performance in derivatives

■ Securities Services revenue of $1.2B, up 6% YoY, predominantly

driven by growth in fees and to a lesser extent higher rates,

partially offset by lower market levels

■ Credit Adjustments & Other was a loss of $218mm, largely driven

by funding spread widening

Expense of $6.7B, up 3% YoY, reflecting higher structural expense

and investments in the business, largely offset by lower revenue-

related compensation

JPMORGAN CHASE & Co.View entire presentation