Allwyn Results Presentation Deck

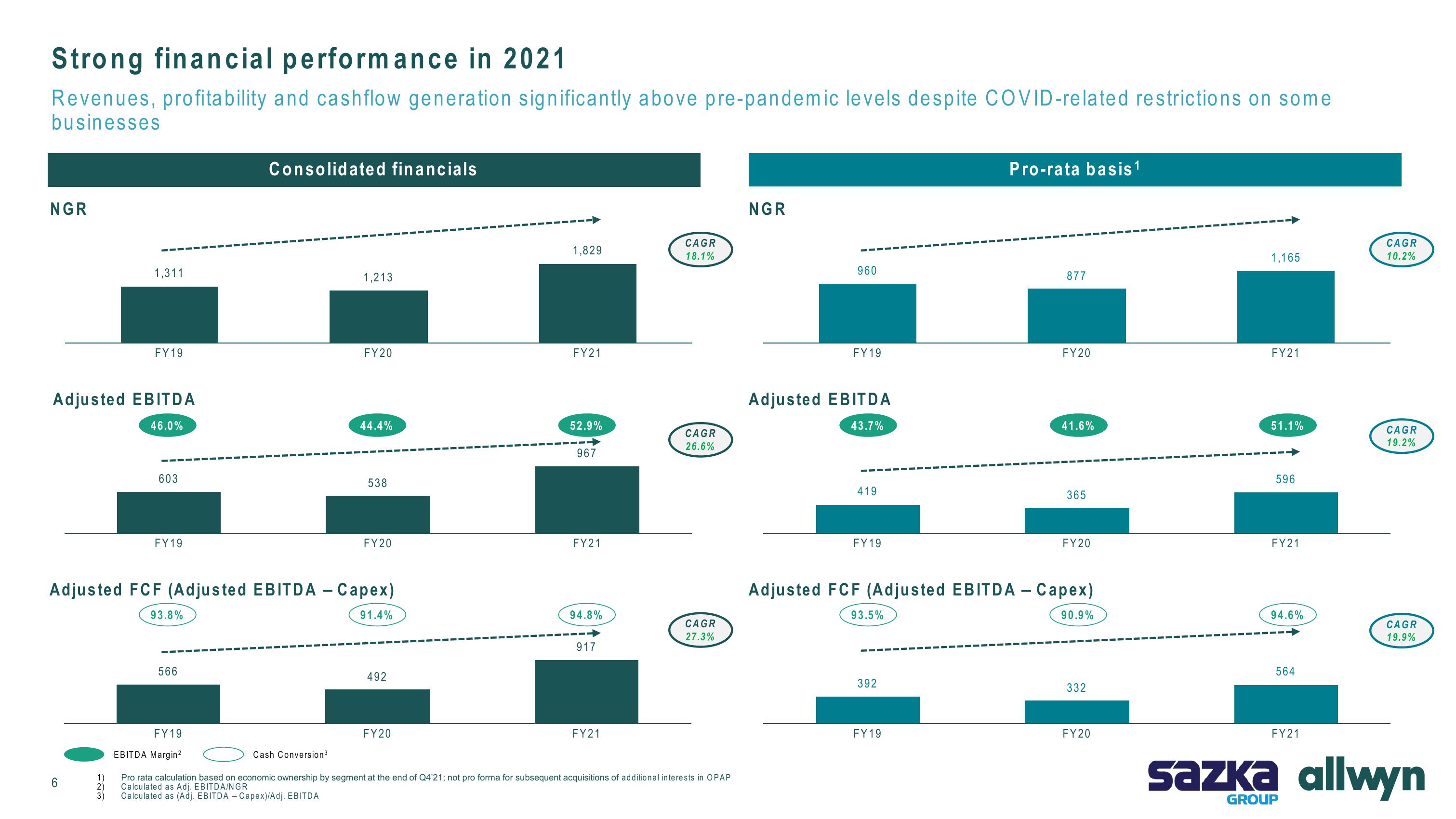

Strong financial performance in 2021

Revenues, profitability and cashflow generation significantly above pre-pandemic levels despite COVID-related restrictions on some

businesses

NGR

1,311

Adjusted EBITDA

46.0%

6

FY 19

1)

2)

3)

603

FY19

93.8%

566

Consolidated financials

FY19

EBITDA Margin²

Adjusted FCF (Adjusted EBITDA - Capex)

91.4%

1,213

Cash Conversion³

FY20

44.4%

538

FY20

492

FY20

1,829

FY21

52.9%

967

FY21

94.8%

917

FY21

CAGR

18.1%

CAGR

26.6%

CAGR

27.3%

Pro rata calculation based on economic ownership by segment at the end of Q4'21; not pro forma for subsequent acquisitions of additional interests in OPAP

Calculated as Adj. EBITDA/NGR

Calculated as (Adj. EBITDA - Capex)/Adj. EBITDA

NGR

960

FY19

Adjusted EBITDA

43.7%

419

FY19

93.5%

392

Pro-rata basis ¹

FY 19

877

FY20

41.6%

Adjusted FCF (Adjusted EBITDA - Capex)

90.9%

365

FY20

332

FY20

1,165

FY21

51.1%

596

FY21

94.6%

564

FY21

CAGR

10.2%

GROUP

CAGR

19.2%

CAGR

19.9%

sazka allwynView entire presentation