Silicon Valley Bank Results Presentation Deck

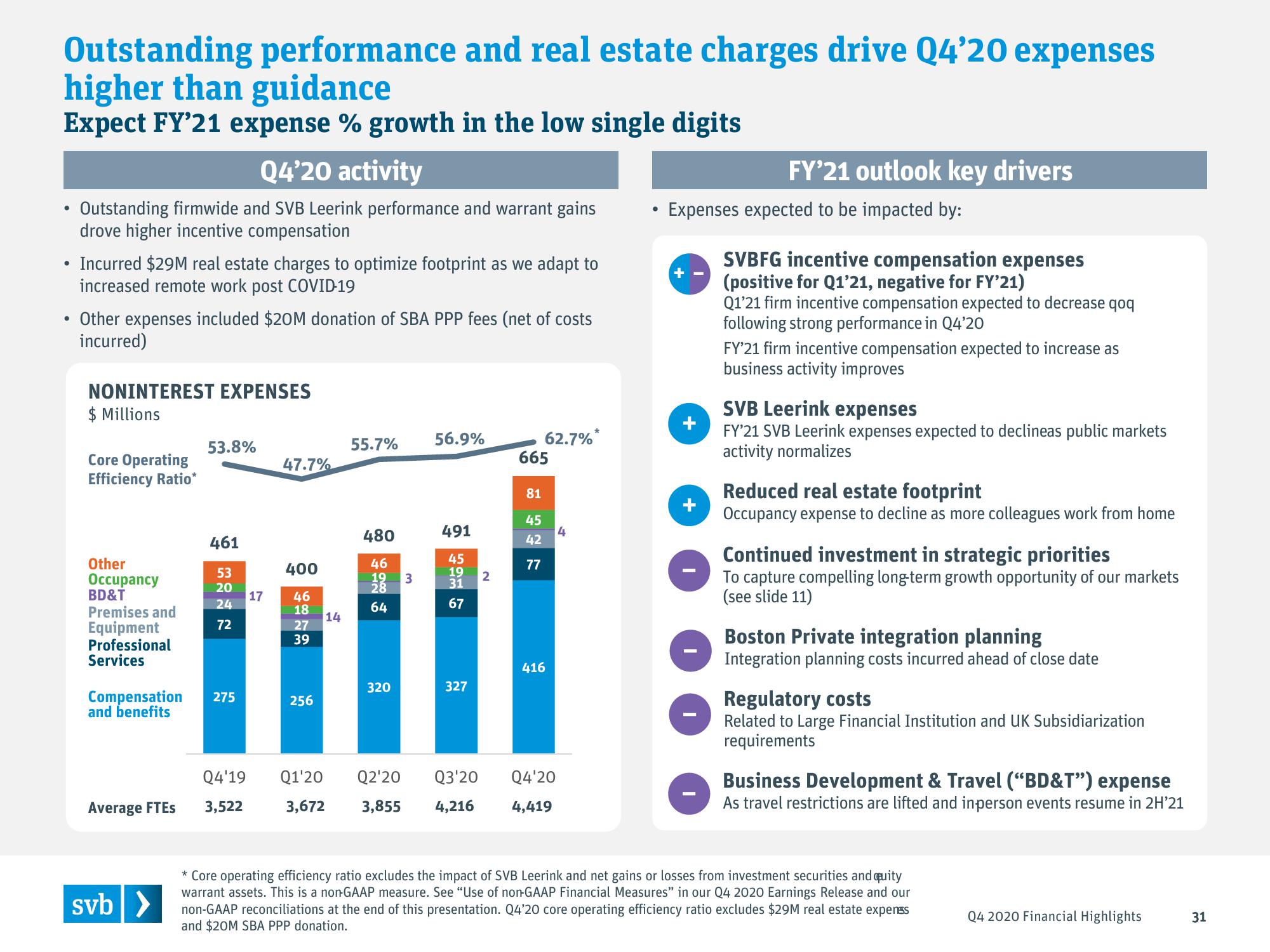

Outstanding performance and real estate charges drive Q4'20 expenses

higher than guidance

Expect FY'21 expense % growth in the low single digits

●

●

Q4'20 activity

Outstanding firmwide and SVB Leerink performance and warrant gains

drove higher incentive compensation

Incurred $29M real estate charges to optimize footprint as we adapt to

increased remote work post COVID-19

Other expenses included $20M donation of SBA PPP fees (net of costs

incurred)

NONINTEREST EXPENSES

$ Millions

Core Operating

Efficiency Ratio*

Other

Occupancy

BD&T

Premises and

Equipment

Professional

Services

Compensation

and benefits

Average FTES

svb >

53.8%

461

53

20

24

72

275

Q4'19

3,522

17

47.7%

400

46

18

27

39

256

Q1'20

3,672

14

55.7%

480

46

19 3

28

64

320

56.9%

491

45

19

31

67

327

2

Q2'20

3,855 4,216

62.7%*

665

81

45

42

77

416

Q3'20 Q4'20

4,419

4

Expenses expected to be impacted by:

+

+

FY'21 outlook key drivers

I

SVBFG incentive compensation expenses

(positive for Q1'21, negative for FY'21)

Q1'21 firm incentive compensation expected to decrease qoq

following strong performance in Q4'20

FY'21 firm incentive compensation expected to increase as

business activity improves

SVB Leerink expenses

FY'21 SVB Leerink expenses expected to declineas public markets

activity normalizes

Reduced real estate footprint

Occupancy expense to decline as more colleagues work from home

Continued investment in strategic priorities

To capture compelling long-term growth opportunity of our markets

(see slide 11)

Boston Private integration planning

Integration planning costs incurred ahead of close date

Regulatory costs

Related to Large Financial Institution and UK Subsidiarization

requirements

Business Development & Travel ("BD&T") expense

As travel restrictions are lifted and in-person events resume in 2H'21

* Core operating efficiency ratio excludes the impact of SVB Leerink and net gains or losses from investment securities and quity

warrant assets. This is a non-GAAP measure. See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release and our

non-GAAP reconciliations at the end of this presentation. Q4'20 core operating efficiency ratio excludes $29M real estate expenss

and $20M SBA PPP donation.

Q4 2020 Financial Highlights

31View entire presentation