Ford Results Presentation Deck

Ford

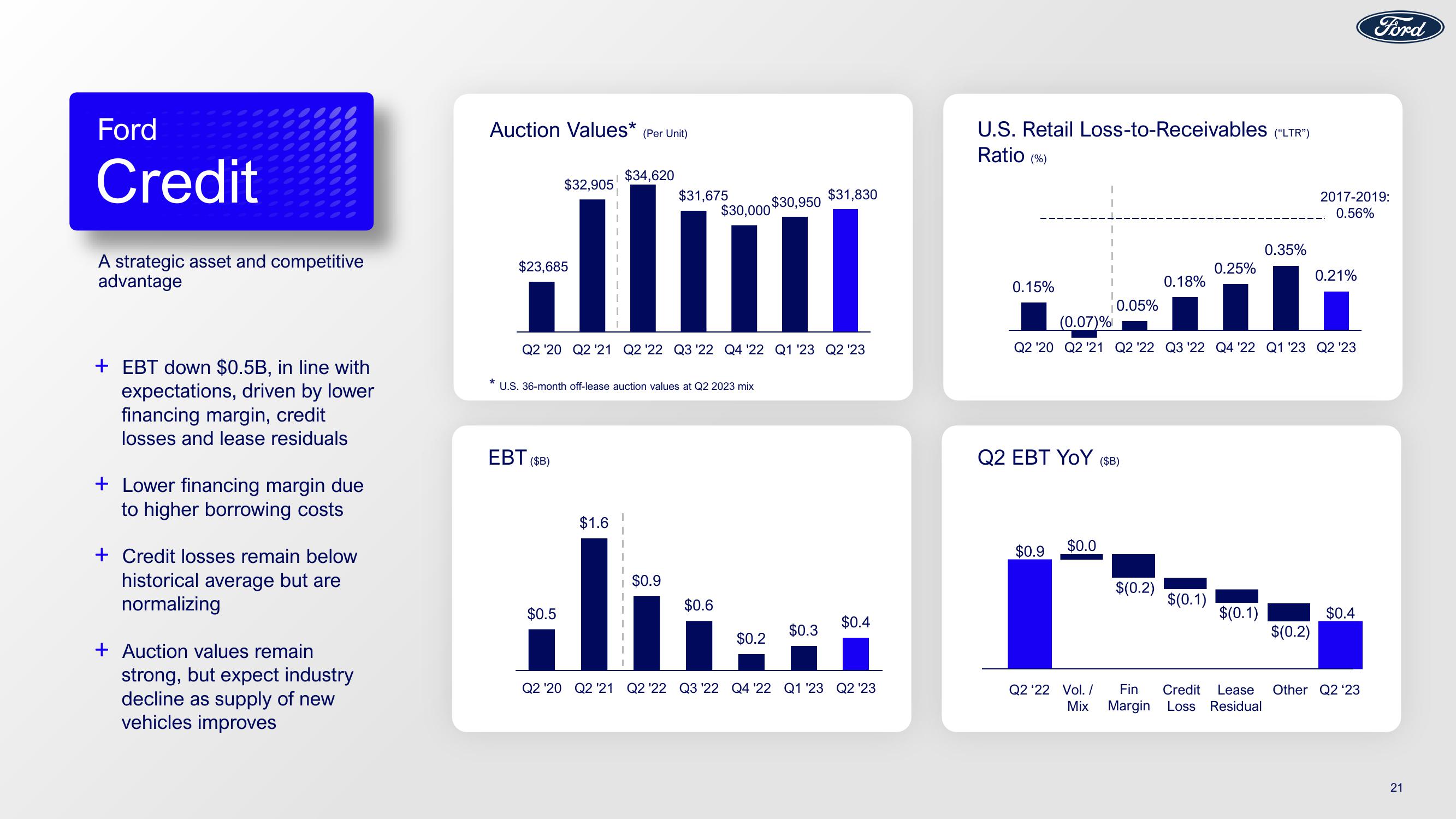

Credit

A strategic asset and competitive

advantage

+ EBT down $0.5B, in line with

expectations, driven by lower

financing margin, credit

losses and lease residuals

+ Lower financing margin due

to higher borrowing costs

+ Credit losses remain below

historical average but are

normalizing

+ Auction values remain

strong, but expect industry

decline as supply of new

vehicles improves

Auction Values* (Per Unit)

*

$34,620

$32,905

$31,675

alm

$23,685

Q2 '20 Q2 '21 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23

U.S. 36-month off-lease auction values at Q2 2023 mix

EBT ($B)

$1.6

$0.5

$30,000

Q2 '20 Q2 '21

$30,950

$0.9

ili....

$0.6

$0.2

Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23

$31,830

$0.3

$0.4

U.S. Retail Loss-to-Receivables ("LTR")

Ratio (%)

0.35%

11

(0.07)%

Q2 '20 Q2 '21 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23

0.15%

Q2 EBT YOY ($B)

$0.9 $0.0

0.05%

Q2 '22 Vol. /

Mix

$(0.2)

0.18%

$(0.1)

0.25%

$(0.1)

$(0.2)

2017-2019:

0.56%

0.21%

$0.4

Ford

Fin Credit Lease Other Q2 '23

Margin Loss Residual

21View entire presentation