Sale of a 19.9% Ownership Interest in NIPSCO

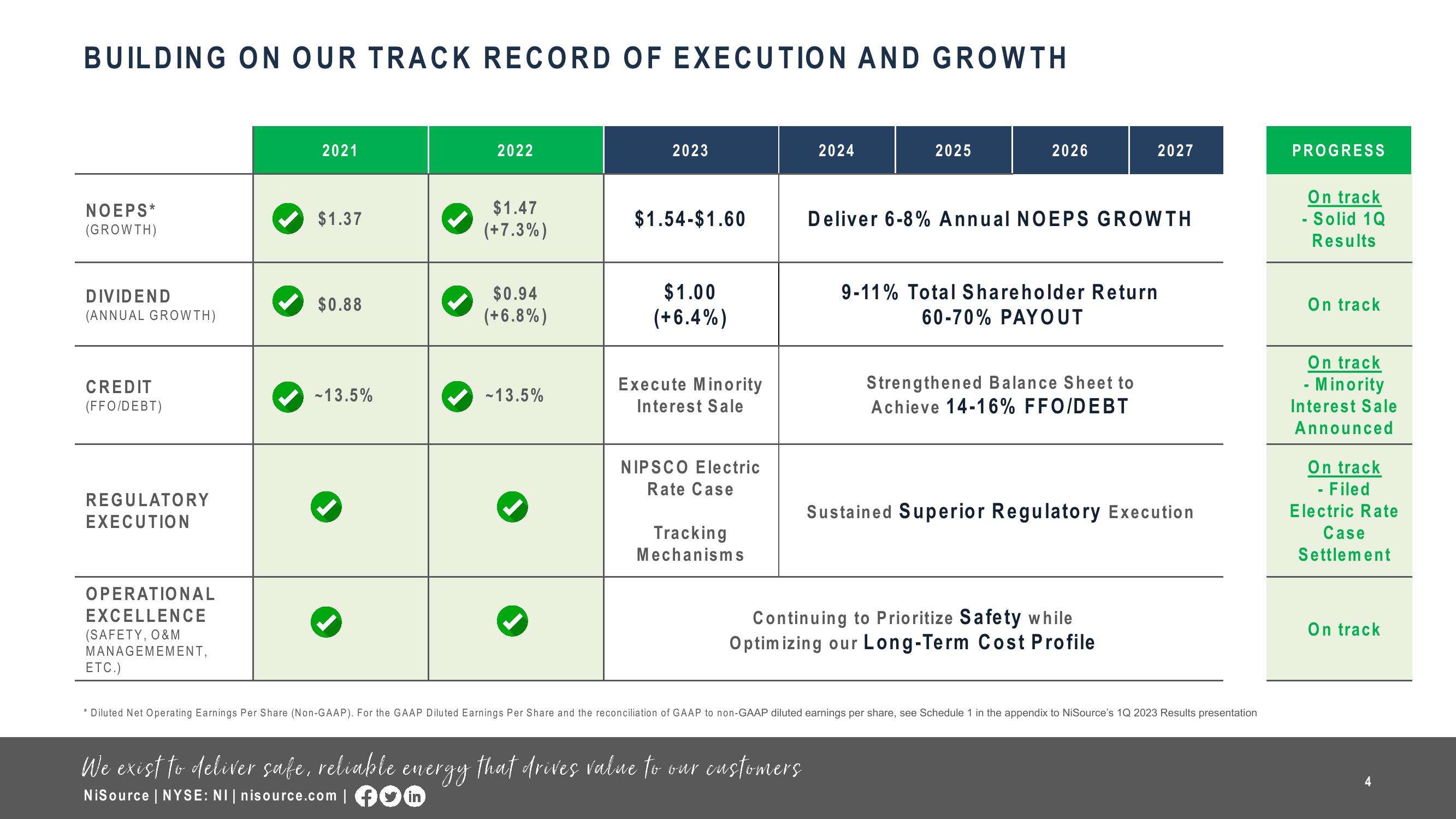

BUILDING ON OUR TRACK RECORD OF EXECUTION AND GROWTH

NOEPS*

(GROWTH)

DIVIDEND

(ANNUAL GROWTH)

CREDIT

(FFO/DEBT)

REGULATORY

EXECUTION

OPERATIONAL

EXCELLENCE

(SAFETY, O&M

MANAGEMEMENT,

ETC.)

2021

$1.37

$0.88

-13.5%

We exist to deliver safe, reliable

NiSource | NYSE: NI| nisource.com | ♥M

2022

energy

$1.47

(+7.3%)

$0.94

(+6.8%)

-13.5%

2023

$1.54-$1.60

$1.00

(+6.4%)

Execute Minority

Interest Sale

NIPSCO Electric

Rate Case

Tracking

Mechanisms

2024

2025

that drives value to our customers

2026

Deliver 6-8% Annual NOEPS GROWTH

2027

9-11% Total Shareholder Return

60-70% PAYOUT

Strengthened Balance Sheet to

Achieve 14-16% FFO/DEBT

Continuing to Prioritize Safety while

Optimizing our Long-Term Cost Profile

* Diluted Net Operating Earnings Per Share (Non-GAAP). For the GAAP Diluted Earnings Per Share and the reconciliation of GAAP to non-GAAP diluted earnings per share, see Schedule 1 in the appendix to NiSource's 1Q 2023 Results presentation

Sustained Superior Regulatory Execution

PROGRESS

On track

- Solid 1Q

Results

On track

On track

- Minority

Interest Sale

Announced

On track

- Filed

Electric Rate

Case

Settlement

On track

4View entire presentation