Kinnevik Results Presentation Deck

Intro

Net Asset Value

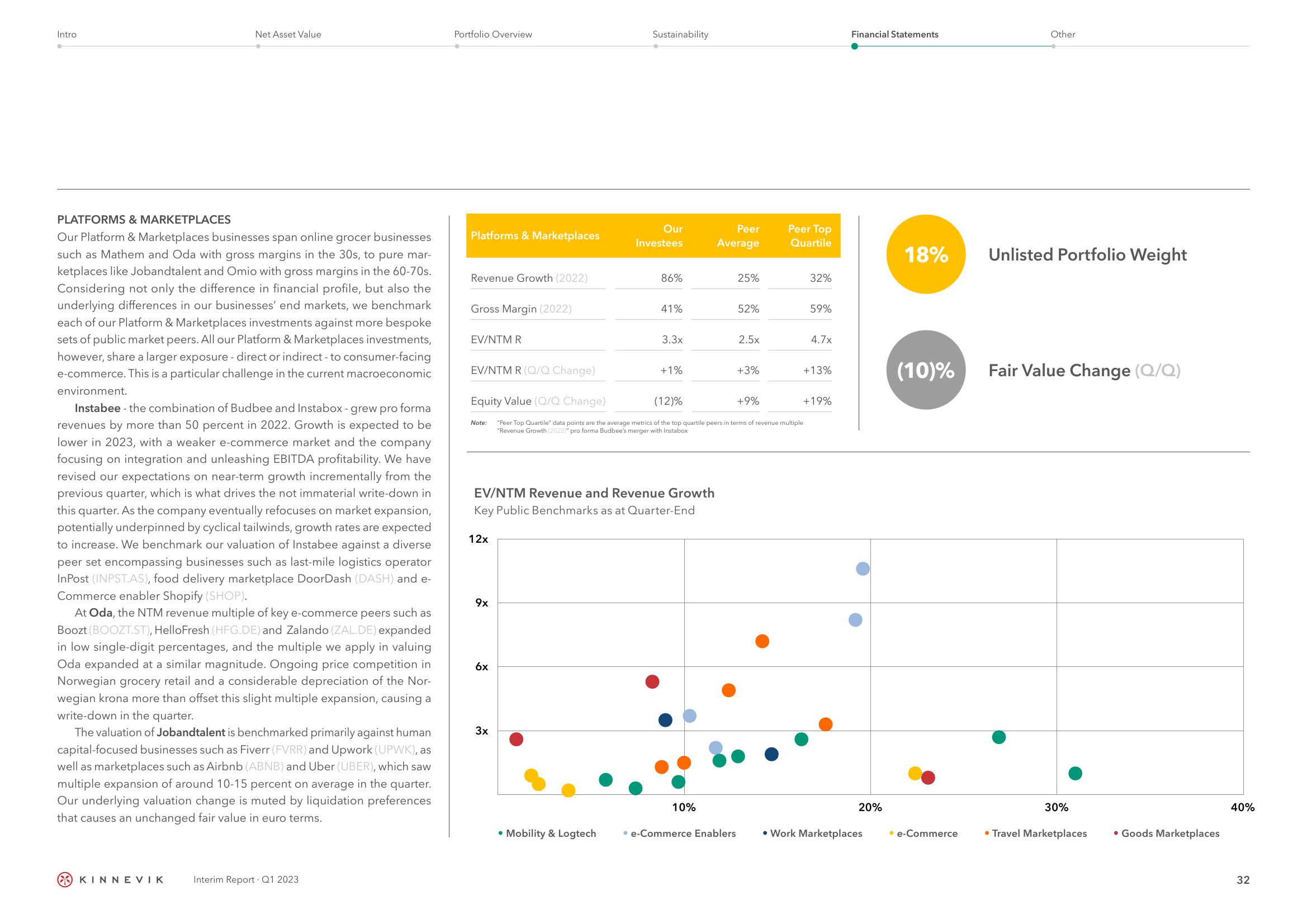

PLATFORMS & MARKETPLACES

Our Platform & Marketplaces businesses span online grocer businesses

such as Mathem and Oda with gross margins in the 30s, to pure mar-

ketplaces like Jobandtalent and Omio with gross margins in the 60-70s.

Considering not only the difference in financial profile, but also the

underlying differences in our businesses' end markets, we benchmark

each of our Platform & Marketplaces investments against more bespoke

sets of public market peers. All our Platform & Marketplaces investments,

however, share a larger exposure - direct or indirect - to consumer-facing

e-commerce. This is a particular challenge in the current macroeconomic

environment.

Instabee - the combination of Budbee and Instabox - grew pro forma

revenues by more than 50 percent in 2022. Growth is expected to be

lower in 2023, with a weaker e-commerce market and the company

focusing on integration and unleashing EBITDA profitability. We have

revised our expectations on near-term growth incrementally from the

previous quarter, which is what drives the not immaterial write-down in

this quarter. As the company eventually refocuses on market expansion,

potentially underpinned by cyclical tailwinds, growth rates are expected

to increase. We benchmark our valuation of Instabee against a diverse

peer set encompassing businesses such as last-mile logistics operator

InPost (INPST.AS), food delivery marketplace DoorDash (DASH) and e-

Commerce enabler Shopify (SHOP).

At Oda, the NTM revenue multiple of key e-commerce peers such as

Boozt (BOOZT.ST), HelloFresh (HFG.DE) and Zalando (ZAL.DE) expanded

in low single-digit percentages, and the multiple we apply in valuing

Oda expanded at a similar magnitude. Ongoing price competition in

Norwegian grocery retail and a considerable depreciation of the Nor-

wegian krona more than offset this slight multiple expansion, causing a

write-down in the quarter.

The valuation of Jobandtalent is benchmarked primarily against human

capital-focused businesses such as Fiverr (FVRR) and Upwork (UPWK), as

well as marketplaces such as Airbnb (ABNB) and Uber (UBER), which saw

multiple expansion of around 10-15 percent on average in the quarter.

Our underlying valuation change is muted by liquidation preferences

that causes an unchanged fair value in euro terms.

KINNEVIK

Interim Report Q1 2023

Portfolio Overview

Platforms & Marketplaces

Revenue Growth (2022)

Gross Margin (2022)

EV/NTM R

EV/NTM R (Q/Q Change)

Note:

12x

9x

6x

Sustainability

3x

Our

Investees

• Mobility & Logtech

86%

EV/NTM Revenue and Revenue Growth

Key Public Benchmarks as at Quarter-End

41%

3.3x

+1%

Peer

Average

Equity Value (Q/Q Change)

(12)%

"Peer Top Quartile" data points are the average metrics of the top quartile peers in terms of revenue multiple

"Revenue Growth (2022)" pro forma Budbee's merger with Instabox

10%

25%

• e-Commerce Enablers

52%

2.5x

+3%

+9%

Peer Top

Quartile

32%

59%

4.7x

+13%

+19%

Financial Statements

20%

• Work Marketplaces

18%

(10)%

Other

Unlisted Portfolio Weight

Fair Value Change (Q/Q)

30%

e-Commerce • Travel Marketplaces • Goods Marketplaces

40%

32View entire presentation