OpenText Investor Day Presentation Deck

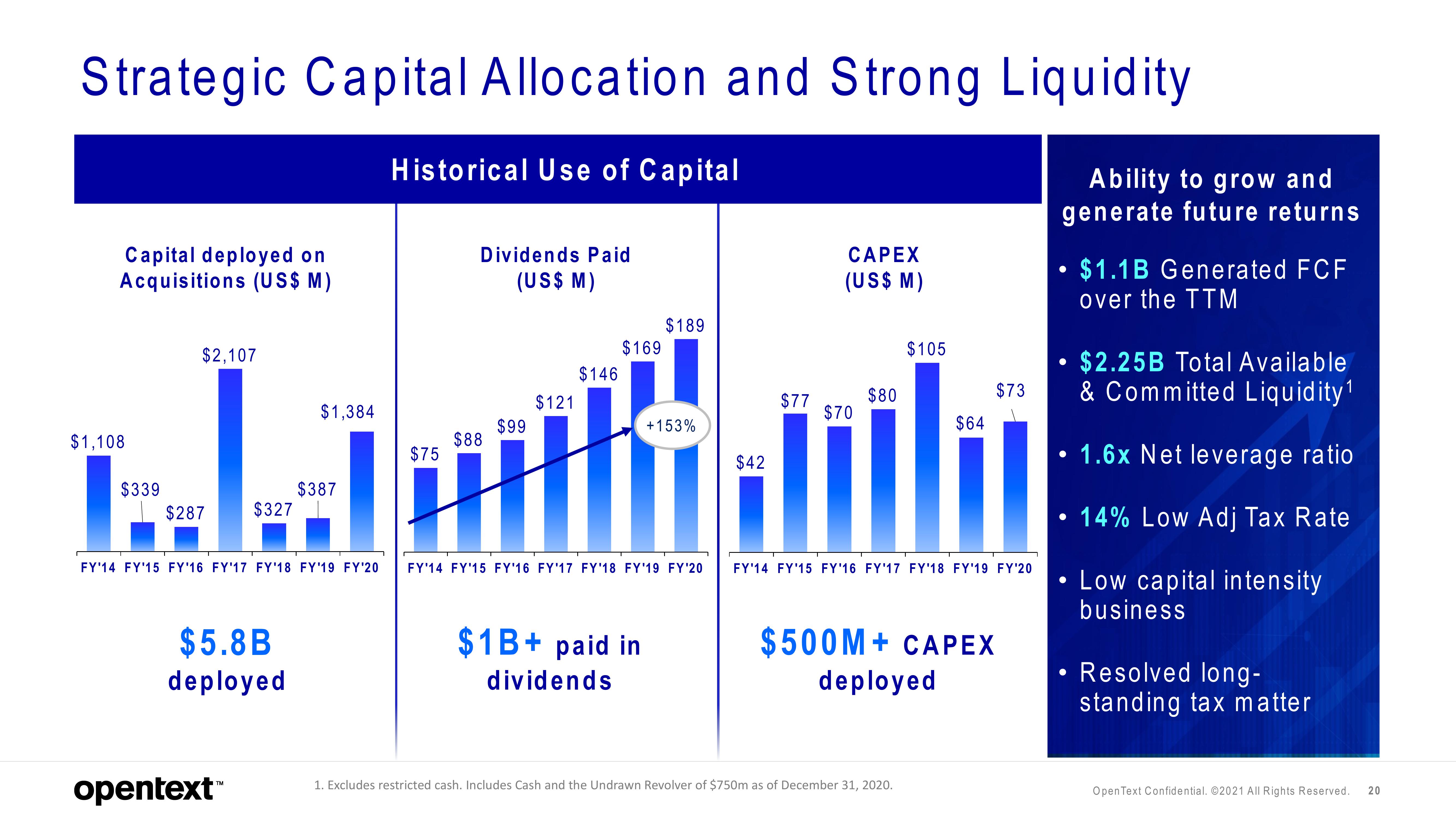

Strategic Capital Allocation and Strong Liquidity

Historical Use of Capital

Capital deployed on

Acquisitions (US$ M)

$1,108

$339

$2,107

$287

$327

$5.8B

deployed

opentext™

$1,384

$387

$75

Dividends Paid

(US$ M)

$88

$99

$121

$146

$169

FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20 FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20

$189

$1B+ paid in

dividends

+153%

$42

$77

CAPEX

(US$ M)

$70

$80

$105

$64

1. Excludes restricted cash. Includes Cash and the Undrawn Revolver of $750m as of December 31, 2020.

$73

FY'14 FY'15 FY'16 FY'17 FY'18 FY'19 FY'20

$500M+ CAPEX

deployed

Ability to grow and

generate future returns

●

●

• $2.25B Total Available

& Committed Liquidity¹

●

●

●

$1.1B Generated FCF

over the TTM

●

1.6x Net leverage ratio

14% Low Adj Tax Rate

Low capital intensity

business

Resolved long-

standing tax matter

Open Text Confidential. ©2021 All Rights Reserved. 20View entire presentation