Kinnevik Results Presentation Deck

Intro

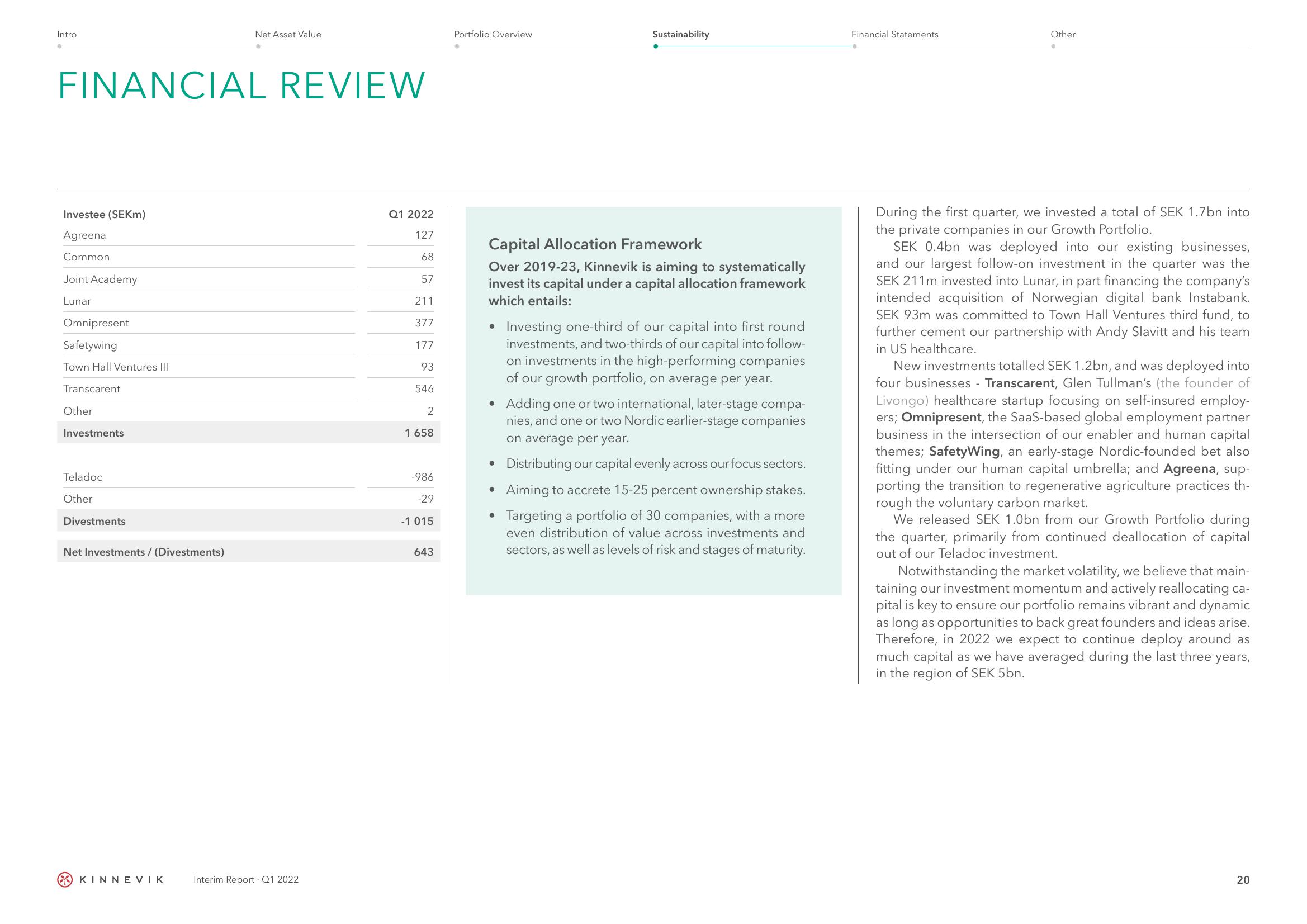

FINANCIAL REVIEW

Investee (SEKm)

Agreena

Common

Joint Academy

Lunar

Omnipresent

Safetywing

Town Hall Ventures III

Transcarent

Other

Investments

Teladoc

Other

Divestments

Net Investments / (Divestments)

Net Asset Value

KINNEVIK

Interim Report Q1 2022

Q1 2022

127

68

57

211

377

177

93

546

2

1 658

-986

-29

-1 015

643

Portfolio Overview

Sustainability

Capital Allocation Framework

Over 2019-23, Kinnevik is aiming to systematically

invest its capital under a capital allocation framework

which entails:

• Investing one-third of our capital into first round

investments, and two-thirds of our capital into follow-

on investments in the high-performing companies

of our growth portfolio, on average per year.

• Adding one or two international, later-stage compa-

nies, and one or two Nordic earlier-stage companies

on average per year.

Distributing our capital evenly across our focus sectors.

●

• Aiming to accrete 15-25 percent ownership stakes.

• Targeting a portfolio of 30 companies, with a more

even distribution of value across investments and

sectors, as well as levels of risk and stages of maturity.

Financial Statements

Other

During the first quarter, we invested a total of SEK 1.7bn into

the private companies in our Growth Portfolio.

SEK 0.4bn was deployed into our existing businesses,

and our largest follow-on investment in the quarter was the

SEK 211m invested into Lunar, in part financing the company's

intended acquisition of Norwegian digital bank Instabank.

SEK 93m was committed to Town Hall Ventures third fund, to

further cement our partnership with Andy Slavitt and his team

in US healthcare.

New investments totalled SEK 1.2bn, and was deployed into

four businesses - Transcarent, Glen Tullman's (the founder of

Livongo) healthcare startup focusing on self-insured employ-

ers; Omnipresent, the SaaS-based global employment partner

business in the intersection of our enabler and human capital

themes; SafetyWing, an early-stage Nordic-founded bet also

fitting under our human capital umbrella; and Agreena, sup-

porting the transition to regenerative agriculture practices th-

rough the voluntary carbon market.

We released SEK 1.0bn from our Growth Portfolio during

the quarter, primarily from continued deallocation of capital

out of our Teladoc investment.

Notwithstanding the market volatility, we believe that main-

taining our investment momentum and actively reallocating ca-

pital is key to ensure our portfolio remains vibrant and dynamic

as long as opportunities to back great founders and ideas arise.

Therefore, in 2022 we expect to continue deploy around as

much capital as we have averaged during the last three years,

in the region of SEK 5bn.

20View entire presentation