CorpAcq SPAC Presentation Deck

34

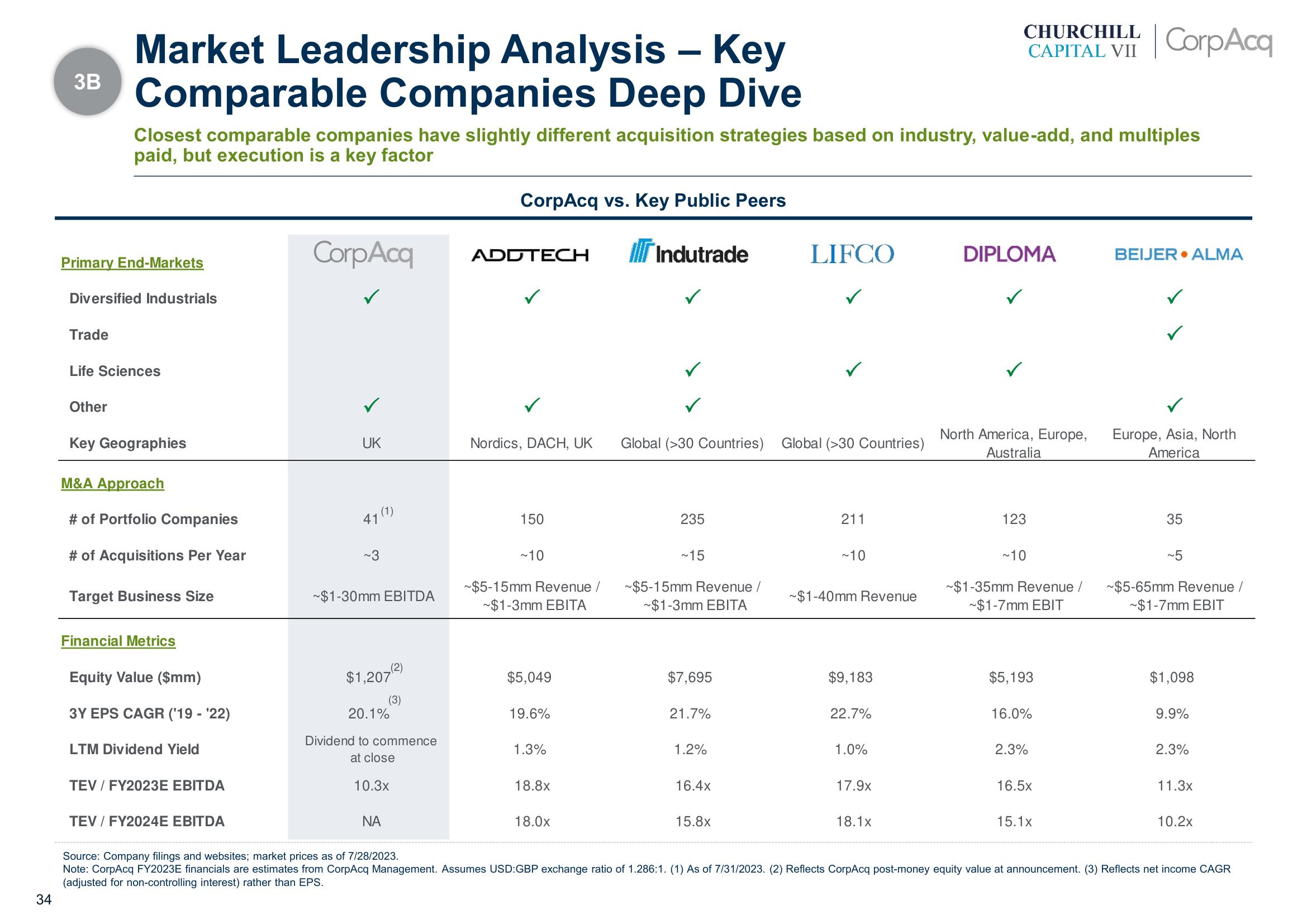

Market Leadership Analysis - Key

3B Comparable Companies Deep Dive

Primary End-Markets

Diversified Industrials

Trade

Closest comparable companies have slightly different acquisition strategies based on industry, value-add, and multiples

paid, but execution is a key factor

Life Sciences

Other

Key Geographies

M&A Approach

# of Portfolio Companies

# of Acquisitions Per Year

Target Business Size

Financial Metrics

Equity Value ($mm)

3Y EPS CAGR ('19 - '22)

LTM Dividend Yield

TEV / FY2023E EBITDA

TEV / FY2024E EBITDA

CorpAcq

UK

47 (1)

-3

~$1-30mm EBITDA

(2)

$1,207

(3)

20.1%

Dividend to commence

at close

10.3x

ΝΑ

CorpAcq vs. Key Public Peers

Indutrade

ADDTECH

Nordics, DACH, UK

150

~10

~$5-15mm Revenue /

~$1-3mm EBITA

$5,049

19.6%

1.3%

18.8x

18.0x

Global (>30 Countries) Global (>30 Countries)

235

~15

~$5-15mm Revenue /

~$1-3mm EBITA

$7,695

21.7%

1.2%

16.4x

LIFCO

15.8x

211

~10

~$1-40mm Revenue

$9,183

22.7%

1.0%

17.9x

CHURCHILL

CAPITAL VII CorpAcq

18.1x

DIPLOMA

North America, Europe,

Australia

123

~10

~$1-35mm Revenue /

~$1-7mm EBIT

$5,193

16.0%

2.3%

16.5x

15.1x

BEIJER ALMA

Europe, Asia, North

America

35

~5

~$5-65mm Revenue /

~$1-7mm EBIT

$1,098

9.9%

2.3%

11.3x

10.2x

Source: Company filings and websites; market prices as of 7/28/2023.

Note: CorpAcq FY2023E financials are estimates from CorpAcq Management. Assumes USD:GBP exchange ratio of 1.286:1. (1) As of 7/31/2023. (2) Reflects CorpAcq post-money equity value at announcement. (3) Reflects net income CAGR

(adjusted for non-controlling interest) rather than EPS.View entire presentation