Ashtead Group Results Presentation Deck

ROBUST AND FLEXIBLE DEBT STRUCTURE

$5,000m

$4,000m

$3,000m

$2,000m

$1,000m

$m

$5,000m

$4,000m

$3,000m

$2,000m

$1,000m

11

$m

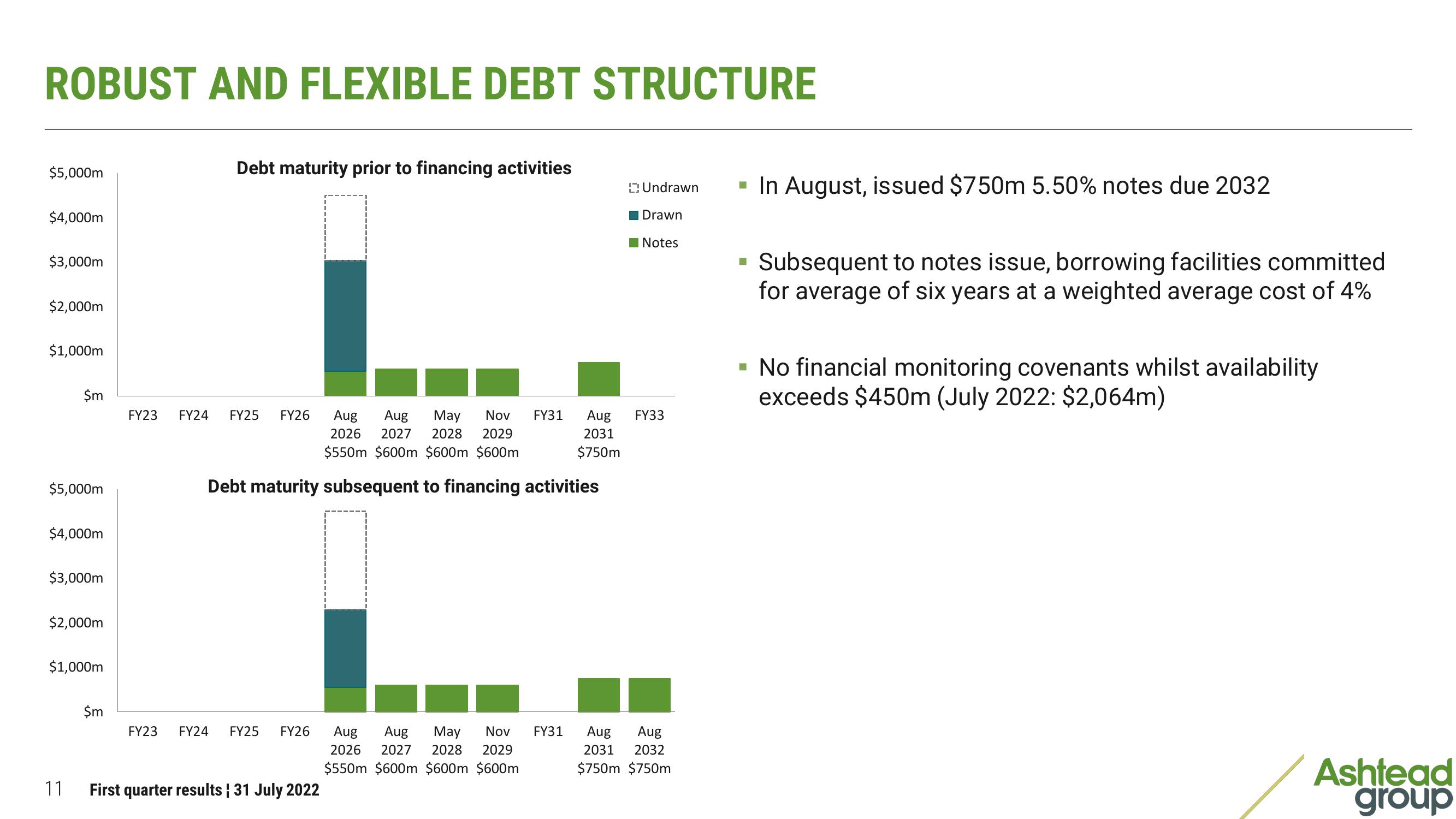

Debt maturity prior to financing activities

Aug Aug May Nov FY31 Aug

2026 2027 2028 2029

2031

$750m

$550m $600m $600m $600m

Debt maturity subsequent to financing activities

FY23 FY24 FY25 FY26

FY23 FY24 FY25 FY26

First quarter results ¦ 31 July 2022

Aug Aug May Nov FY31

2026 2027 2028 2029

$550m $600m $600m $600m

Undrawn

Drawn

Notes

FY33

Aug Aug

2031 2032

$750m $750m

■

In August, issued $750m 5.50% notes due 2032

Subsequent to notes issue, borrowing facilities committed

for average of six years at a weighted average cost of 4%

▪ No financial monitoring covenants whilst availability

exceeds $450m (July 2022: $2,064m)

Ashtead

groupView entire presentation