Paysafe SPAC Presentation Deck

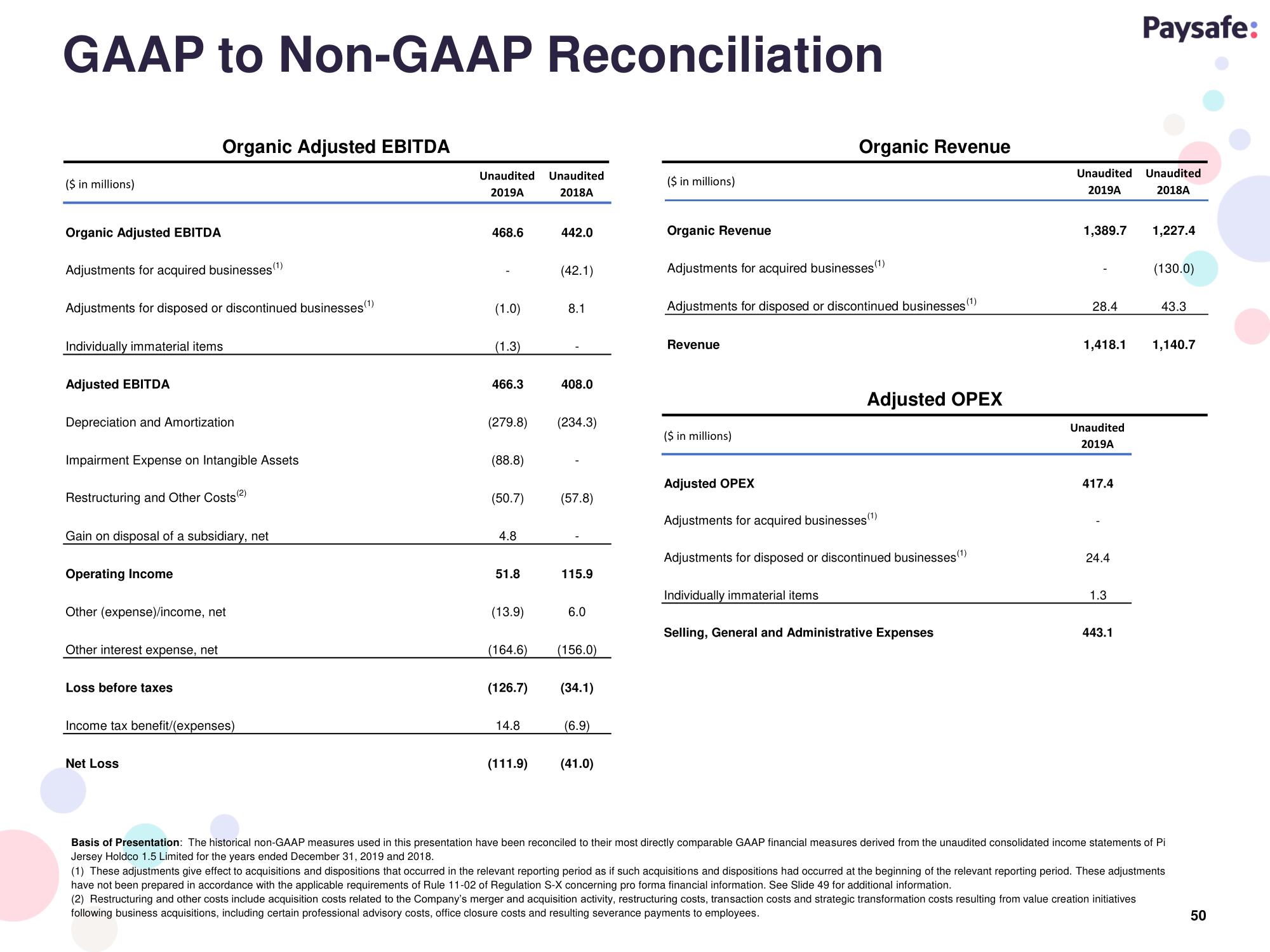

GAAP to Non-GAAP Reconciliation

($ in millions)

Organic Adjusted EBITDA

Adjustments for acquired businesses (¹)

Adjustments for disposed or discontinued businesses(¹)

Individually immaterial items

Adjusted EBITDA

Depreciation and Amortization

Organic Adjusted EBITDA

Impairment Expense on Intangible Assets

Restructuring and Other Costs (2)

Gain on disposal of a subsidiary, net

Operating Income

Other (expense)/income, net

Other interest expense, net

Loss before taxes

Income tax benefit/(expenses)

Net Loss

Unaudited Unaudited

2019A

2018A

468.6

(1.0)

(1.3)

466.3

(279.8)

(88.8)

(50.7)

4.8

51.8

(13.9)

(164.6)

(126.7)

14.8

(111.9)

442.0

(42.1)

8.1

408.0

(234.3)

(57.8)

115.9

6.0

(156.0)

(34.1)

(6.9)

(41.0)

($ in millions)

Organic Revenue

Adjustments for acquired businesses (1)

Adjustments for disposed or discontinued businesses (1)

Revenue

($ in millions)

Adjusted OPEX

Organic Revenue

Individually immaterial items

Adjusted OPEX

Adjustments for acquired businesses (1)

Adjustments for disposed or discontinued businesses (1)

Selling, General and Administrative Expenses

Unaudited

2019A

1,389.7

28.4

1,418.1

Unaudited

2019A

417.4

24.4

1.3

443.1

Paysafe:

Unaudited

2018A

1,227.4

(130.0)

43.3

1,140.7

Basis of Presentation: The historical non-GAAP measures used in this presentation have been reconciled to their most directly comparable GAAP financial measures derived from the unaudited consolidated income statements of Pi

Jersey Holdco 1.5 Limited for the years ended December 31, 2019 and 2018.

(1) These adjustments give effect to acquisitions and dispositions that occurred in the relevant reporting period as if such acquisitions and dispositions had occurred at the beginning of the relevant reporting period. These adjustments

have not been prepared in accordance with the applicable requirements of Rule 11-02 of Regulation S-X concerning pro forma financial information. See Slide 49 for additional information.

(2) Restructuring and other costs include acquisition costs related to the Company's merger and acquisition activity, restructuring costs, transaction costs and strategic transformation costs resulting from value creation initiatives

following business acquisitions, including certain professional advisory costs, office closure costs and resulting severance payments to employees.

50View entire presentation