Energy Vault SPAC Presentation Deck

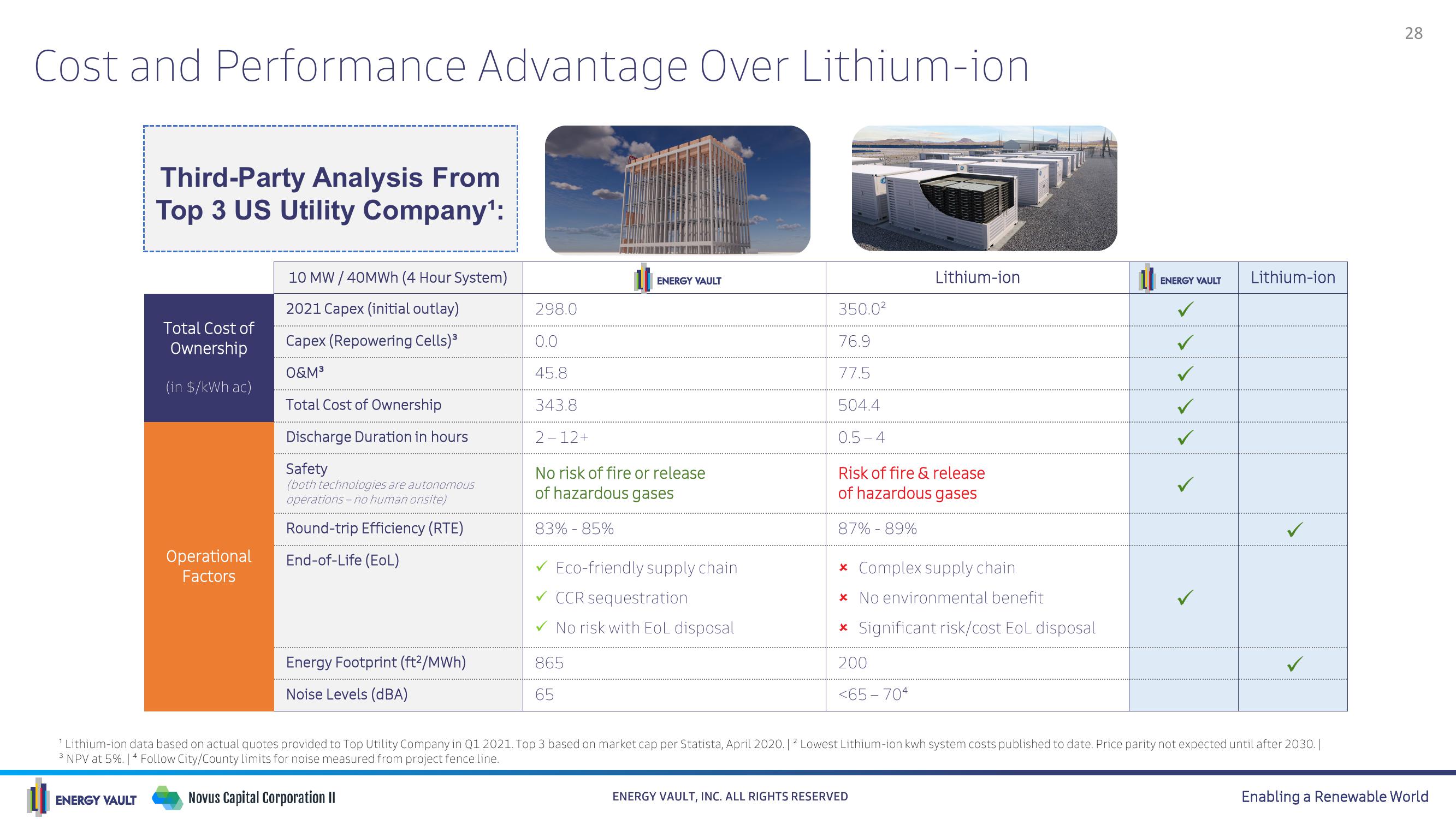

Cost and Performance Advantage Over Lithium-ion

Third-Party Analysis From

Top 3 US Utility Company¹:

Total Cost of

Ownership

(in $/kWh ac)

ENERGY VAULT

Operational

Factors

10 MW / 40MWh (4 Hour System)

2021 Capex (initial outlay)

Capex (Repowering Cells) ³

O&M³

Total Cost of Ownership

Discharge Duration in hours

Safety

(both technologies are autonomous

operations-no human onsite)

Round-trip Efficiency (RTE)

End-of-Life (EOL)

Energy Footprint (ft²/MWh)

Noise Levels (dBA)

298.0

0.0

45.8

343.8

2-12+

No risk of fire or release

of hazardous gases

83%-85%

ENERGY VAULT

Eco-friendly supply chain

CCR sequestration

No risk with EoL disposal

865

65

WE

350.0²

76.9

77.5

504.4

0.5-4

Risk of fire & release

of hazardous gases

87% -89%

Lithium-ion

* Complex supply chain

* No environmental benefit

* Significant risk/cost EoL disposal

200

<65-704

ENERGY VAULT, INC. ALL RIGHTS RESERVED

ENERGY VAULT

Lithium-ion

¹ Lithium-ion data based on actual quotes provided to Top Utility Company in Q1 2021. Top 3 based on market cap per Statista, April 2020. | ² Lowest Lithium-ion kwh system costs published to date. Price parity not expected until after 2030. |

3 NPV at 5%. | 4 Follow City/County limits for noise measured from project fence line.

Novus Capital Corporation II

✓

28

Enabling a Renewable WorldView entire presentation