Main Street Capital Investor Day Presentation Deck

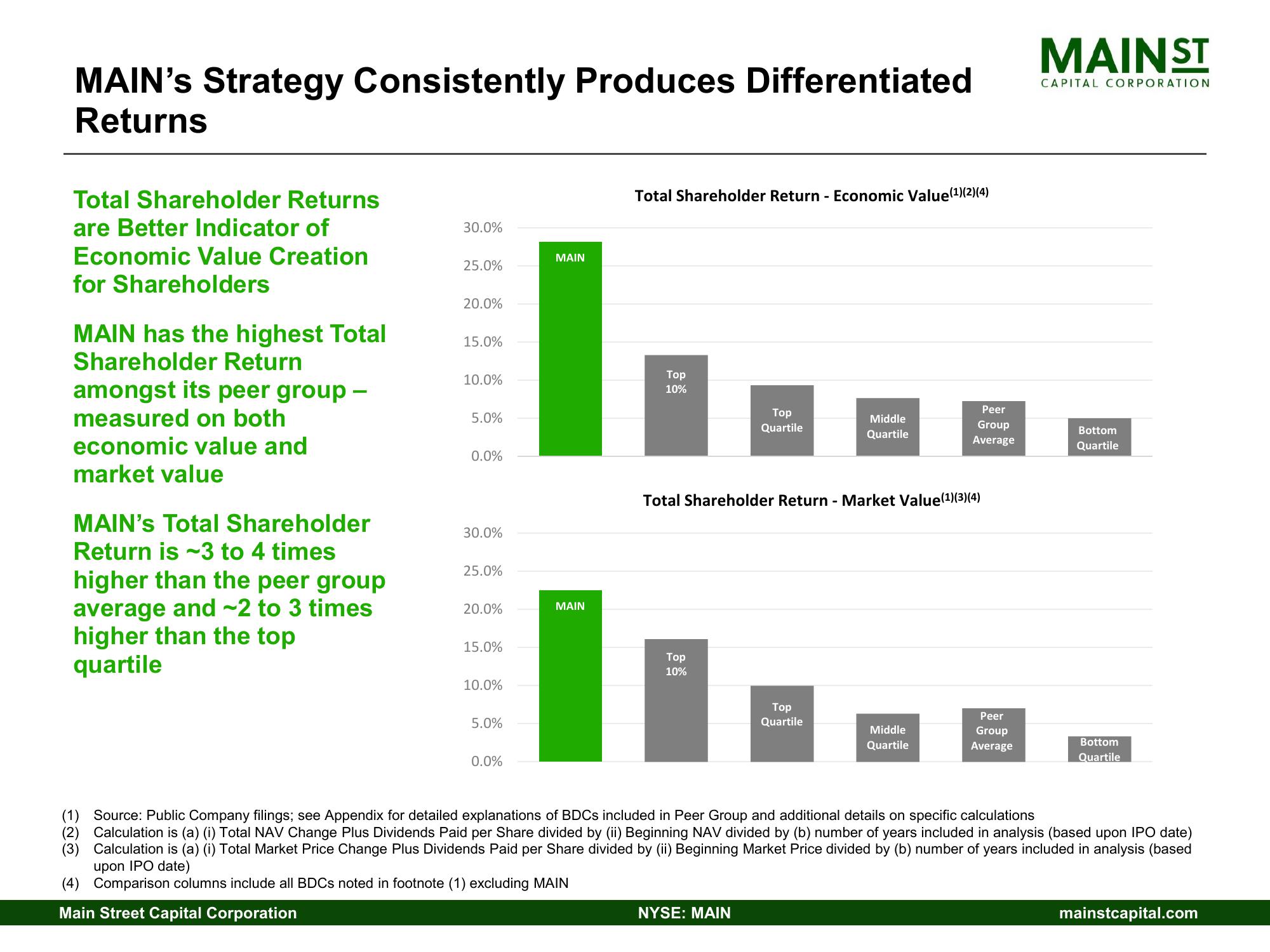

MAIN's Strategy Consistently Produces Differentiated

Returns

Total Shareholder Returns

are Better Indicator of

Economic Value Creation

for Shareholders

MAIN has the highest Total

Shareholder Return

amongst its peer group -

measured on both

economic value and

market value

MAIN's Total Shareholder

Return is 3 to 4 times

higher than the peer group

average and ~2 to 3 times

higher than the top

quartile

30.0%

25.0%

T

20.0%

15.0%

10.0%

5.0%

0.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

MAIN

MAIN

(4) Comparison columns include all BDCs noted in footnote (1) excluding MAIN

Main Street Capital Corporation

Total Shareholder Return - Economic Value(1)(2)(4)

Top

10%

Top

10%

Top

Quartile

Total Shareholder Return - Market Value(¹)(3)(4)

NYSE: MAIN

Middle

Quartile

Top

Quartile

Peer

Group

Average

Middle

Quartile

Peer

Group

Average

MAINST

CAPITAL CORPORATION

(1) Source: Public Company filings; Appendix for detailed explanations of BDCs included in Peer Group and additional details on specific calculations

(2) Calculation is (a) (i) Total NAV Change Plus Dividends Paid per Share divided by (ii) Beginning NAV divided by (b) number of years included in analysis (based upon IPO date)

(3) Calculation is (a) (i) Total Market Price Change Plus Dividends Paid per Share divided by (ii) Beginning Market Price divided by (b) number of years included in analysis (based

upon IPO date)

Bottom

Quartile

Bottom

Quartile

mainstcapital.comView entire presentation