Pershing Square Activist Presentation Deck

B. PF McDonald's Financial Analysis

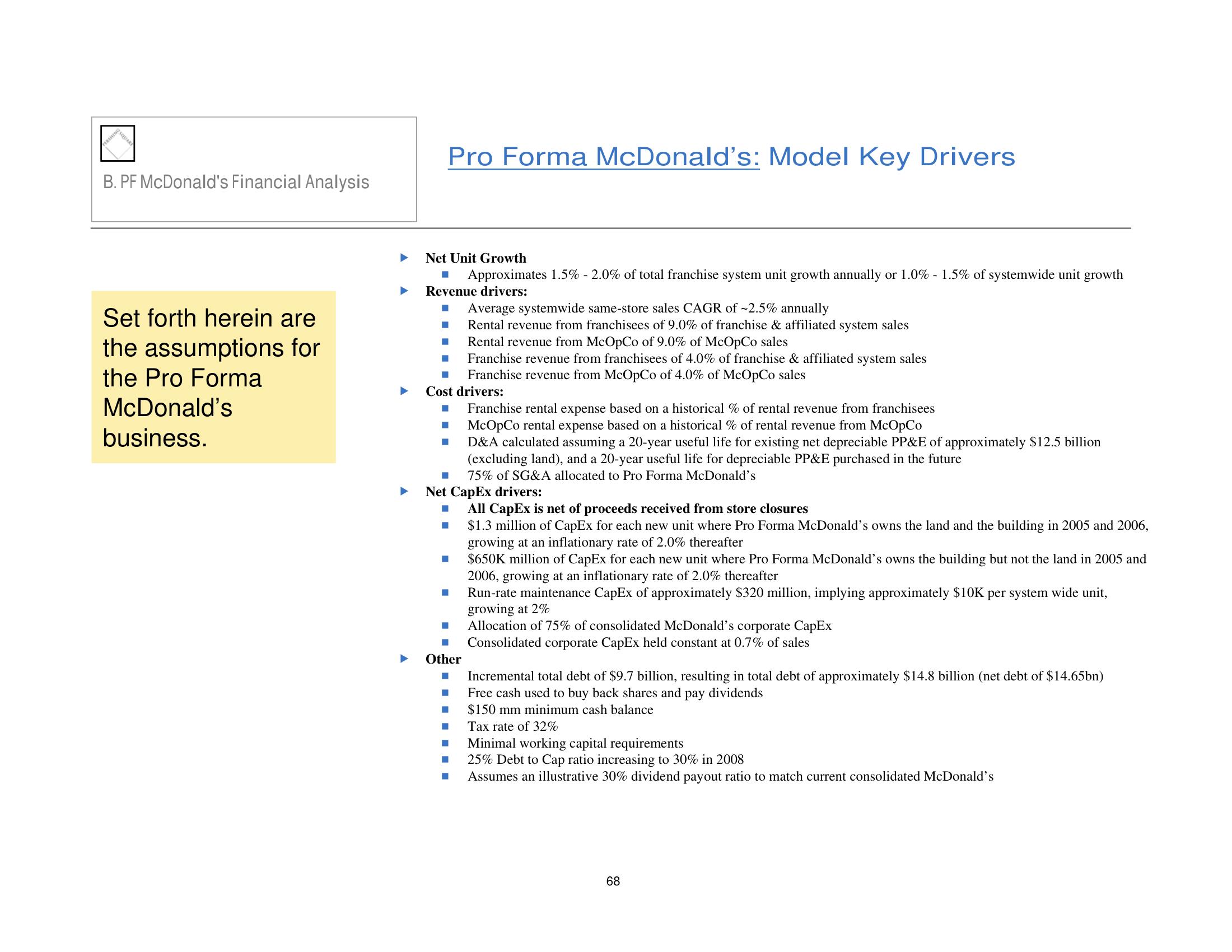

Set forth herein are

the assumptions for

the Pro Forma

McDonald's

business.

▶

Pro Forma McDonald's: Model Key Drivers

Net Unit Growth

■ Approximates 1.5% - 2.0% of total franchise system unit growth annually or 1.0% - 1.5% of systemwide unit growth

Revenue drivers:

■ Average systemwide same-store sales CAGR of -2.5% annually

■

Rental revenue from franchisees of 9.0% of franchise & affiliated system sales

■

Rental revenue from McOpCo of 9.0% of McOpCo sales

Franchise revenue from franchisees of 4.0% of franchise & affiliated system sales

Franchise revenue from McOpCo of 4.0% of McOpCo sales

■

Cost drivers:

■ Franchise rental expense based on a historical % of rental revenue from franchisees

■

McOpCo rental expense based on a historical % of rental revenue from McOpCo

■

D&A calculated assuming a 20-year useful life for existing net depreciable PP&E of approximately $12.5 billion

(excluding land), and a 20-year useful life for depreciable PP&E purchased in the future

75% of SG&A allocated to Pro Forma McDonald's

■

Net CapEx drivers:

■

■

■

■

■

■

Other

■

■

■

■

■

■

■

All CapEx is net of proceeds received from store closures

$1.3 million of CapEx for each new unit where Pro Forma McDonald's owns the land and the building in 2005 and 2006,

growing at an inflationary rate of 2.0% thereafter

$650K million of CapEx for each new unit where Pro Forma McDonald's owns the building but not the land in 2005 and

2006, growing at an inflationary rate of 2.0% thereafter

Run-rate maintenance CapEx of approximately $320 million, implying approximately $10K per system wide unit,

growing at 2%

Allocation of 75% of consolidated McDonald's corporate CapEx

Consolidated corporate CapEx held constant at 0.7% of sales

Incremental total debt of $9.7 billion, resulting in total debt of approximately $14.8 billion (net debt of $14.65bn)

Free cash used to buy back shares and pay dividends

$150 mm minimum cash balance

Tax rate of 32%

Minimal working capital requirements

25% Debt to Cap ratio increasing to 30% in 2008

Assumes an illustrative 30% dividend payout ratio to match current consolidated McDonald's

68View entire presentation