Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

287

PERFORMANCE

269

Dec-20

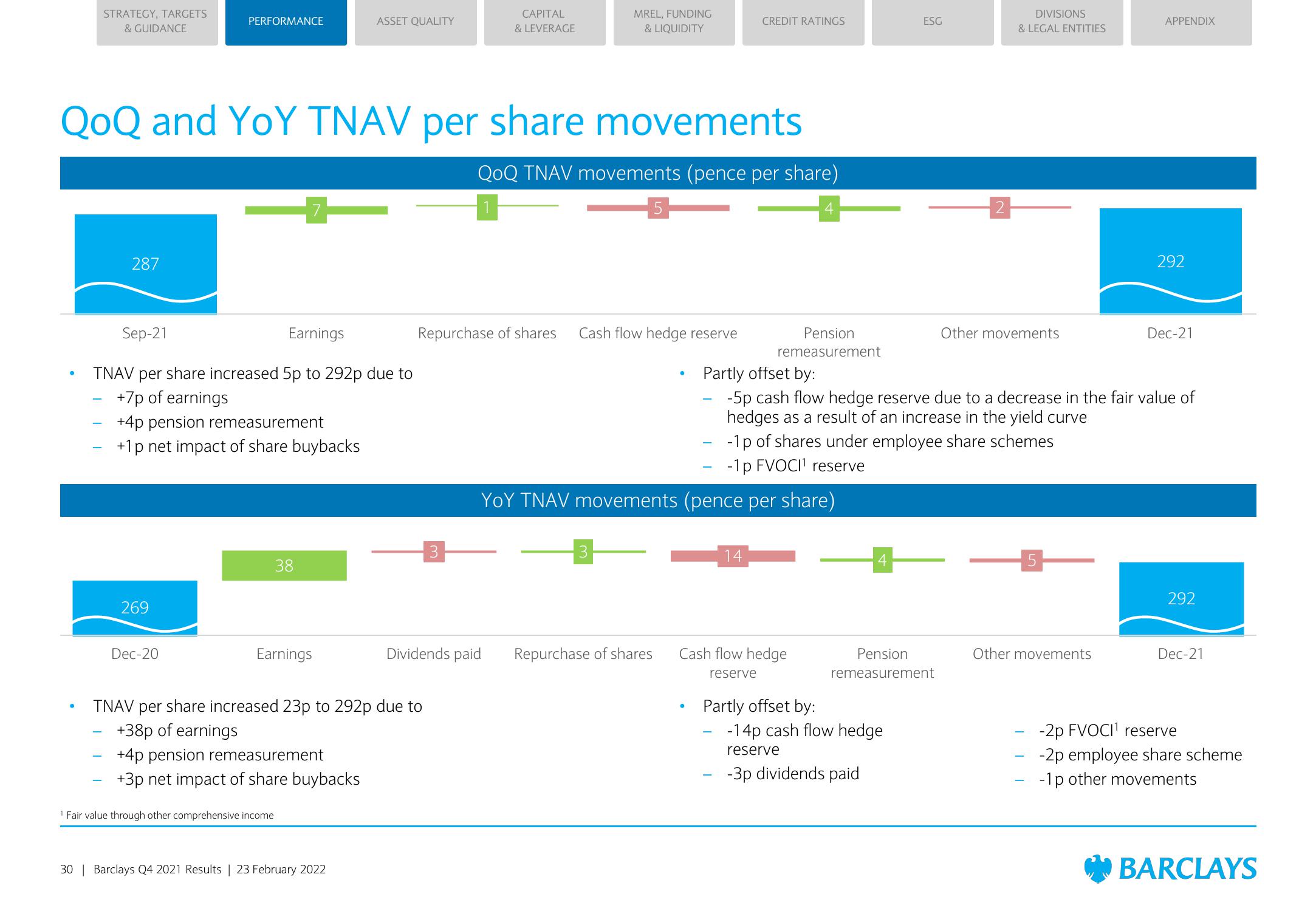

QoQ and YoY TNAV per share movements

QoQ TNAV movements (pence per share)

5

Sep-21

Earnings

TNAV per share increased 5p to 292p due to

+7p of earnings

+4p pension remeasurement

+1 p net impact of share buybacks

(7

38

Earnings

1 Fair value through other comprehensive income

ASSET QUALITY

30 | Barclays Q4 2021 Results | 23 February 2022

—3-

TNAV per share increased 23p to 292p due to

+38p of earnings

+4p pension remeasurement

+3p net impact of share buybacks

CAPITAL

& LEVERAGE

Repurchase of shares Cash flow hedge reserve

MREL, FUNDING

& LIQUIDITY

Dividends paid

3 -

Repurchase of shares

CREDIT RATINGS

Pension

remeasurement

14

-1p of shares under employee share schemes

-1p FVOCI¹ reserve

YOY TNAV movements (pence per share)

-

Cash flow hedge

reserve

Partly offset by:

ESG

4

Partly offset by:

-5p cash flow hedge reserve due to a decrease in the fair value of

hedges as a result of an increase in the yield curve

2

Pension

remeasurement

-14p cash flow hedge

reserve

-3p dividends paid

DIVISIONS

& LEGAL ENTITIES

Other movements

—5—

APPENDIX

Other movements

292

Dec-21

292

Dec-21

-2p FVOCI¹ reserve

-2p employee share scheme

-1p other movements

BARCLAYSView entire presentation