Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION

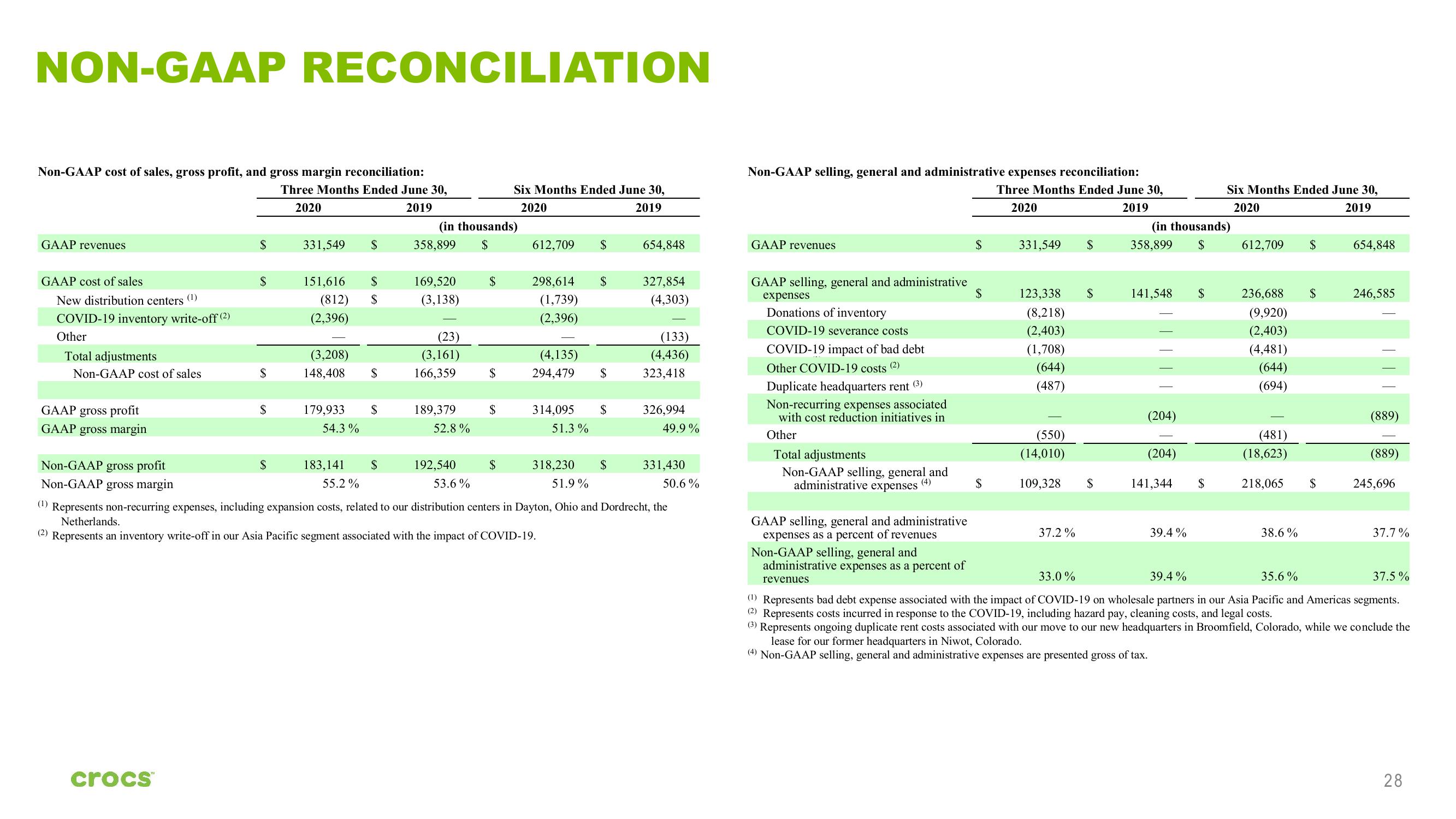

Non-GAAP cost of sales, gross profit, and gross margin reconciliation:

Three Months Ended June 30,

2020

2019

GAAP revenues

GAAP cost of sales

New distribution centers (1)

COVID-19 inventory write-off (2)

Other

Total adjustments

Non-GAAP cost of sales

GAAP gross profit

GAAP gross margin

Non-GAAP gross profit

Non-GAAP gross margin

$

crocs™

$

$

$

331,549 $

$

151,616 $

(812) $

(2,396)

(3,208)

148,408

$

179,933 $

54.3 %

183,141

$

(in thousands)

358,899

169,520

(3,138)

(23)

(3,161)

166,359

189,379

52.8%

192,540

$

53.6%

$

$

Six Months Ended June 30,

2020

2019

$

612,709

298,614

(1,739)

(2,396)

(4,135)

294,479

$

318,230 $

51.9%

55.2%

(1) Represents non-recurring expenses, including expansion costs, related to our distribution centers in Dayton, Ohio and Dordrecht, the

Netherlands.

(2) Represents an inventory write-off in our Asia Pacific segment associated with the impact of COVID-19.

$

314,095 $

51.3%

654,848

327,854

(4,303)

(133)

(4,436)

323,418

326,994

49.9%

331,430

50.6%

Non-GAAP selling, general and administrative expenses reconciliation:

Three Months Ended June 30,

2020

2019

GAAP revenues

GAAP selling, general and administrative

expenses

Donations of inventory

COVID-19 severance costs

(2)

COVID-19 impact of bad debt

Other COVID-19 costs

Duplicate headquarters rent (³)

Non-recurring expenses associated

with cost reduction initiatives in

Other

Total adjustments

Non-GAAP selling, general and

administrative expenses (4)

GAAP selling, general and administrative

expenses as a percent of revenues

Non-GAAP selling, general and

administrative expenses as a percent of

revenues

$

$

331,549 $

123,338

(8,218)

(2,403)

(1,708)

(644)

(487)

(550)

(14,010)

109,328

37.2%

$

$

(in thousands)

358,899 $

141,548 $

|||||||

(204)

(204)

141,344

39.4%

Six Months Ended June 30,

2020

2019

$

612,709

236,688

(9,920)

(2,403)

(4,481)

(644)

(694)

(481)

(18,623)

$

38.6%

$

218,065 $

654,848

246,585

(889)

(889)

245,696

37.7%

33.0%

39.4%

35.6%

37.5%

(1)

Represents bad debt expense associated with the impact of COVID-19 on wholesale partners in our Asia Pacific and Americas segments.

(2) Represents costs incurred in response to the COVID-19, including hazard pay, cleaning costs, and legal costs.

(3) Represents ongoing duplicate rent costs associated with our move to our new headquarters in Broomfield, Colorado, while we conclude the

lease for our former headquarters in Niwot, Colorado.

(4) Non-GAAP selling, general and administrative expenses are presented gross of tax.

28View entire presentation