Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

APM

TERMINALS

Contents

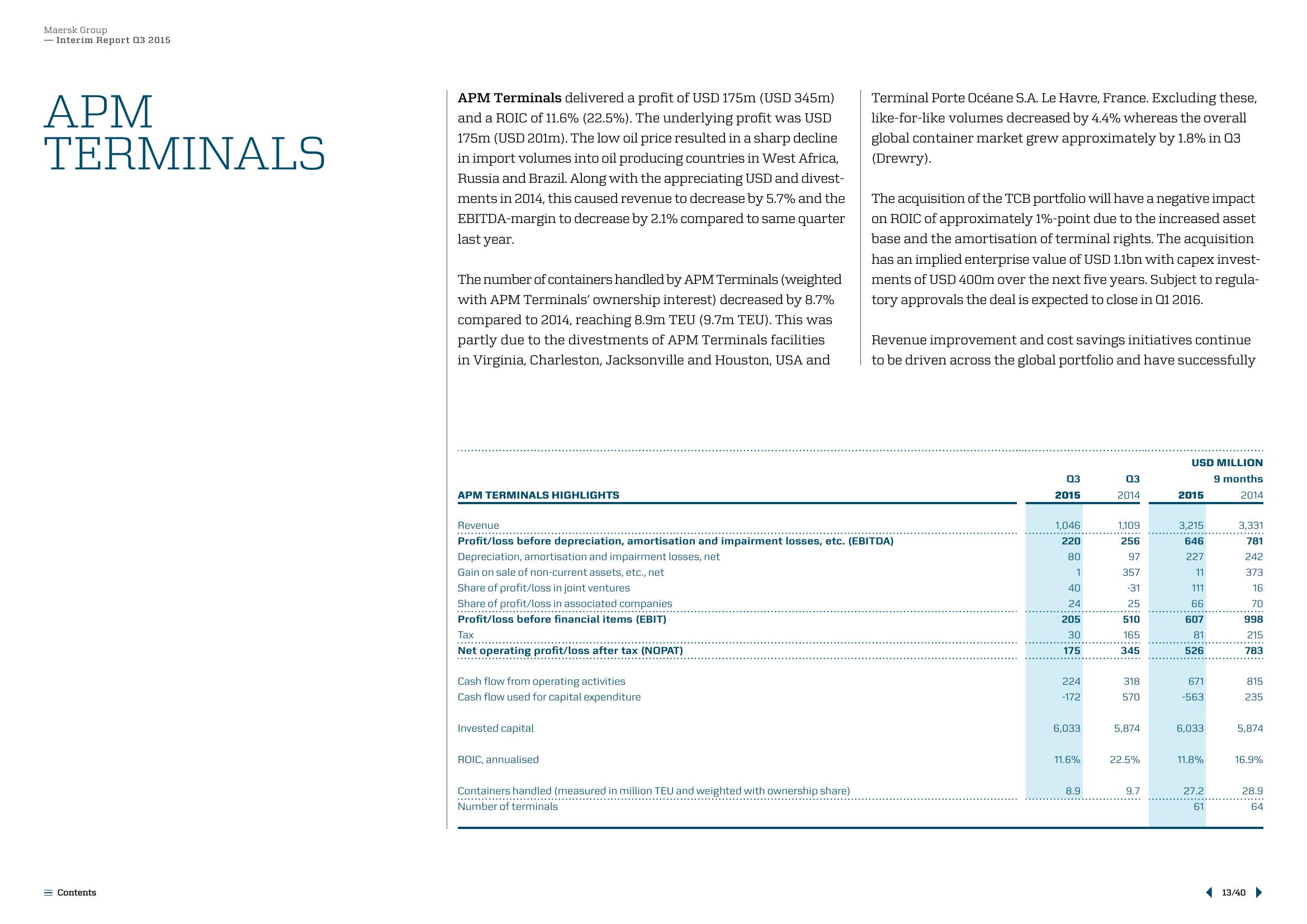

APM Terminals delivered a profit of USD 175m (USD 345m)

and a ROIC of 11.6% (22.5%). The underlying profit was USD

175m (USD 201m). The low oil price resulted in a sharp decline

in import volumes into oil producing countries in West Africa,

Russia and Brazil. Along with the appreciating USD and divest-

ments in 2014, this caused revenue to decrease by 5.7% and the

EBITDA-margin to decrease by 2.1% compared to same quarter

last year.

The number of containers handled by APM Terminals (weighted

with APM Terminals' ownership interest) decreased by 8.7%

compared to 2014, reaching 8.9m TEU (9.7m TEU). This was

partly due to the divestments of APM Terminals facilities

in Virginia, Charleston, Jacksonville and Houston, USA and

APM TERMINALS HIGHLIGHTS

..............

Tax

Net operating profit/loss after tax (NOPAT)

Revenue

***********

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

Cash flow from operating activities

Cash flow used for capital expenditure

Invested capital

ROIC, annualised

Terminal Porte Océane S.A. Le Havre, France. Excluding these,

like-for-like volumes decreased by 4.4% whereas the overall

global container market grew approximately by 1.8% in 03

(Drewry).

Containers handled (measured in million TEU and weighted with ownership share)

Number of terminals

The acquisition of the TCB portfolio will have a negative impact

on ROIC of approximately 1%-point due to the increased asset

base and the amortisation of terminal rights. The acquisition

has an implied enterprise value of USD 1.1bn with capex invest-

ments of USD 400m over the next five years. Subject to regula-

tory approvals the deal is expected to close in Q1 2016.

Revenue improvement and cost savings initiatives continue

to be driven across the global portfolio and have successfully

03

2015

1,046

220

80

1

40

24

205

30

175

224

-172

6,033

11.6%

8.9

03

2014

1,109

256

97

357

-31

25

510

165

345

318

570

5,874

22.5%

9.7

USD MILLION

9 months

2014

2015

3,215

646

227

11

111

66

607

81

526

671

-563

6,033

11.8%

27.2

61

3,331

781

242

373

16

70

998

215

783

815

235

5,874

16.9%

28.9

64

13/40View entire presentation