Forte's Value Destruction Analysis

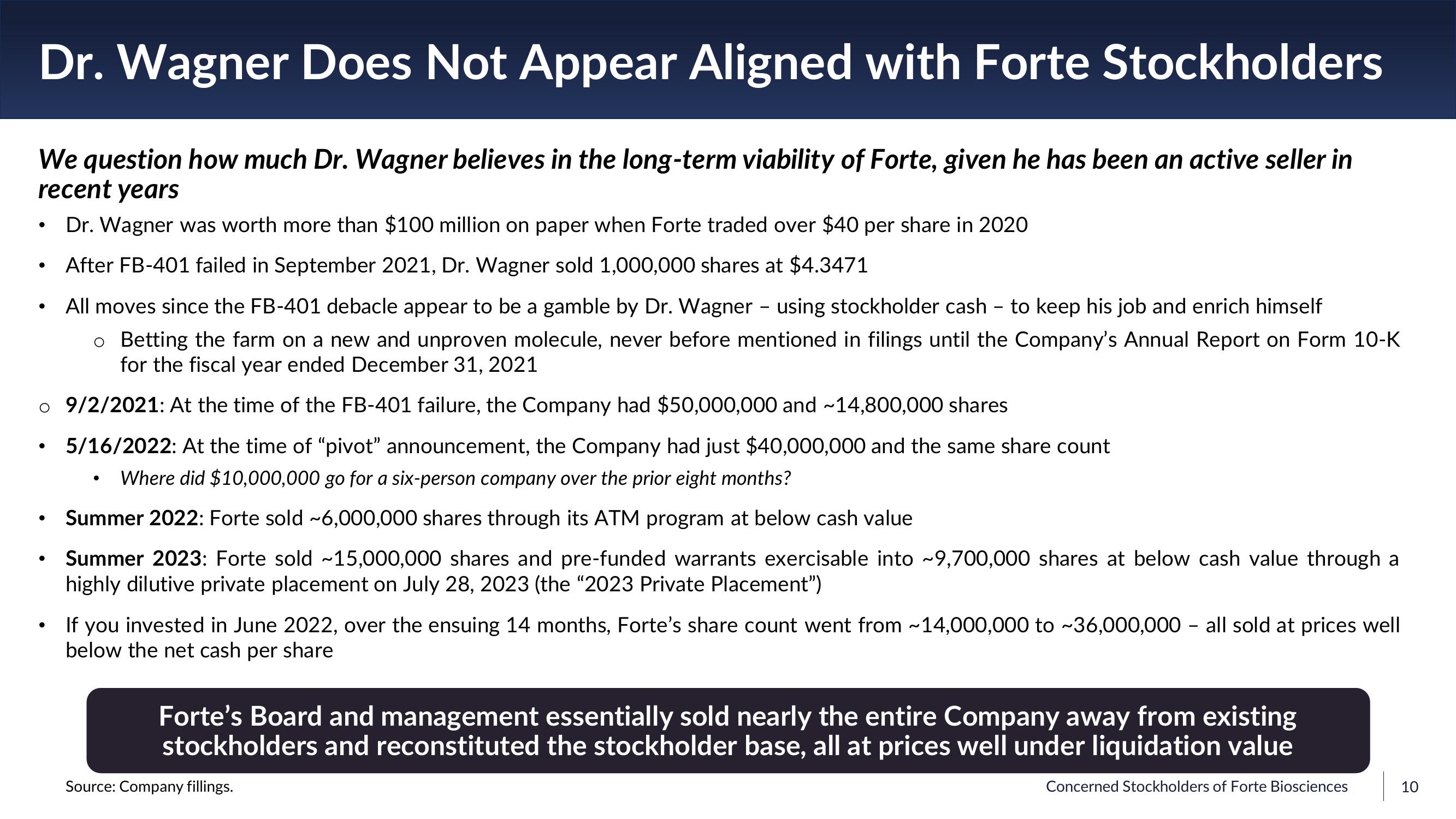

Dr. Wagner Does Not Appear Aligned with Forte Stockholders

We question how much Dr. Wagner believes in the long-term viability of Forte, given he has been an active seller in

recent years

Dr. Wagner was worth more than $100 million on paper when Forte traded over $40 per share in 2020

After FB-401 failed in September 2021, Dr. Wagner sold 1,000,000 shares at $4.3471

All moves since the FB-401 debacle appear to be a gamble by Dr. Wagner - using stockholder cash - to keep his job and enrich himself

o Betting the farm on a new and unproven molecule, never before mentioned in filings until the Company's Annual Report on Form 10-K

for the fiscal year ended December 31, 2021

o 9/2/2021: At the time of the FB-401 failure, the Company had $50,000,000 and ~14,800,000 shares

5/16/2022: At the time of "pivot" announcement, the Company had just $40,000,000 and the same share count

Where did $10,000,000 go for a six-person company over the prior eight months?

Summer 2022: Forte sold ~6,000,000 shares through its ATM program at below cash value

Summer 2023: Forte sold ~15,000,000 shares and pre-funded warrants exercisable into ~9,700,000 shares at below cash value through a

highly dilutive private placement on July 28, 2023 (the "2023 Private Placement")

●

●

●

●

If you invested in June 2022, over the ensuing 14 months, Forte's share count went from ~14,000,000 to ~36,000,000 - all sold at prices well

below the net cash per share

Forte's Board and management essentially sold nearly the entire Company away from existing

stockholders and reconstituted the stockholder base, all at prices well under liquidation value

Concerned Stockholders of Forte Biosciences

Source: Company fillings.

10View entire presentation