Silicon Valley Bank Results Presentation Deck

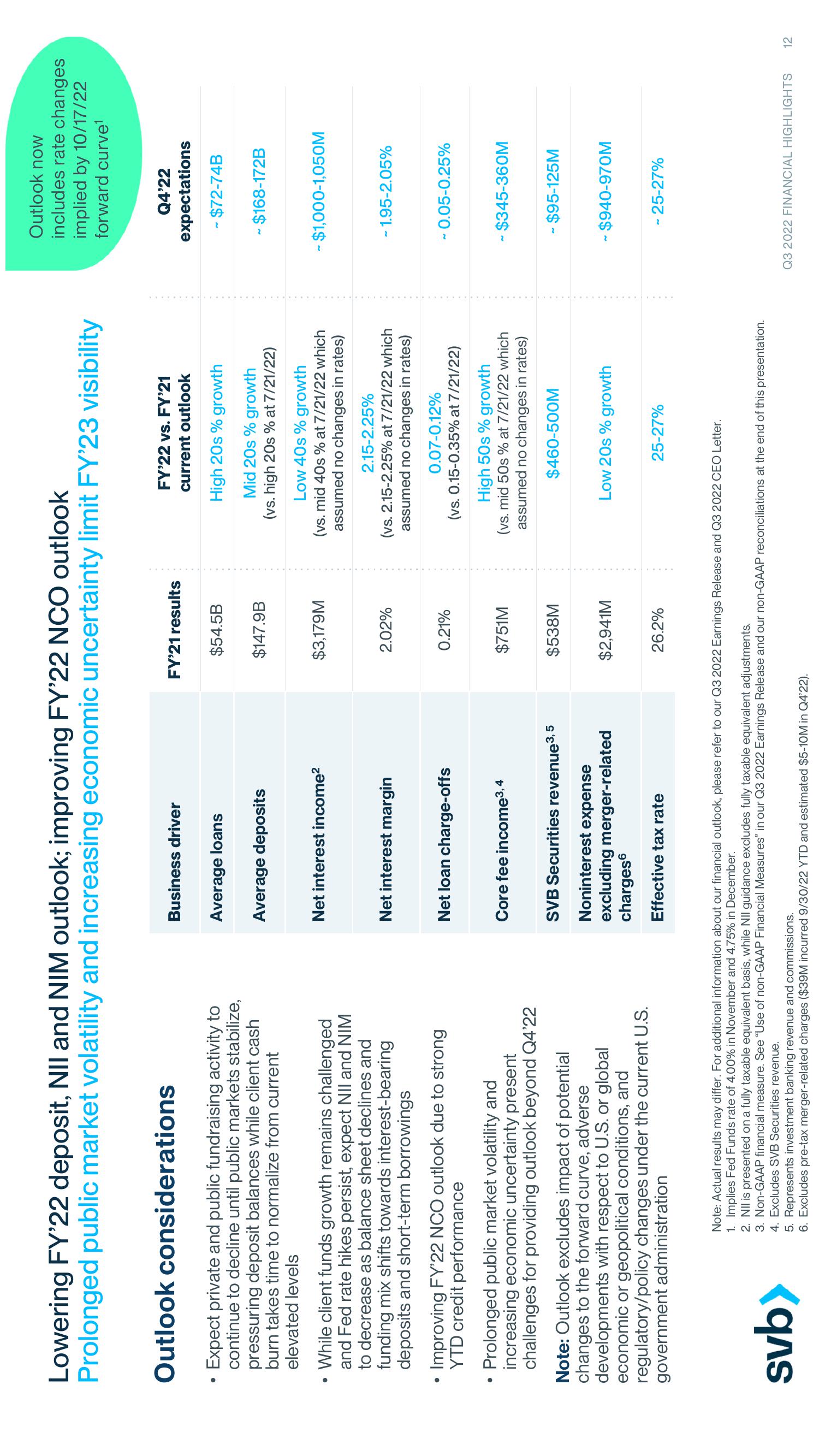

Lowering FY'22 deposit, NII and NIM outlook; improving FY'22 NCO outlook

Prolonged public market volatility and increasing economic uncertainty limit FY'23 visibility

Outlook considerations

• Expect private and public fundraising activity to

continue to decline until public markets stabilize,

pressuring deposit balances while client cash

burn takes time to normalize from current

elevated levels

While client funds growth remains challenged

and Fed rate hikes persist, expect NII and NIM

to decrease as balance sheet declines and

funding mix shifts towards interest-bearing

deposits and short-term borrowings

Improving FY'22 NCO outlook due to strong

YTD credit performance

• Prolonged public market volatility and

increasing economic uncertainty present

challenges for providing outlook beyond Q4'22

Note: Outlook excludes impact of potential

changes to the forward curve, adverse

developments with respect to U.S. or global

economic or geopolitical conditions, and

regulatory/policy changes under the current U.S.

government administration

svb>

Business driver

Average loans

Average deposits

Net interest income²

Net interest margin

Net loan charge-offs

Core fee income³,4

SVB Securities revenue ³,5

Noninterest expense

excluding merger-related

charges6

Effective tax rate

FY'21 results

$54.5B

$147.9B

5. Represents investment banking revenue and commissions.

6. Excludes pre-tax merger-related charges ($39M incurred 9/30/22 YTD and estimated $5-10M in Q4'22).

$3,179M

2.02%

0.21%

$751M

$538M

$2,941M

26.2%

FY'22 vs. FY'21

current outlook

High 20s % growth

Mid 20s % growth

(vs. high 20s % at 7/21/22)

Low 40s % growth

(vs. mid 40s % at 7/21/22 which

assumed no changes in rates)

2.15-2.25%

(vs. 2.15-2.25% at 7/21/22 which

assumed no changes in rates)

0.07-0.12%

(vs. 0.15-0.35% at 7/21/22)

High 50s % growth

(vs. mid 50s % at 7/21/22 which

assumed no changes in rates)

$460-500M

Low 20s % growth

25-27%

Note: Actual results may differ. For additional information about our financial outlook, please refer to our Q3 2022 Earnings Release and Q3 2022 CEO Letter.

1. Implies Fed Funds rate of 4.00% in November and 4.75% in December.

2. NII is presented on a fully taxable equivalent basis, while NII guidance excludes fully taxable equivalent adjustments.

3. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q3 2022 Earnings Release and our non-GAAP reconciliations at the end of this presentation.

4. Excludes SVB Securities revenue.

Outlook now

includes rate changes

implied by 10/17/22

forward curve¹

Q4'22

expectations

- $72-74B

- $168-172B

- $1,000-1,050M

~ 1.95-2.05%

~ 0.05-0.25%

- $345-360M

~ $95-125M

- $940-970M

~ 25-27%

Q3 2022 FINANCIAL HIGHLIGHTS 12View entire presentation