TPG Results Presentation Deck

Fee-Related Earnings

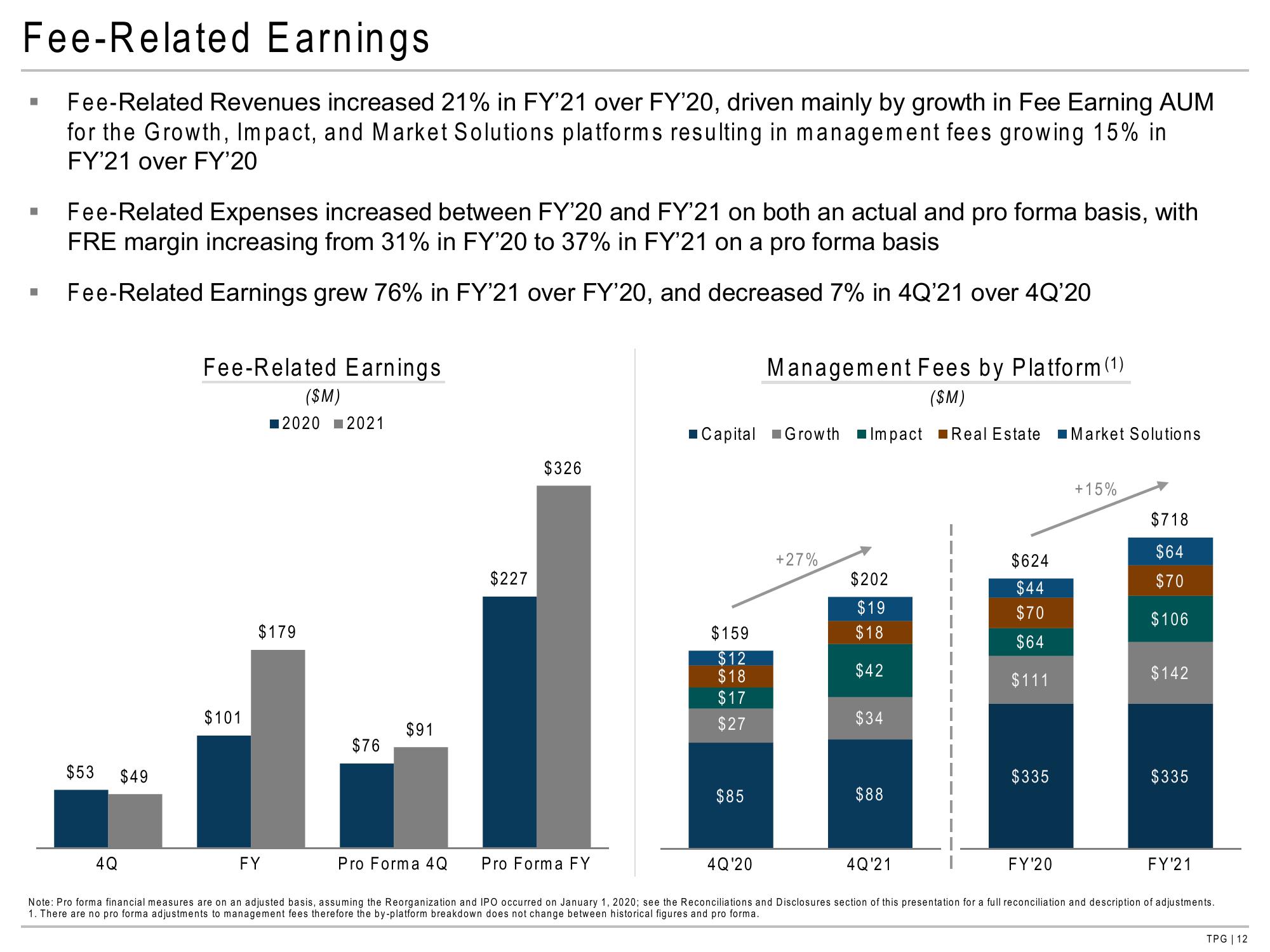

Fee-Related Revenues increased 21% in FY'21 over FY'20, driven mainly by growth in Fee Earning AUM

for the Growth, Impact, and Market Solutions platforms resulting in management fees growing 15% in

FY'21 over FY'20

■

■

Fee-Related Expenses increased between FY'20 and FY'21 on both an actual and pro forma basis, with

FRE margin increasing from 31% in FY'20 to 37% in FY'21 on a pro forma basis

Fee-Related Earnings grew 76% in FY'21 over FY'20, and decreased 7% in 4Q'21 over 4Q'20

$53

4Q

$49

Fee-Related Earnings

$101

($M)

2020 2021

$179

FY

$76

$91

$227

$326

Pro Forma 4Q Pro Forma FY

Management Fees by Platform (1)

($M)

Capital Growth Impact Real Estate Market Solutions

$159

$12

$18

$17

$27

$85

4Q'20

+27%

$202

$19

$18

$42

$34

$88

4Q'21

$624

$44

$70

$64

$111

$335

FY'20

+15%

$718

$64

$70

$106

$142

$335

FY'21

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Reconciliations and Disclosures section of this presentation for a full reconciliation and description of adjustments.

1. There are no pro forma adjustments to management fees therefore the by-platform breakdown does not change between historical figures and pro forma.

TPG | 12View entire presentation