Overstock Results Presentation Deck

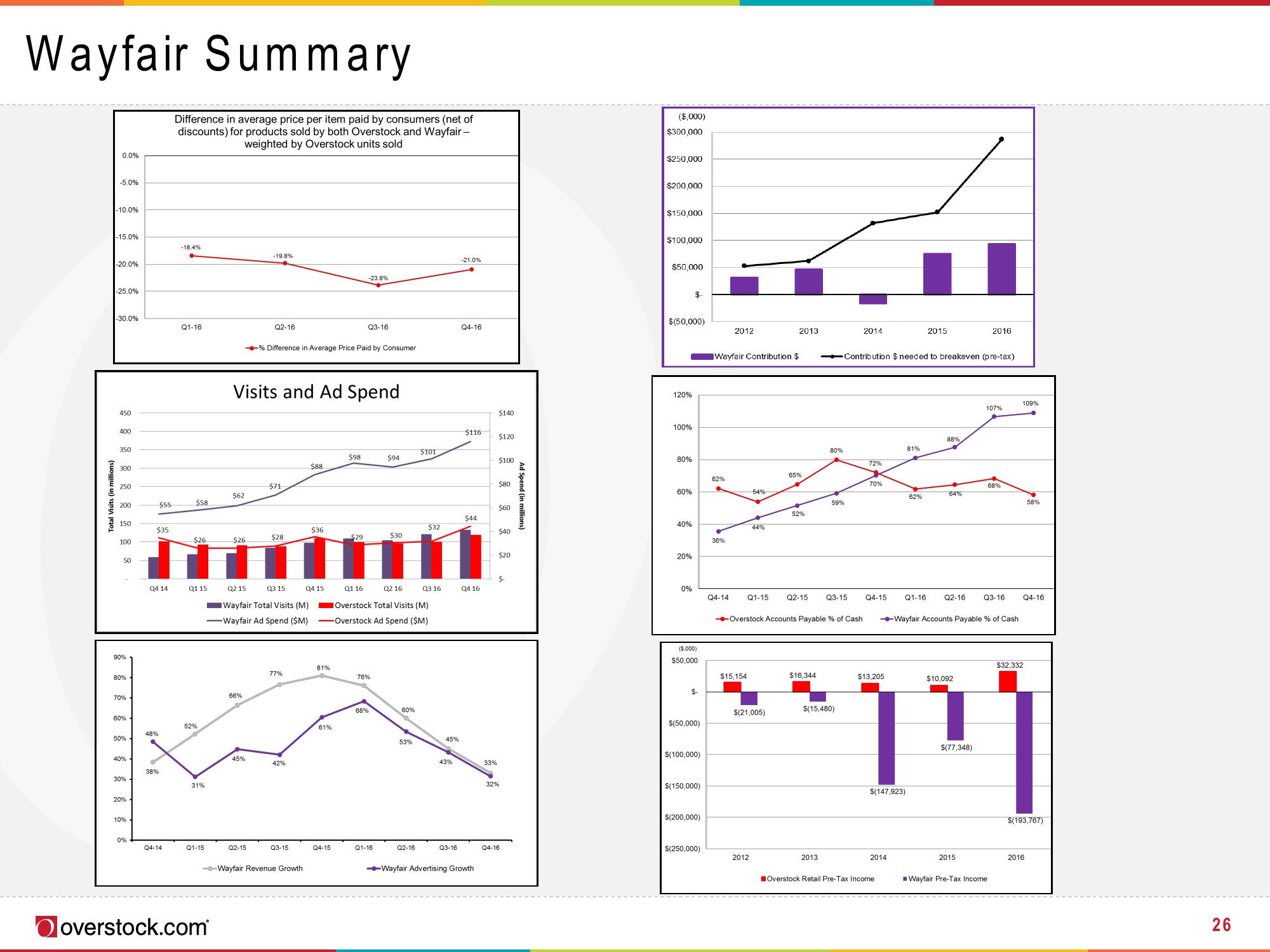

Wayfair Summary

Total Visits (in millions)

0.0%

-5.0%

-10.0%

-15.0%

-20.0%

-25.0%

-30.0%

450

400

350

300

250

200

150

100

50

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

48%

$55

38%

Difference in average price per item paid by consumers (net of

discounts) for products sold by both Overstock and Wayfair -

weighted by Overstock units sold

Q4-14

-18.4%

$35

$26

HH

Q4 14

Q1 15

Q1-16

$58

52%

31%

Q1-15

$62

overstock.com

$26

Q2 15

Visits and Ad Spend

66%

-19.8%

→→→% Difference in Average Price Paid by Consumer

Q2-16

45%

Q2-15

$71

Wayfair Total Visits (M)

-Wayfair Ad Spend ($M)

$28

Q3 15

77%

42%

Q3-15

--Wayfair Revenue Growth

$88

$36

04 15

81%

61%

Q4-15

$98

$29

-23.8%

Q3-16

Q1 16

76%

68%

$94

Q1-16

$30

Q2 16

Overstock Total Visits (M)

Overstock Ad Spend ($M)

60%

53%

$101

Q2-16

$32

Q3 16

45%

43%

Q3-16

-21.0%

Q4-16

$116

$44

Q4 16

--Wayfair Advertising Growth

33%

32%

$140

$120

$100

$80

$60

$40

$20

Q4-16

$-

Ad Spend (in millions)

($,000)

$300,000

$250,000

$200,000

$150,000

$100,000

$50,000

$(50,000)

120%

100%

80%

60%

40%

20%

$

0%

($,000)

$50,000

$

$(50,000)

$(100,000)

$(150,000)

$(200,000)

$(250,000)

Wayfair Contribution $

62%

36%

2012

Q4-14

54%

Q1-15

$15,154

44%

2012

$(21,005)

2013

65%

52%

Q2-15

→→-Overstock Accounts Payable % of Cash

$16,344

80%

2013

59%

-Contribution $ needed to breakeven (pre-tax)

Q3-15

$(15,480)

2014

72%

70%

$13,205

$(147,923)

81%

2014

Overstock Retail Pre-Tax Income

2015

62%

Q4-15 Q1-16 Q2-16

88%

64%

-Wayfair Accounts Payable % of Cash

$10,092

$(77,348)

2016

2015

107%

68%

Q3-16

■Wayfair Pre-Tax Income

109%

Q4-16

$32,332

58%

$(193,767)

2016

26View entire presentation