Pershing Square Activist Presentation Deck

A. Pershing's Proposal: Assumptions

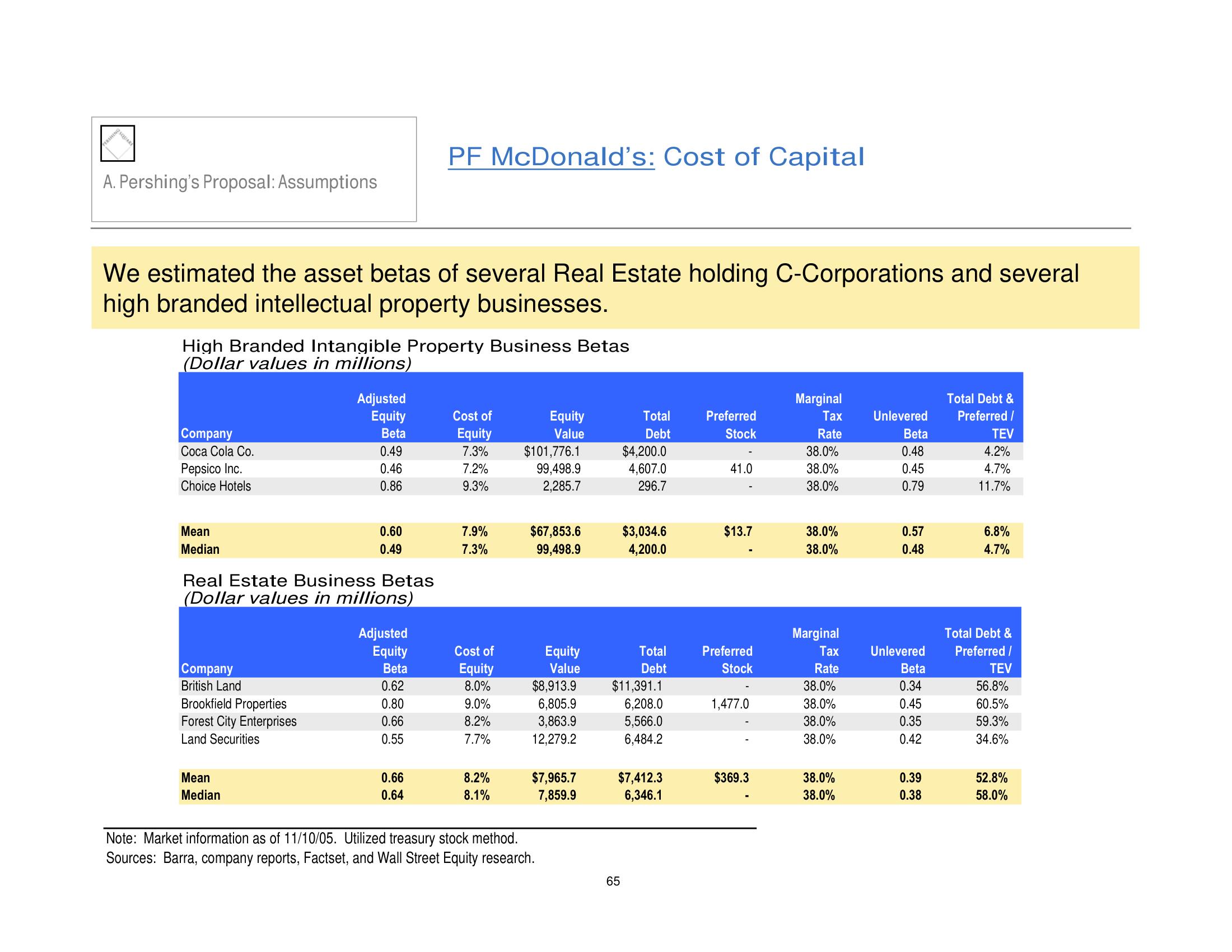

We estimated the asset betas of several Real Estate holding C-Corporations and several

high branded intellectual property businesses.

High Branded Intangible Property Business Betas

(Dollar values in millions)

Company

Coca Cola Co.

Pepsico Inc.

Choice Hotels

Mean

Median

Company

British Land

Brookfield Properties

Forest City Enterprises

Land Securities

Adjusted

Equity

Beta

Mean

Median

0.49

0.46

0.86

Real Estate Business Betas

(Dollar values in millions)

0.60

0.49

PF McDonald's: Cost of Capital

Adjusted

Equity

Beta

0.62

0.80

0.66

0.55

0.66

0.64

Cost of

Equity

7.3%

7.2%

9.3%

7.9%

7.3%

Cost of

Equity

8.0%

9.0%

8.2%

7.7%

8.2%

8.1%

Equity

Value

$101,776.1

99,498.9

2,285.7

$67,853.6

99,498.9

Equity

Value

$8,913.9

6,805.9

3,863.9

12,279.2

Note: Market information as of 11/10/05. Utilized treasury stock method.

Sources: Barra, company reports, Factset, and Wall Street Equity research.

$7,965.7

7,859.9

Total

Debt

$4,200.0

4,607.0

296.7

65

$3,034.6

4,200.0

Total

Debt

$11,391.1

6,208.0

5,566.0

6,484.2

$7,412.3

6,346.1

Preferred

Stock

41.0

$13.7

Preferred

Stock

1,477.0

$369.3

Marginal

Tax Unlevered

Rate

38.0%

38.0%

38.0%

38.0%

38.0%

Marginal

Tax

Rate

38.0%

38.0%

38.0%

38.0%

38.0%

38.0%

Beta

0.48

0.45

0.79

0.57

0.48

Unlevered

Beta

0.34

0.45

0.35

0.42

0.39

0.38

Total Debt &

Preferred /

TEV

4.2%

4.7%

11.7%

6.8%

4.7%

Total Debt &

Preferred /

TEV

56.8%

60.5%

59.3%

34.6%

52.8%

58.0%View entire presentation