Netstreit Investor Presentation Deck

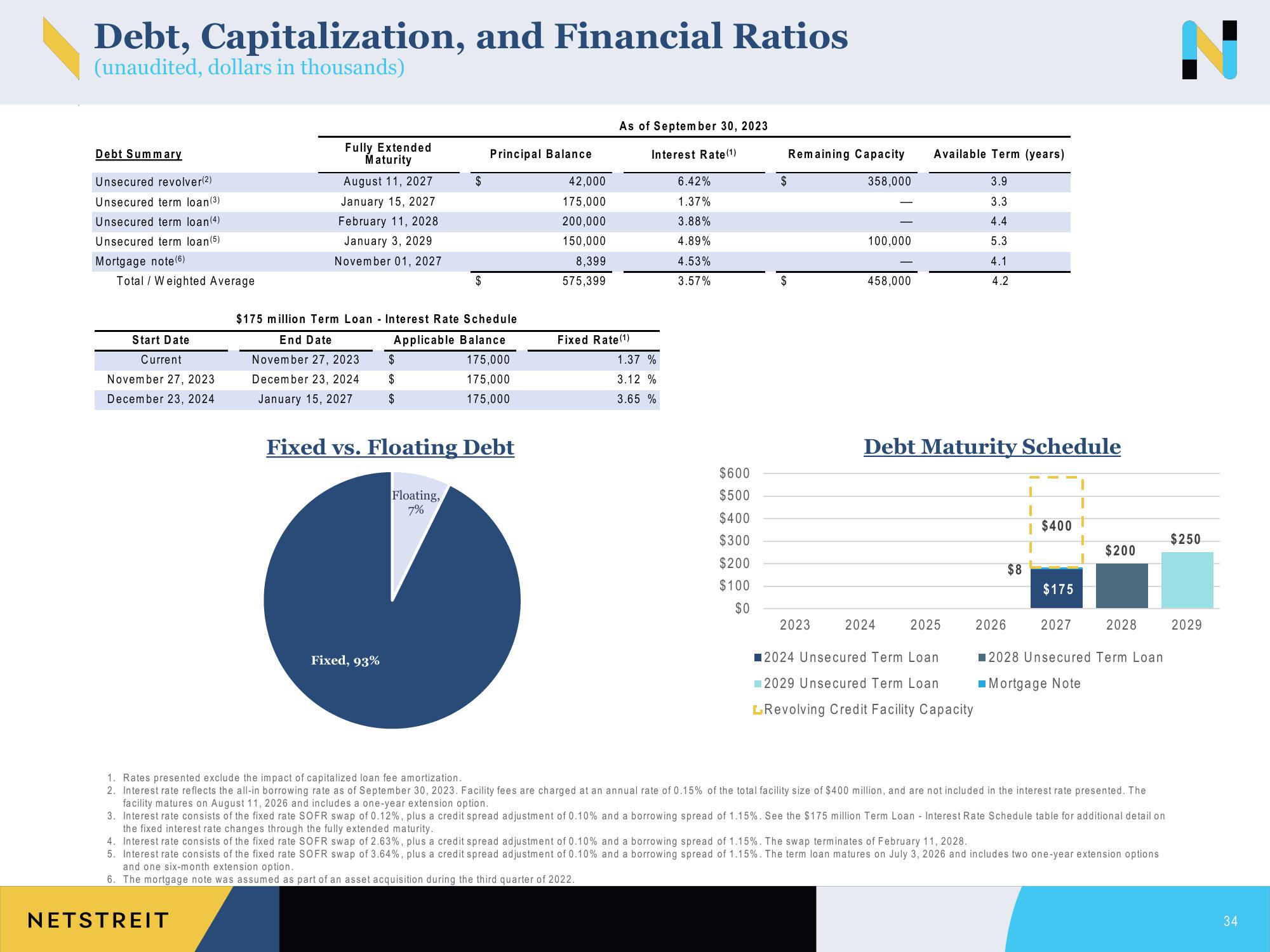

Debt, Capitalization, and Financial Ratios

(unaudited, dollars in thousands)

Debt Summary

Unsecured revolver(2)

Unsecured term loan (3)

Unsecured term loan (4)

Unsecured term loan (5)

Mortgage note (6)

Total Weighted Average

Start Date

Current

November 27, 2023

December 23, 2024

Fully Extended

Maturity

NETSTREIT

August 11, 2027

January 15, 2027

February 11, 2028

January 3, 2029

November 01, 2027

Fixed, 93%

$

$

$

$

$

$175 million Term Loan Interest Rate Schedule

Applicable Balance

175,000

End Date

November 27, 2023

December 23, 2024

January 15, 2027

175,000

175,000

Fixed vs. Floating Debt

Floating,

7%

Principal Balance

42,000

175,000

200,000

150,000

8,399

575,399

As of September 30, 2023

Interest Rate (1)

Fixed Rate (1)

1.37 %

3.12%

3.65 %

6.42%

1.37%

3.88%

4.89%

4.53%

3.57%

$600

$500

$400

$300

$200

$100

$0

Remaining Capacity

358,000

$

$

2023

100,000

458,000

Available Term (years)

3.9

3.3

4.4

5.3

4.1

4.2

Debt Maturity Schedule

2024

2025

2026

2024 Unsecured Term Loan

2029 Unsecured Term Loan

LRevolving Credit Facility Capacity

$8

I $400

$175

2027

$200

2028

■2028 Unsecured Term Loan

Mortgage Note

1. Rates presented exclude the impact of capitalized loan fee amortization.

2. Interest rate reflects the all-in borrowing rate as of September 30, 2023. Facility fees are charged at an annual rate of 0.15% of the total facility size of $400 million, and are not included in the interest rate presented. The

facility matures on August 11, 2026 and includes a one-year extension option.

3. Interest rate consists of the fixed rate SOFR swap of 0.12%, plus a credit s ead adjustment of 0.10% and a borrowing spread of 1.15%. See the $175 million Term Loan - Interest Rate Schedule table for additional detail on

the fixed interest rate changes through the fully extended maturity.

4. Interest rate consists of the fixed rate SOFR swap of 2.63%, plus a credit spread adjustment of 0.10% and a borrowing spread of 1.15%. The swap terminates of February 11, 2028.

5. Interest rate consists of the fixed rate SOFR swap of 3.64%, plus a credit spread adjustment of 0.10% and a borrowing spread of 1.15%. The term loan matures on July 3, 2026 and includes two one-year extension options

and one six-month extension option.

6. The mortgage note was assumed as part of an asset acquisition during the third quarter of 2022.

$250

2029

34View entire presentation