Shopify Results Presentation Deck

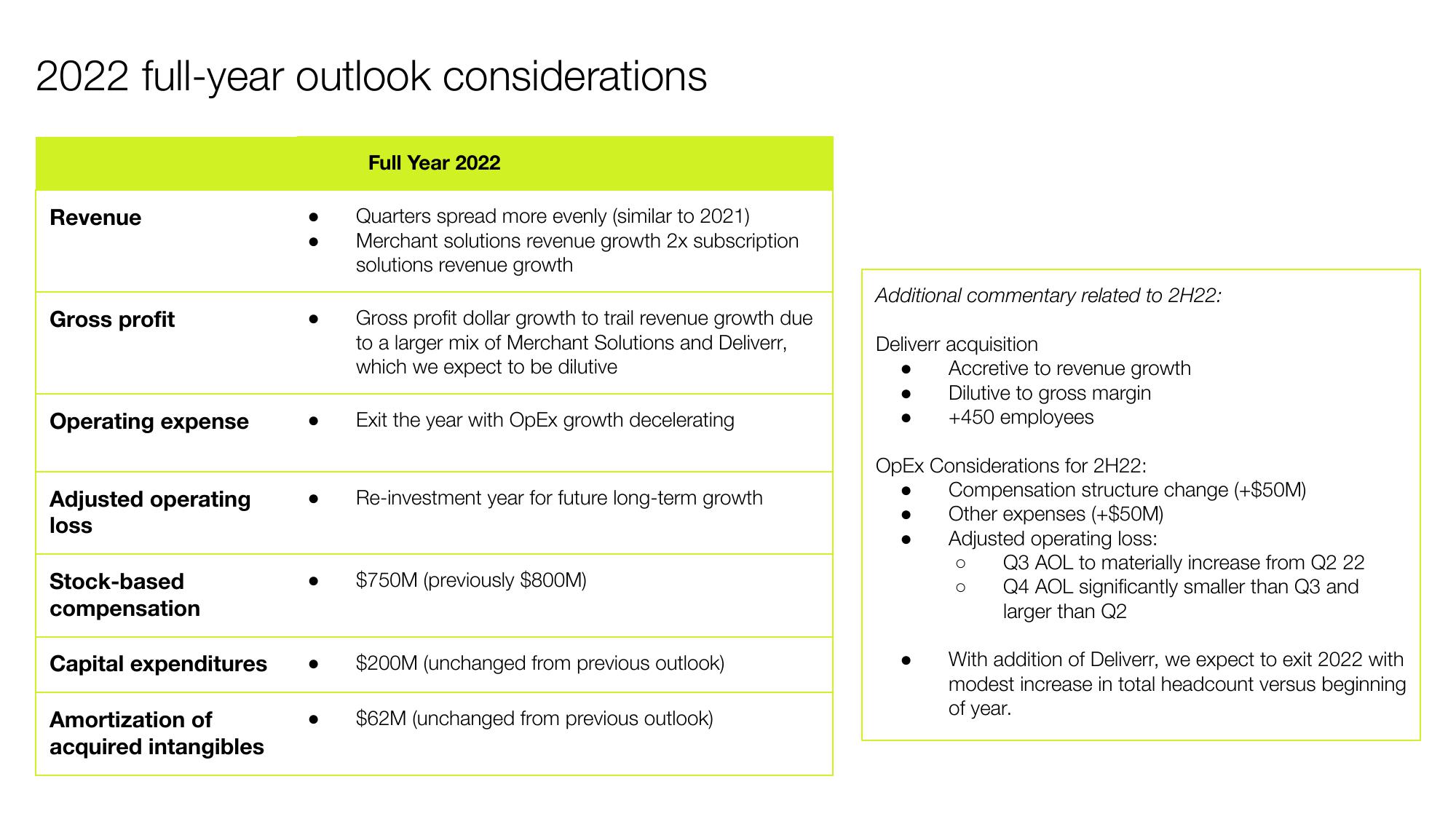

2022 full-year outlook considerations

Revenue

Gross profit

Operating expense

Adjusted operating

loss

Stock-based

compensation

Capital expenditures

Amortization of

acquired intangibles

Full Year 2022

Quarters spread more evenly (similar to 2021)

Merchant solutions revenue growth 2x subscription

solutions revenue growth

Gross profit dollar growth to trail revenue growth due

to a larger mix of Merchant Solutions and Deliverr,

which we expect to be dilutive

Exit the year with OpEx growth decelerating

Re-investment year for future long-term growth

$750M (previously $800M)

$200M (unchanged from previous outlook)

$62M (unchanged from previous outlook)

Additional commentary related to 2H22:

Deliverr acquisition

Accretive to revenue growth

Dilutive to gross margin

+450 employees

OpEx Considerations for 2H22:

Compensation structure change (+$50M)

Other expenses (+$50M)

Adjusted operating loss:

Q3 AOL to materially increase from Q2 22

Q4 AOL significantly smaller than Q3 and

larger than Q2

With addition of Deliverr, we expect to exit 2022 with

modest increase in total headcount versus beginning

of year.View entire presentation