CorpAcq SPAC Presentation Deck

13

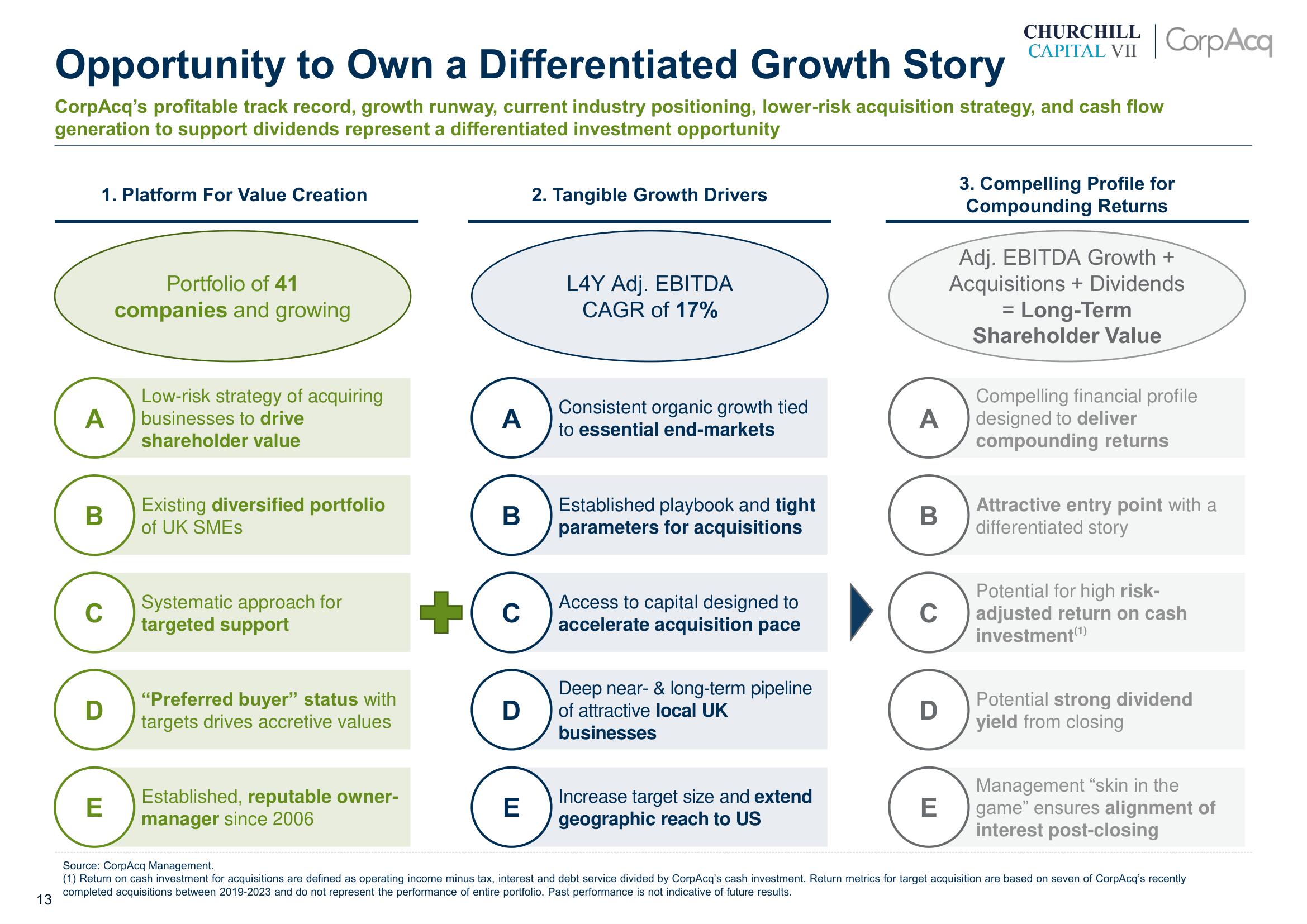

Opportunity to Own a Differentiated Growth Story

CorpAcq's profitable track record, growth runway, current industry positioning, lower-risk acquisition strategy, and cash flow

generation to support dividends represent a differentiated investment opportunity

1. Platform For Value Creation

A

B

C

D

E

Portfolio of 41

companies and growing

Low-risk strategy of acquiring

businesses to drive

shareholder value

Existing diversified portfolio

of UK SMES

Systematic approach for

targeted support

"Preferred buyer" status with

targets drives accretive values

Established, reputable owner-

manager since 2006

A

B

2. Tangible Growth Drivers

E

L4Y Adj. EBITDA

CAGR of 17%

Consistent organic growth tied

to essential end-markets

C

+O

D

D

Established playbook and tight

parameters for acquisitions

Access to capital designed to

accelerate acquisition pace

Deep near- & long-term pipeline

of attractive local UK

businesses

Increase target size and extend

geographic reach to US

A

B

C

D

CHURCHILL

CAPITAL VII CorpAcq

E

3. Compelling Profile for

Compounding Returns

Adj. EBITDA Growth +

Acquisitions + Dividends

= Long-Term

Shareholder Value

Compelling financial profile

designed to deliver

compounding returns

Attractive entry point with a

differentiated story

Potential for high risk-

adjusted return on cash

investment (¹)

Potential strong dividend

yield from closing

Management "skin in the

game" ensures alignment of

interest post-closing

Source: CorpAcq Management.

(1) Return on cash investment for acquisitions are defined as operating income minus tax, interest and debt service divided by CorpAcq's cash investment. Return metrics for target acquisition are based on seven of CorpAcq's recently

completed acquisitions between 2019-2023 and do not represent the performance of entire portfolio. Past performance is not indicative of future results.View entire presentation