Credit Suisse Results Presentation Deck

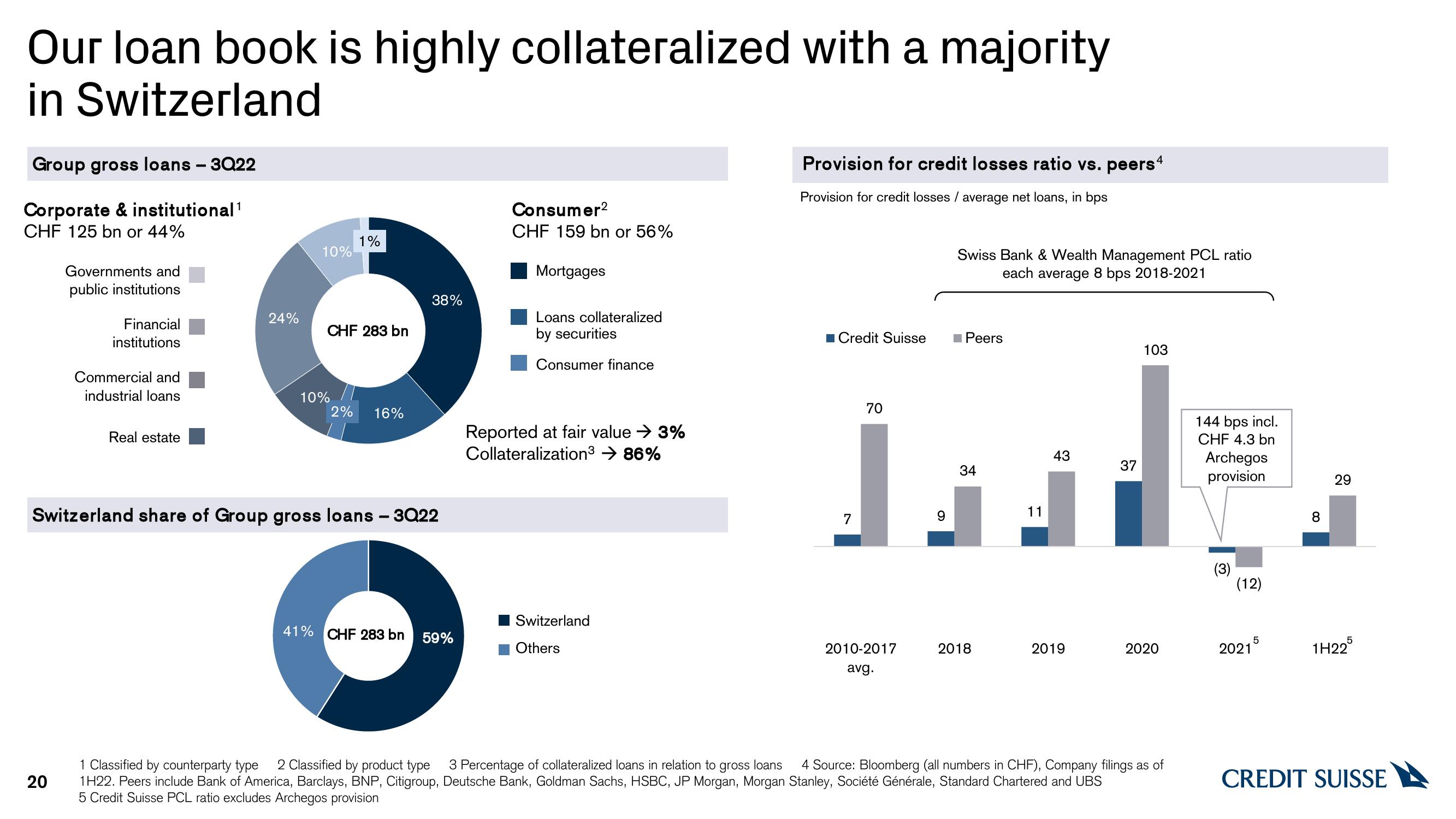

Our loan book is highly collateralized with a majority

in Switzerland

Group gross loans - 3Q22

Corporate & institutional ¹

CHF 125 bn or 44%

Governments and

public institutions

20

Financial

institutions

Commercial and

industrial loans

Real estate

24%

10%

CHF 283 bn

10%

1%

2%

16%

38%

Switzerland share of Group gross loans - 3Q22

41% CHF 283 bn 59%

Consumer²

CHF 159 bn or 56%

Mortgages

Loans collateralized

by securities

Consumer finance

Reported at fair value → 3%

Collateralization³ → 86%

Switzerland

Others

Provision for credit losses ratio vs. peers4

Provision for credit losses / average net loans, in bps

■Credit Suisse

7

70

2010-2017

avg.

9

Swiss Bank & Wealth Management PCL ratio

each average 8 bps 2018-2021

Peers

34

2018

11

43

2019

37

103

2020

1 Classified by counterparty type 2 Classified by product type 3 Percentage of collateralized loans in relation to gross loans 4 Source: Bloomberg (all numbers in CHF), Company filings as of

1H22. Peers include Bank of America, Barclays, BNP, Citigroup, Deutsche Bank, Goldman Sachs, HSBC, JP Morgan, Morgan Stanley, Société Générale, Standard Chartered and UBS

5 Credit Suisse PCL ratio excludes Archegos provision

144 bps incl.

CHF 4.3 bn

Archegos

provision

(3)

(12)

20215

8

29

1H225

CREDIT SUISSEView entire presentation