Netstreit Investor Presentation Deck

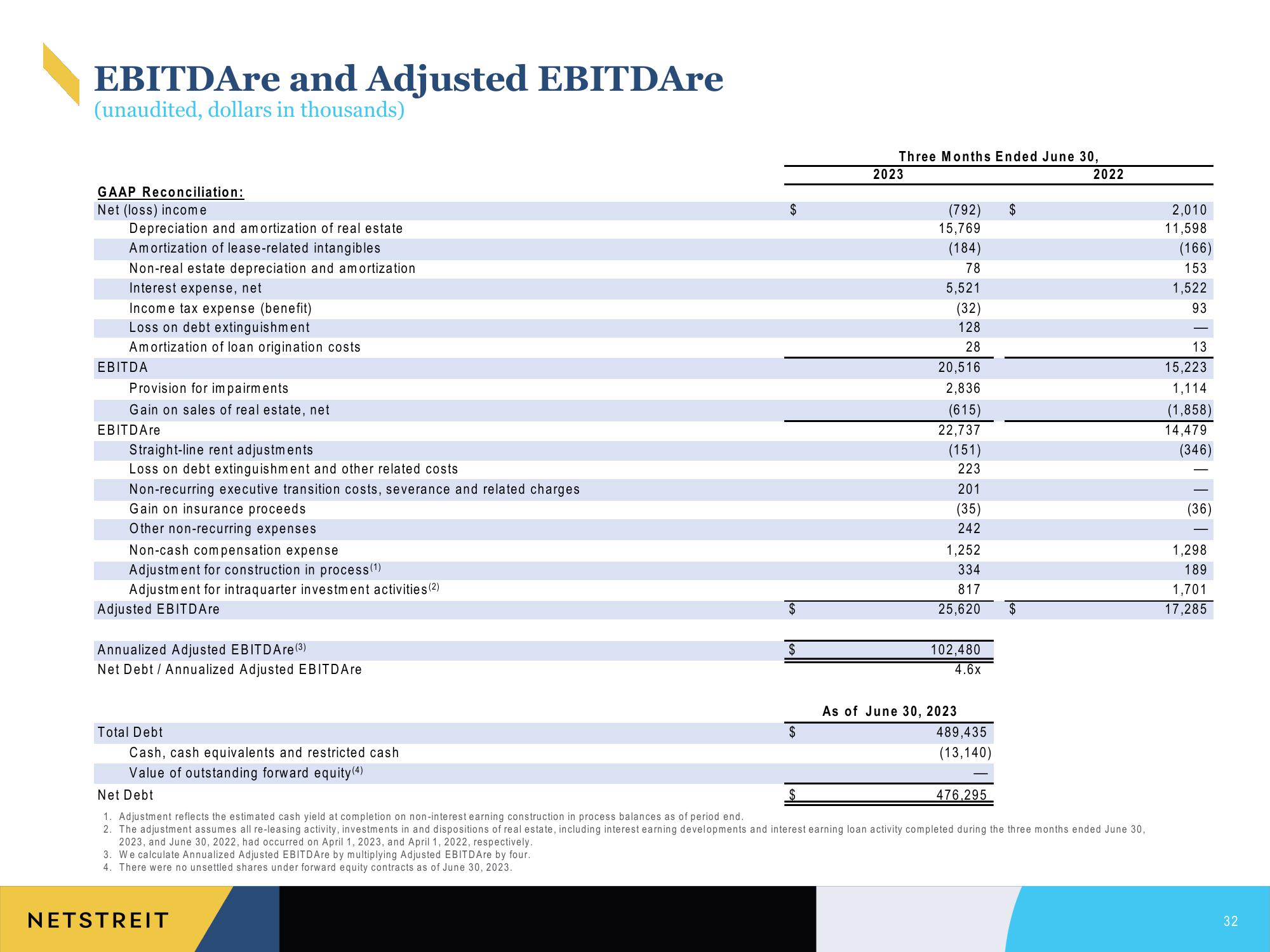

EBITDAre and Adjusted EBITDAre

(unaudited, dollars in thousands)

GAAP Reconciliation:

Net (loss) income

Depreciation and amortization of real estate

Amortization of lease-related intangibles

Non-real estate depreciation and amortization

Interest expense, net

Income tax expense (benefit)

Loss on debt extinguishment

Amortization of loan origination costs

EBITDA

Provision for impairments

Gain on sales of real estate, net

EBITDAre

Straight-line rent adjustments

Loss on debt extinguishment and other related costs

Non-recurring executive transition costs, severance and related charges

Gain on insurance proceeds

Other non-recurring expenses

Non-cash compensation expense

Adjustment for construction in process (¹)

Adjustment for intraquarter investment activities (2)

Adjusted EBITDAre

Annualized Adjusted EBITDAre (³)

Net Debt / Annualized Adjusted EBITD Are

Total Debt

Cash, cash equivalents and restricted cash

Value of outstanding forward equity (4)

Net Debt

3. We calculate Annualized Adjusted EBITDAre by multiplying Adjusted EBITDAre by four.

4. There were no unsettled shares under forward equity contracts as of June 30, 2023.

$

NETSTREIT

$

$

$

Three Months Ended June 30,

2023

(792)

15,769

(184)

78

5,521

(32)

128

28

20,516

2,836

(615)

22,737

(151)

223

201

(35)

242

1,252

334

817

25,620

102,480

4.6x

As of June 30, 2023

489,435

(13,140)

476.295

$

$

1. Adjustment reflects the estimated cash yield at completion on non-interest earning construction in process balances as of period end.

2. The adjustment assumes all re-leasing activity, investments in and dispositions of real estate, including interest earning developments and interest earning loan activity completed during the three months ended June 30,

2023, and June 30, 2022, had occurred on April 1, 2023, and April 1, 2022, respectively.

2022

2,010

11,598

(166)

153

1,522

93

13

15,223

1,114

(1,858)

14,479

(346)

(36)

1,298

189

1,701

17,285

32View entire presentation