FiscalNote Investor Presentation Deck

15

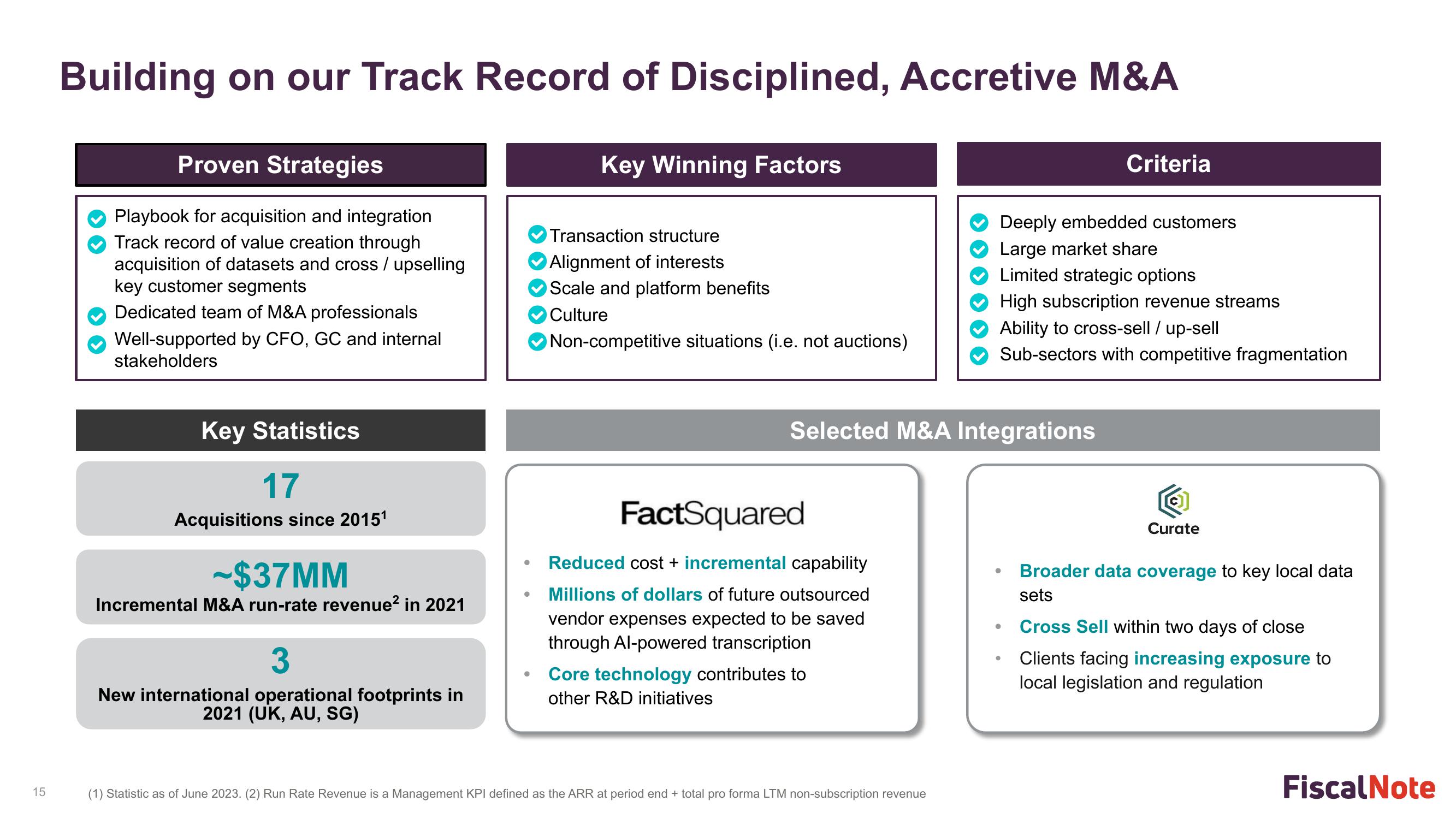

Building on our Track Record of Disciplined, Accretive M&A

Proven Strategies

Playbook for acquisition and integration

Track record of value creation through

acquisition of datasets and cross / upselling

key customer segments

Dedicated team of M&A professionals

Well-supported by CFO, GC and internal

stakeholders

Key Statistics

17

Acquisitions since 2015¹

-$37MM

Incremental M&A run-rate revenue² in 2021

New international operational footprints in

2021 (UK, AU, SG)

●

●

Key Winning Factors

Transaction structure

Alignment of interests

Scale and platform benefits

Culture

Non-competitive situations (i.e. not auctions)

Selected M&A Integrations

FactSquared

Reduced cost + incremental capability

Millions of dollars of future outsourced

vendor expenses expected to be saved

through Al-powered transcription

Core technology contributes to

other R&D initiatives

(1) Statistic as of June 2023. (2) Run Rate Revenue is a Management KPI defined as the ARR at period end + total pro forma LTM non-subscription revenue

Deeply embedded customers

Large market share

Limited strategic options

High subscription revenue streams

Ability to cross-sell / up-sell

Sub-sectors with competitive fragmentation

●

Criteria

●

C

Curate

Broader data coverage to key local data

sets

Cross Sell within two days of close

Clients facing increasing exposure to

local legislation and regulation

Fiscal NoteView entire presentation