Allwyn Investor Conference Presentation Deck

LTM September 2022 financials summary

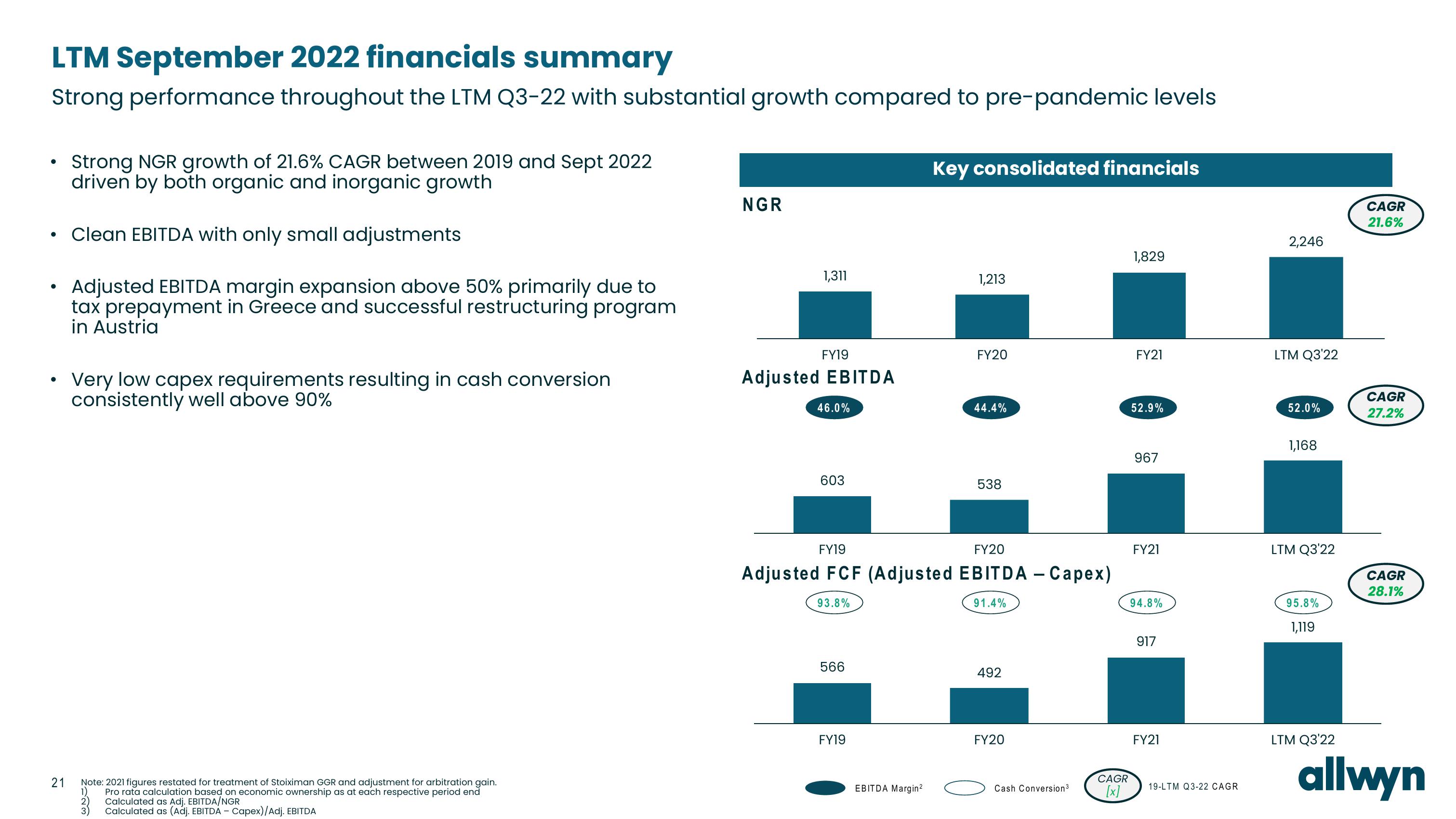

Strong performance throughout the LTM Q3-22 with substantial growth compared to pre-pandemic levels

Strong NGR growth of 21.6% CAGR between 2019 and Sept 2022

driven by both organic and inorganic growth

• Clean EBITDA with only small adjustments

Adjusted EBITDA margin expansion above 50% primarily due to

tax prepayment in Greece and successful restructuring program

in Austria

●

●

●

21

N

Very low capex requirements resulting in cash conversion

consistently well above 90%

Note: 2021 figures restated for treatment of Stoiximan GGR and adjustment for arbitration gain.

Pro rata calculation based on economic ownership as at each respective period end

Calculated as Adj. EBITDA/NGR

Calculated as (Adj. EBITDA - Capex)/Adj. EBITDA

1)

2)

3)

NGR

1,311

FY19

Adjusted EBITDA

46.0%

603

566

FY19

Key consolidated financials

EBITDA Margin²

1,213

FY20

FY19

FY20

Adjusted FCF (Adjusted EBITDA - Capex)

93.8%

91.4%

44.4%

538

492

FY20

Cash Conversion ³

CAGR

[x]

1,829

FY21

52.9%

967

FY21

94.8%

917

FY21

19-LTM Q3-22 CAGR

2,246

LTM Q3'22

52.0%

1,168

LTM Q3'22

95.8%

1,119

LTM Q3'22

CAGR

21.6%

CAGR

27.2%

CAGR

28.1%

allwynView entire presentation