flyExclusive SPAC

II. WHO WE ARE

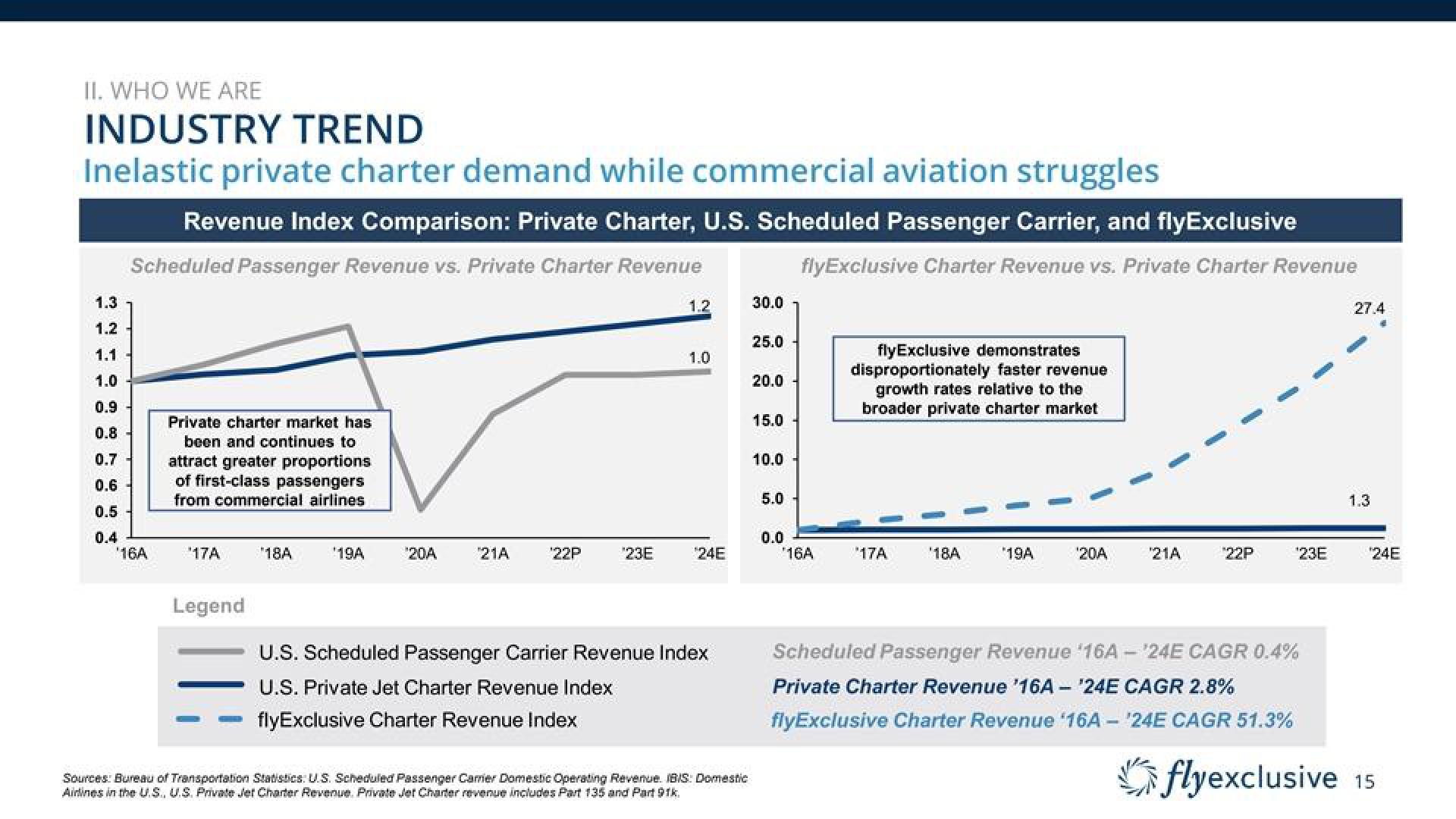

INDUSTRY TREND

Inelastic private charter demand while commercial aviation struggles

Revenue Index Comparison: Private Charter, U.S. Scheduled Passenger Carrier, and flyExclusive

Scheduled Passenger Revenue vs. Private Charter Revenue

flyExclusive Charter Revenue vs. Private Charter Revenue

1.3

1.2

1.1

1.0

0.9

0.8

0.7

0.6

0.5

0.4

'16A

OSTERNE

Private charter market has

been and continues to

attract greater proportions

of first-class passengers

from commercial airlines

'17A

Legend

18A

'19A

'20A

21A

¹22P

'23E

1.2

1.0

*24E

U.S. Scheduled Passenger Carrier Revenue Index

U.S. Private Jet Charter Revenue Index

flyExclusive Charter Revenue Index

Sources: Bureau of Transportation Statistics: U.S. Scheduled Passenger Carrer Domestic Operating Revenue. IBIS: Domestic

Airlines in the U.S., U.S. Private Jet Charter Revenue. Private Jet Charter revenue includes Part 135 and Part 91k.

30.0

25.0

20.0

15.0

10.0

5.0

0.0

'16A

flyExclusive demonstrat

disproportionately faster revenue

growth rates relative to the

broader private charter market

'17A

'18A

"19A

'20A

'21A

22P

¹23E

Scheduled Passenger Revenue '16A- '24E CAGR 0.4%

Private Charter Revenue '16A- '24E CAGR 2.8%

flyExclusive Charter Revenue '16A- '24E CAGR 51.3%

27.4

1.3

¹24E

flyexclusive 15View entire presentation