Kinnevik Results Presentation Deck

Intro

Net Asset Value

A VOLATILE YET STABLE START TO 2023

Comparing levels at the end of Q1 2023 to the end of 2022, public

equity markets seem to have been stable and positive. Thereinbetween,

however, volatility remained high with continued market jitters to ma-

croeconomic indicators and fears of instability in the banking system.

Broader market indices appreciated by 15-20 percent, largely driven

by the large tech giants. The weighted-average share price increase

in our unlisted portfolio's peer universe was just over 10 percent when

excluding buyouts, compared to a 2 percent weighted-average write-up

of our underlying valuations.

We saw positive movements in our value-based care benchmarks,

noting however that the number of comparable businesses is shrinking

drastically through buyouts, and stable movements in our software and

virtual care benchmarks. On average, the weighted-average peer multiple

expanded by 16 percent (less than 10 percent when excluding buyouts),

compared to 1 percent multiple expansion in our unlisted portfolio.

We revised our expectations on 2023 quite materially in the last quarter,

with our investees deprioritizing growth in favor of longer cash runways

and financial strength. In the first quarter, our 2023 revenue estimates

have been revised downwards in low single-digit percentages, driven by

our more consumer-facing businesses expecting a further weakening of

consumer spending. In our B2B businesses, the outlook remained stable.

In aggregate, the NTM revenue outlook for Q2 2023 through Q1 2024 is

5-6 percent higher than last quarter's outlook for the 2023 full-year (or

around 10 percent higher in our B2B businesses).

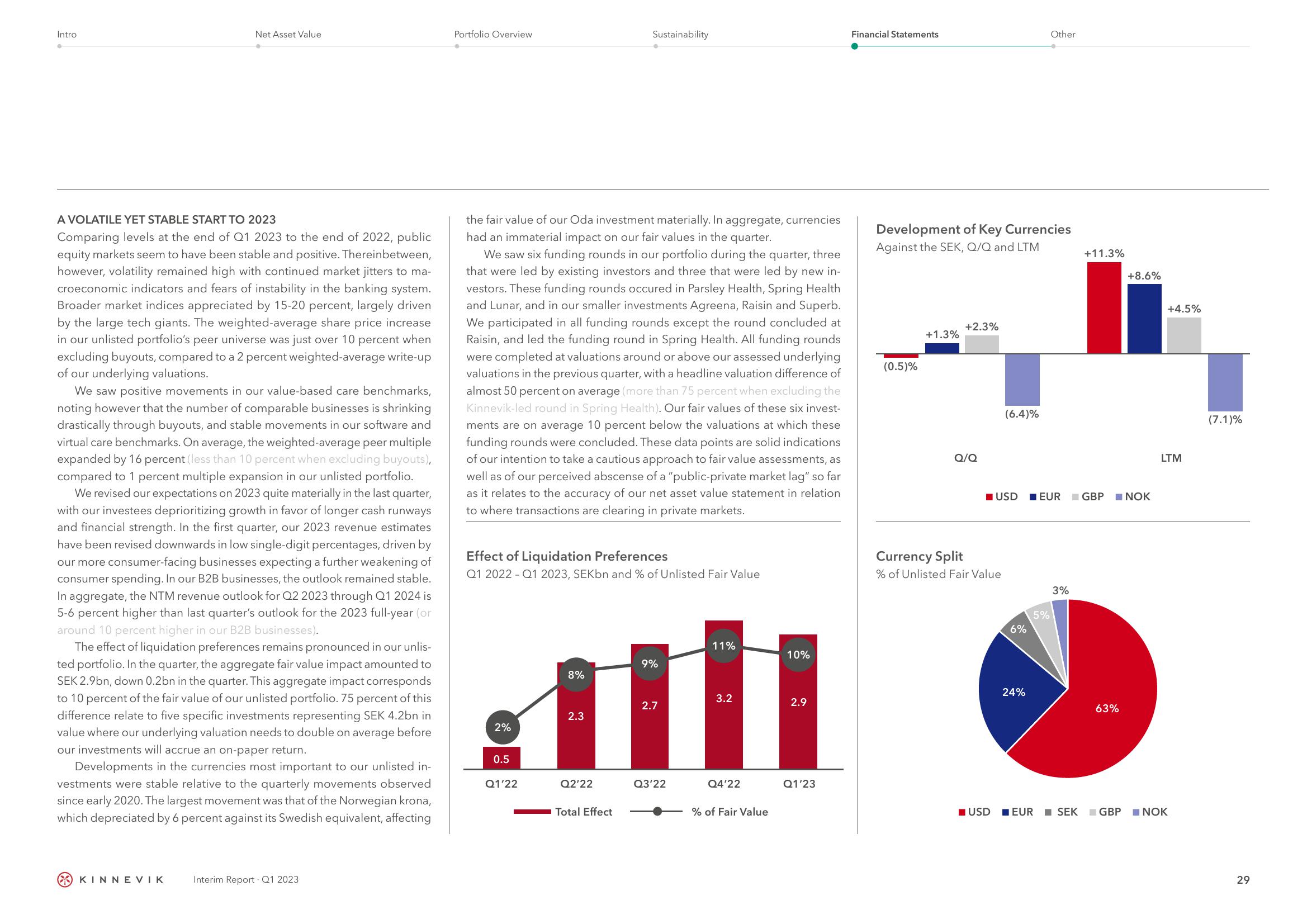

The effect of liquidation preferences remains pronounced in our unlis-

ted portfolio. In the quarter, the aggregate fair value impact amounted to

SEK 2.9bn, down 0.2bn in the quarter. This aggregate impact corresponds

to 10 percent of the fair value of our unlisted portfolio. 75 percent of this

difference relate to five specific investments representing SEK 4.2bn in

value where our underlying valuation needs to double on average before

our investments will accrue an on-paper return.

Developments in the currencies most important to our unlisted in-

vestments were stable relative to the quarterly movements observed

since early 2020. The largest movement was that of the Norwegian krona,

which depreciated by 6 percent against its Swedish equivalent, affecting

KINNEVIK

Interim Report Q1 2023

Portfolio Overview

the fair value of our Oda investment materially. In aggregate, currencies

had an immaterial impact on our fair values in the quarter.

We saw six funding rounds in our portfolio during the quarter, three

that were led by existing investors and three that were led by new in-

vestors. These funding rounds occured in Parsley Health, Spring Health

and Lunar, and in our smaller investments Agreena, Raisin and Superb.

We participated in all funding rounds except the round concluded at

Raisin, and led the funding round in Spring Health. All funding rounds

were completed at valuations around or above our assessed underlying

valuations in the previous quarter, with a headline valuation difference of

almost 50 percent on average (more than 75 percent when excluding the

Kinnevik-led round in Spring Health). Our fair values of these six invest-

ments are on average 10 percent below the valuations at which these

funding rounds were concluded. These data points are solid indications

of our intention to take a cautious approach to fair value assessments, as

well as of our perceived abscense of a "public-private market lag" so far

as it relates to the accuracy of our net asset value statement in relation

to where transactions are clearing in private markets.

Effect of Liquidation Preferences

Q1 2022-Q1 2023, SEKbn and % of Unlisted Fair Value

2%

0.5

Q1'22

8%

2.3

Sustainability

Q2'22

Total Effect

9%

2.7

Q3'22

11%

3.2

Q4'22

% of Fair Value

10%

2.9

Q1'23

Financial Statements

Development of Key Currencies

Against the SEK, Q/Q and LTM

(0.5)%

+1.3%

+2.3%

Q/Q

(6.4)%

USD

Currency Split

% of Unlisted Fair Value

6%

24%

Other

5%

EUR GBP

+11.3%

3%

63%

USD EUR SEK GBP

+8.6%

NOK

+4.5%

LTM

NOK

(7.1)%

29View entire presentation