UBS Shareholder Engagement Presentation Deck

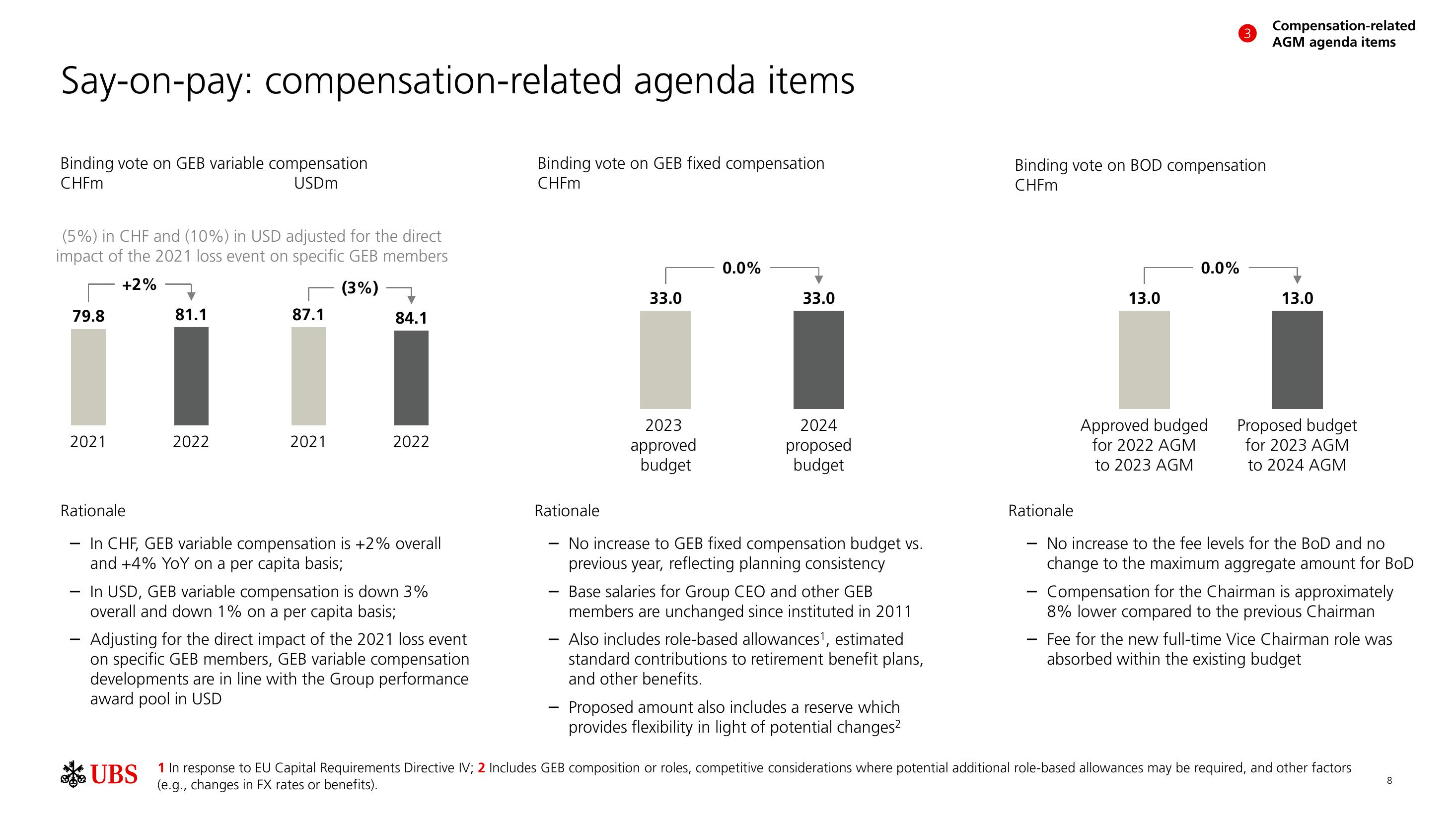

Say-on-pay: compensation-related agenda items.

Binding vote on GEB variable compensation

CHFm

Binding vote on GEB fixed compensation

CHFm

USDm

(5%) in CHF and (10%) in USD adjusted for the direct

impact of the 2021 loss event on specific GEB members

+2%

(3%)

79.8

2021

81.1

2022

87.1

2021

84.1

2022

Rationale

In CHF, GEB variable compensation is +2% overall

and +4% YoY on a per capita basis;

In USD, GEB variable compensation is down 3%

overall and down 1% on a per capita basis;

- Adjusting for the direct impact of the 2021 loss event

on specific GEB members, GEB variable compensation

developments are in line with the Group performance

award pool in USD

33.0

2023

approved

budget

-

0.0%

33.0

2024

proposed

budget

Rationale

No increase to GEB fixed compensation budget vs.

previous year, reflecting planning consistency

Base salaries for Group CEO and other GEB

members are unchanged since instituted in 2011

-

- Also includes role-based allowances¹, estimated

standard contributions to retirement benefit plans,

and other benefits.

Proposed amount also includes a reserve which

provides flexibility in light of potential changes²

Binding vote on BOD compensation

CHFm

Rationale

13.0

0.0%

3

Approved budged

for 2022 AGM

to 2023 AGM

Compensation-related

AGM agenda items

13.0

Proposed budget

for 2023 AGM

to 2024 AGM

No increase to the fee levels for the BoD and no

change to the maximum aggregate amount for BoD

Compensation for the Chairman is approximately

8% lower compared to the previous Chairman

Fee for the new Il-time Vice Chairman role was

absorbed within the existing budget

UBS

1 In response to EU Capital Requirements Directive IV; 2 Includes GEB composition or roles, competitive considerations where potential additional role-based allowances may be required, and other factors

(e.g., changes in FX rates or benefits).

8View entire presentation