OppFi Investor Presentation Deck

Originations

($ in millions)

& Percent

Growth

·

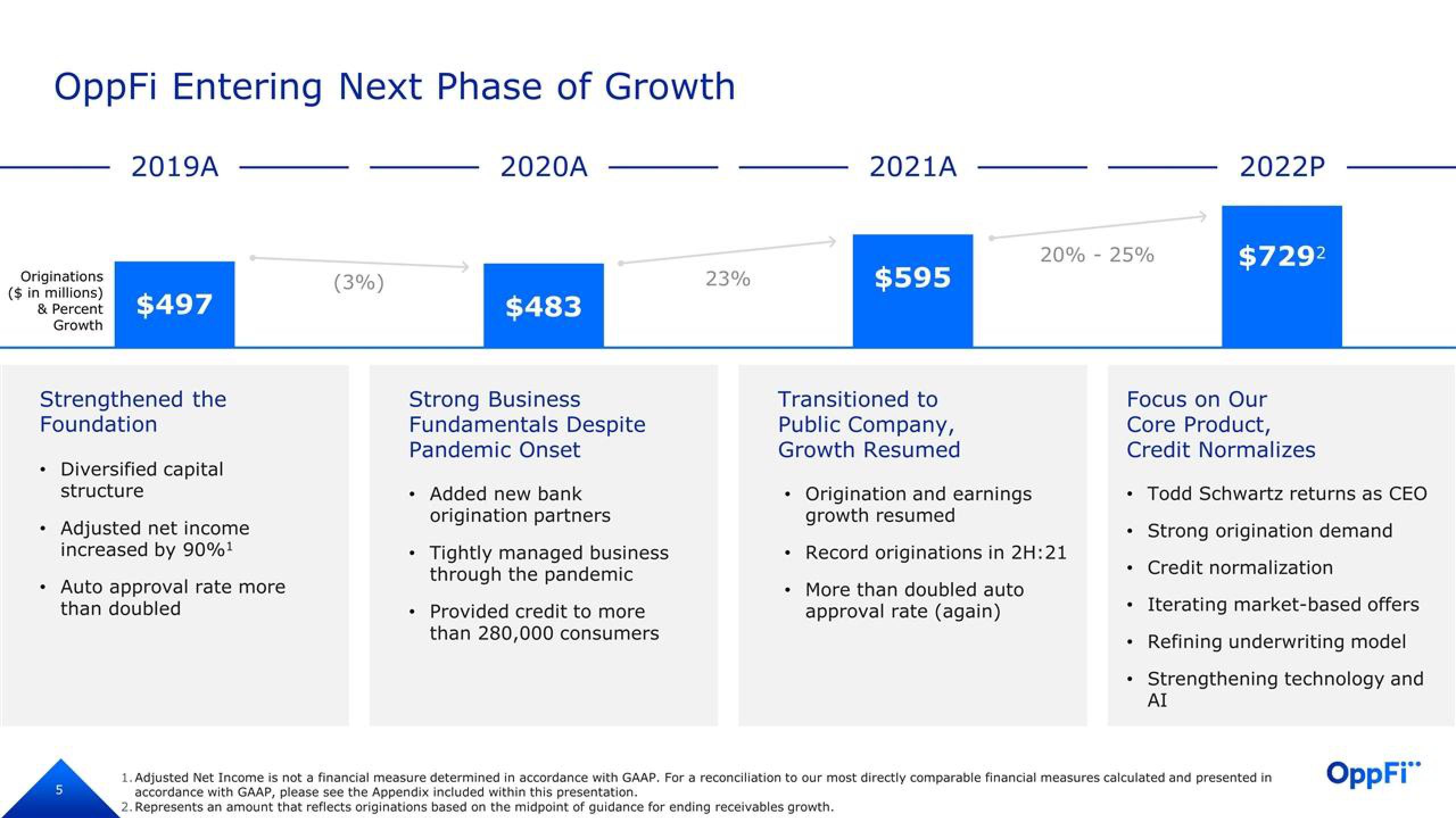

OppFi Entering Next Phase of Growth

.

Strengthened the

Foundation

.

2019A

$497

Diversified capital

structure

Adjusted net income

increased by 90%¹

In

Auto approval rate more

than doubled

(3%)

2020A

.

$483

Strong Business

Fundamentals Despite

Pandemic Onset

Added new bank

origination partners

Tightly managed business

through the pandemic

Provided credit to more

than 280,000 consumers

23%

2021A

Transitioned to

Public Company,

Growth Resumed

.

$595

⠀

Origination and earnings

growth resumed

Record originations in 2H:21

. More than doubled auto

approval rate (again)

20% - 25%

·

Focus on Our

Core Product,

Credit Normalizes

#

.

·

2022P

$729²

Todd Schwartz returns as CEO

Strong origination demand

Credit normalization

AI

Iterating market-based offers

Refining underwriting model

Strengthening technology and

1. Adjusted Net Income is not a financial measure determined in accordance with GAAP. For a reconciliation to our most directly comparable financial measures calculated and presented in

accordance with GAAP, please see the Appendix included within this presentation.

2. Represents an amount that reflects originations based on the midpoint of guidance for ending receivables growth.

OppFi"View entire presentation