Silicon Valley Bank Results Presentation Deck

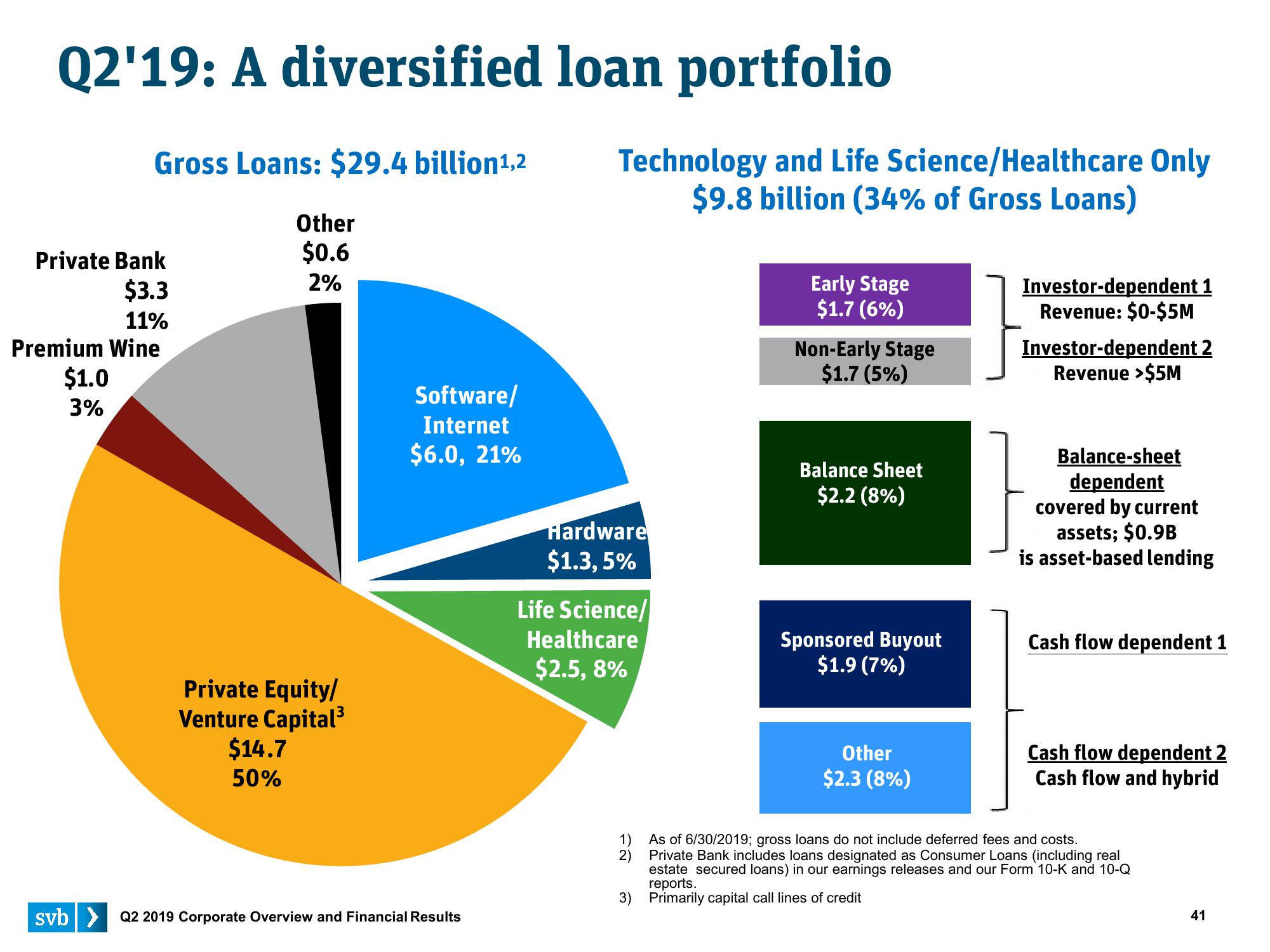

Q2'19: A diversified loan portfolio

Gross Loans: $29.4 billion¹,2

Private Bank

$3.3

11%

Premium Wine

$1.0

3%

Other

$0.6

2%

Private Equity/

Venture Capital³

$14.7

50%

Software/

Internet

$6.0, 21%

svb> Q2 2019 Corporate Overview and Financial Results

Technology and Life Science/Healthcare Only

$9.8 billion (34% of Gross Loans)

Hardware

$1.3,5%

Life Science/

Healthcare

$2.5, 8%

Early Stage

$1.7 (6%)

1)

2)

Non-Early Stage

$1.7 (5%)

Balance Sheet

$2.2 (8%)

Sponsored Buyout

$1.9 (7%)

Other

$2.3 (8%)

Investor-dependent 1

Revenue: $0-$5M

Investor-dependent 2

Revenue >$5M

Balance-sheet

dependent

covered by current

assets; $0.9B

is asset-based lending

Cash flow dependent 1

Cash flow dependent 2

Cash flow and hybrid

As of 6/30/2019; gross loans do not include deferred fees and costs.

Private Bank includes loans designated as Consumer Loans (including real

estate secured loans) in our earnings releases and our Form 10-K and 10-Q

reports.

3) Primarily capital call lines of credit

41View entire presentation