DraftKings Results Presentation Deck

PRO FORMA DRAFTKINGS P&L AND ADJUSTED EBITDA RECONCILIATION

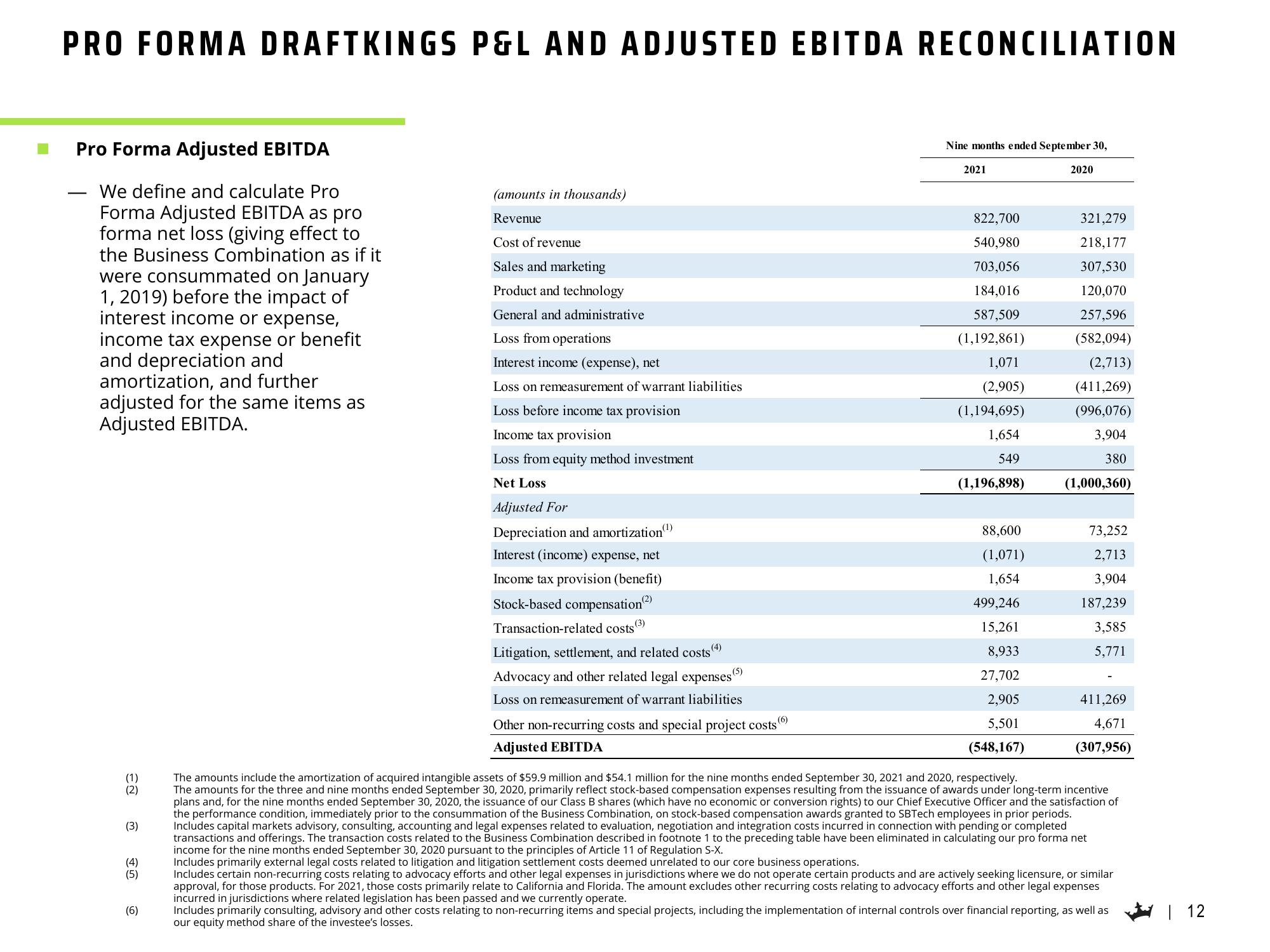

Pro Forma Adjusted EBITDA

We define and calculate Pro

Forma Adjusted EBITDA as pro

forma net loss (giving effect to

the Business Combination as if it

were consummated on January

1, 2019) before the impact of

interest income or expense,

income tax expense or benefit

and depreciation and

amortization, and further

adjusted for the same items as

Adjusted EBITDA.

(1)

(2)

(3)

(4)

(5)

(6)

(amounts in thousands)

Revenue

Cost of revenue

Sales and marketing

Product and technology

General and administrative

Loss from operations

Interest income (expense), net

Loss on remeasurement of warrant liabilities

Loss before income tax provision

Income tax provision

Loss from equity method investment

Net Loss

Adjusted For

Depreciation and amortization (¹)

Interest (income) expense, net

Income tax provision (benefit)

Stock-based compensation (²)

Transaction-related costs

Litigation, settlement, and related costs"

Advocacy and other related legal expenses

Loss on remeasurement of warrant liabilities

(3)

(4)

(6)

Other non-recurring costs and special project costs

Adjusted EBITDA

(5)

Nine months ended September 30,

2021

822,700

540,980

703,056

184,016

587,509

(1,192,861)

1,071

(2,905)

(1,194,695)

1,654

549

(1,196,898)

88,600

(1,071)

1,654

499,246

15,261

8,933

27,702

2,905

5,501

(548,167)

2020

321,279

218,177

307,530

120,070

257,596

(582,094)

(2,713)

(411,269)

(996,076)

3,904

380

(1,000,360)

73,252

2,713

3,904

187,239

3,585

5,771

411,269

4,671

(307,956)

The amounts include the amortization of acquired intangible assets of $59.9 million and $54.1 million for the nine months ended September 30, 2021 and 2020, respectively.

The amounts for the three and nine months ended September 30, 2020, primarily reflect stock-based compensation expenses resulting from the issuance of awards under long-term incentive

plans and, for the nine months ended September 30, 2020, the issuance of our Class B shares (which have no economic or conversion rights) to our Chief Executive Officer and the satisfaction of

the performance condition, immediately prior to the consummation of the Business Combination, on stock-based compensation awards granted to SBTech employees in prior periods.

Includes capital markets advisory, consulting, accounting and legal expenses related to evaluation, negotiation and integration costs incurred in connection with pending or completed

transactions and offerings. The transaction costs related to the Business Combination described in footnote 1 to the preceding table have been eliminated in calculating our pro forma net

income for the nine months ended September 30, 2020 pursuant to the principles of Article 11 of Regulation S-X.

Includes primarily external legal costs related to litigation and litigation settlement costs deemed unrelated to our core business operations.

Includes certain non-recurring costs relating to advocacy efforts and other legal expenses in jurisdictions where we do not operate certain products and are actively seeking licensure, or similar

approval, for those products. For 2021, those costs primarily relate to California and Florida. The amount excludes other recurring costs relating to advocacy efforts and other legal expenses

incurred in jurisdictions where related legislation has been passed and we currently operate.

Includes primarily consulting, advisory and other costs relating to non-recurring items and special projects, including the implementation of internal controls over financial reporting, as well as

our equity method share of the investee's losses.

| 12View entire presentation