Trian Partners Activist Presentation Deck

Q3 '18: Earnings Pre-Announced For a Third Consecutive Year

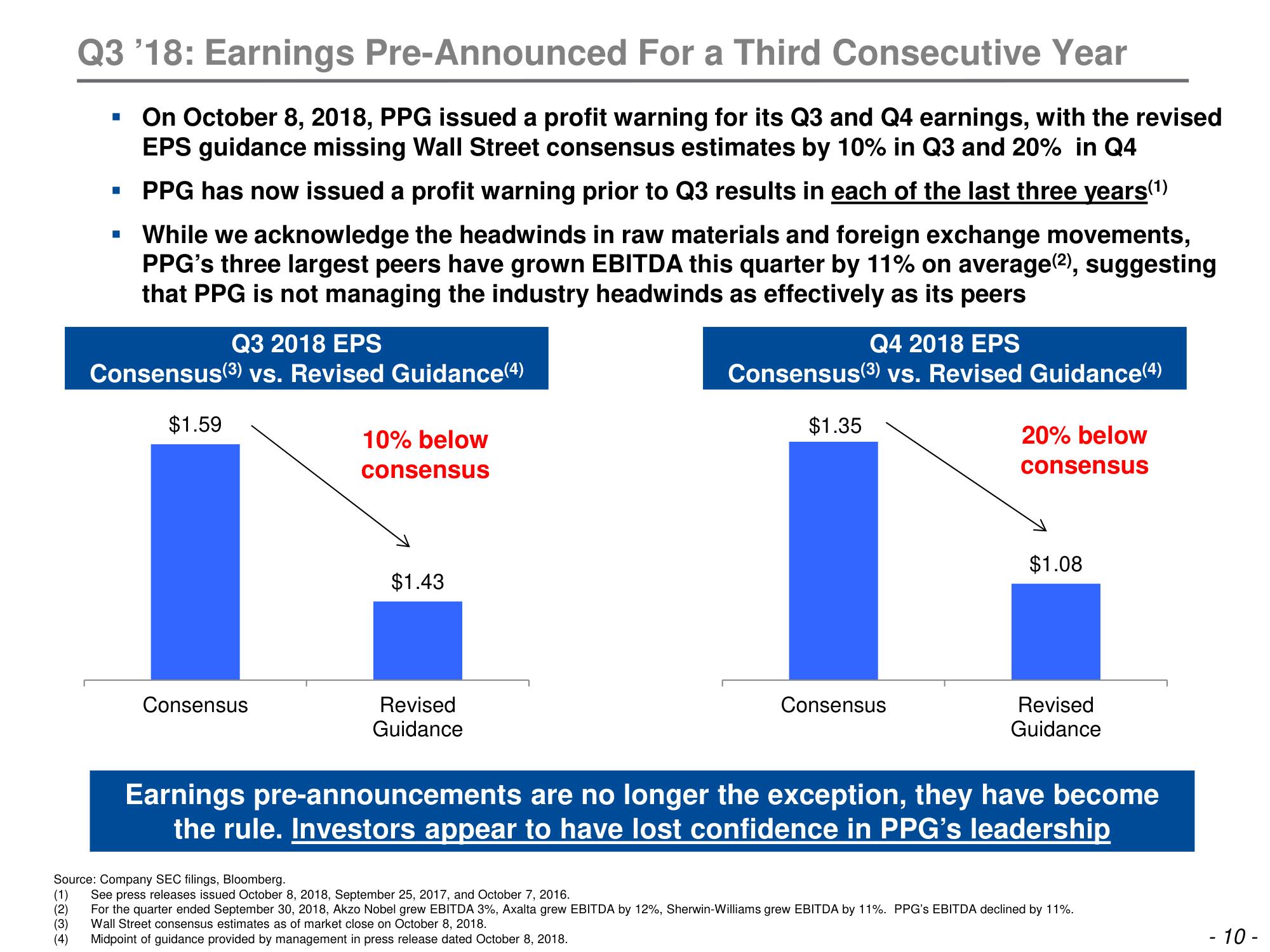

▪ On October 8, 2018, PPG issued a profit warning for its Q3 and Q4 earnings, with the revised

EPS guidance missing Wall Street consensus estimates by 10% in Q3 and 20% in Q4

PPG has now issued a profit warning prior to Q3 results in each of the last three years(1)

While we acknowledge the headwinds in raw materials and foreign exchange movements,

PPG's three largest peers have grown EBITDA this quarter by 11% on average(2), suggesting

that PPG is not managing the industry headwinds as effectively as its peers

■

Q3 2018 EPS

Consensus (3) vs. Revised Guidance (4)

$1.59

Consensus

10% below

consensus

$1.43

Revised

Guidance

Q4 2018 EPS

Consensus (3) vs. Revised Guidance (4)

$1.35

Consensus

20% below

consensus

$1.08

Revised

Guidance

Earnings pre-announcements are no longer the exception, they have become

the rule. Investors appear to have lost confidence in PPG's leadership

Source: Company SEC filings, Bloomberg.

(1)

See press releases issued October 8, 2018, September 25, 2017, and October 7, 2016.

(2) For the quarter ended September 30, 2018, Akzo Nobel grew EBITDA 3%, Axalta grew EBITDA by 12%, Sherwin-Williams grew EBITDA by 11%. PPG's EBITDA declined by 11%.

(3) Wall Street consensus estimates as of market close on October 8, 2018.

(4) Midpoint of guidance provided by management in press release dated October 8, 2018.

- 10 -View entire presentation