Frontier IPO Presentation Deck

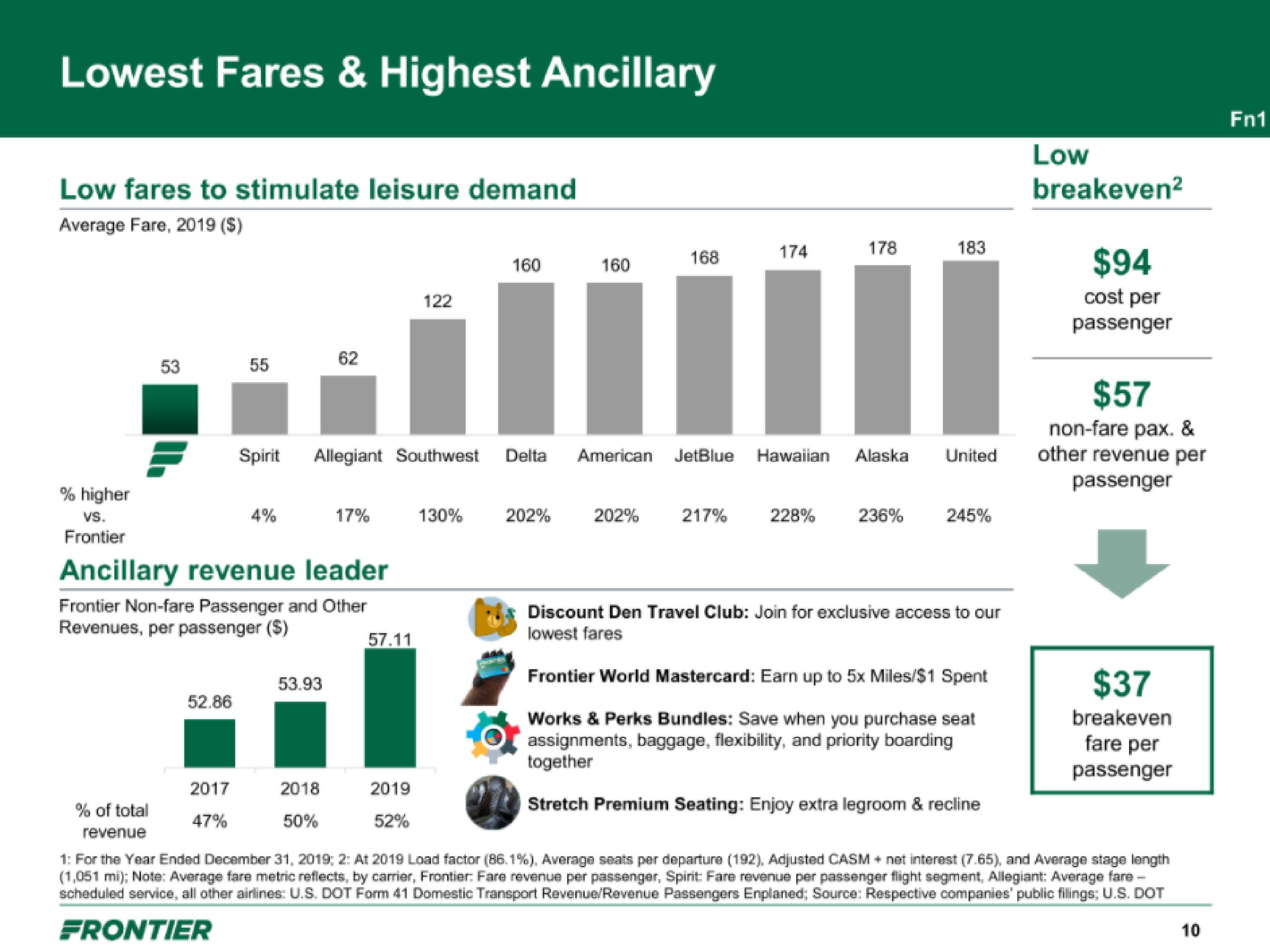

Lowest Fares & Highest Ancillary

Low fares to stimulate leisure demand

Average Fare, 2019 ($)

% higher

VS.

Frontier

53

% of total

revenue

52.86

55

2017

47%

4%

Ancillary revenue leader

Frontier Non-fare Passenger and Other

Revenues, per passenger ($)

62

53.93

2018

50%

Spirit Allegiant Southwest Delta American JetBlue

17%

57.11

122

2019

52%

160

130%

160

202%

168

202%

217%

174

Hawaiian

228%

178

II

Alaska

183

236%

United

245%

Discount Den Travel Club: Join for exclusive access to our

lowest fares

Frontier World Mastercard: Earn up to 5x Miles/$1 Spent

Works & Perks Bundles: Save when you purchase seat

assignments, baggage, flexibility, and priority boarding

together

Stretch Premium Seating: Enjoy extra legroom & recline

Low

breakeven²

$94

cost per

passenger

$57

non-fare pax. &

other revenue per

passenger

$37

breakeven

fare per

passenger

1: For the Year Ended December 31, 2019; 2: At 2019 Load factor (86.1%), Average seats per departure (192), Adjusted CASM + not interest (7.65), and Average stage length

(1,051 mi); Note: Average fare metric reflects, by carrier, Frontier: Fare revenue per passenger, Spirit: Fare revenue per passenger flight segment, Allegiant: Average fare -

scheduled service, all other airlines: U.S. DOT Form 41 Domestic Transport Revenue/Revenue Passengers Enplaned; Source: Respective companies' public filings; U.S. DOT

FRONTIER

10

Fn1View entire presentation