ValueAct Capital Activist Presentation Deck

Step 4. Operational Review of 7-Eleven Outside of Japan

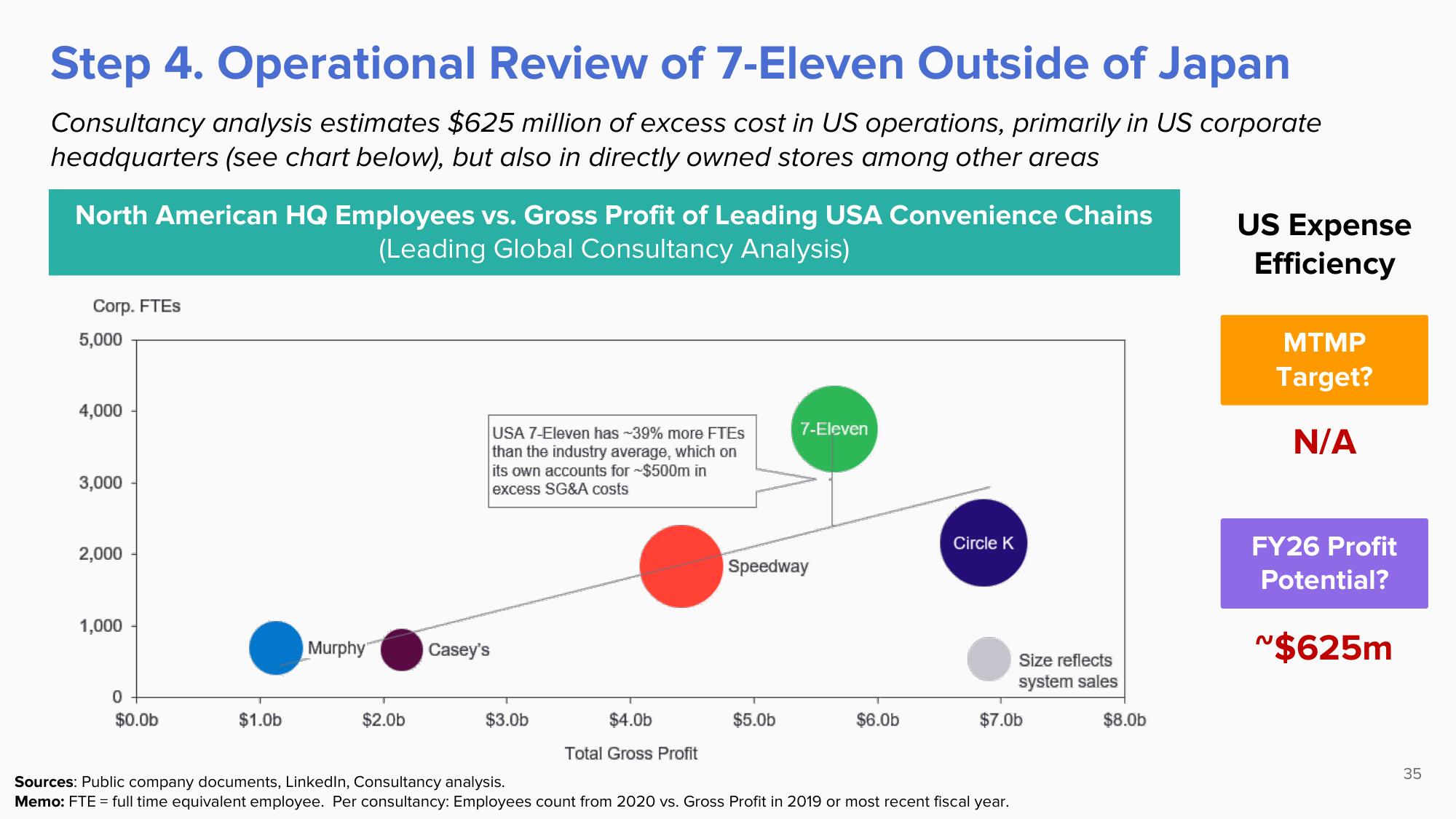

Consultancy analysis estimates $625 million of excess cost in US operations, primarily in US corporate

headquarters (see chart below), but also in directly owned stores among other areas

North American HQ Employees vs. Gross Profit of Leading USA Convenience Chains

(Leading Global Consultancy Analysis)

Corp. FTES

5,000

4,000

3,000

2,000

1,000

0

$0.0b

$1.0b

Murphy

$2.0b

Casey's

USA 7-Eleven has -39% more FTES

than the industry average, which on

its own accounts for ~$500m in

excess SG&A costs

$3.0b

$4.0b

Total Gross Profit

7-Eleven

Speedway

$5.0b

$6.0b

Circle K

Size reflects

system sales

$7.0b

Sources: Public company documents, LinkedIn, Consultancy analysis.

Memo: FTE = full time equivalent employee. Per consultancy: Employees count from 2020 vs. Gross Profit in 2019 or most recent fiscal year.

$8.0b

US Expense

Efficiency

MTMP

Target?

N/A

FY26 Profit

Potential?

~$625m

35View entire presentation