BenevolentAI Investor Conference Presentation Deck

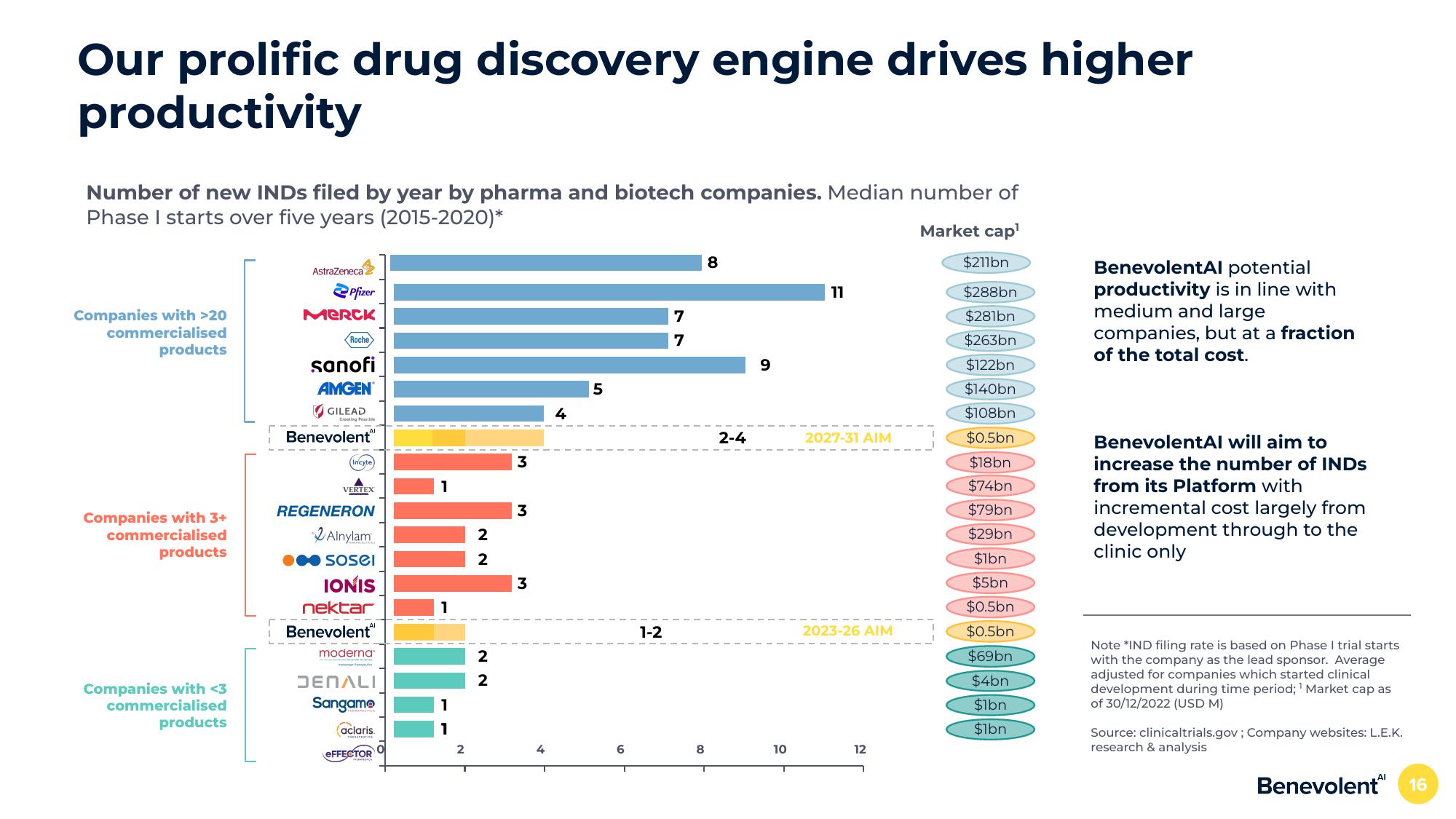

Our prolific drug discovery engine drives higher

productivity

Number of new INDs filed by year by pharma and biotech companies. Median number of

Phase I starts over five years (2015-2020)*

Market cap¹

$211bn

$288bn

$281bn

$263bn

$122bn

$140bn

$108bn

$0.5bn

$18bn

$74bn

$79bn

$29bn

$1bn

$5bn

$0.5bn

Companies with >20

commercialised

products

Companies with 3+

commercialised

products

Companies with <3

commercialised

products

AstraZeneca

Pfizer

Merck

Roche

sanofi

AMGEN

GILEAD

Creating Possible

Benevolent

(Incyte)

VERTEX

REGENERON

Alnylam

sosel

IONIS

nektar

Benevolent

moderna

DENALI

Sangamo

aclaris.

EFFECTOR

1

2

2

2

N N

2

3

M

3

4

5

6

1-2

7

7

8

8

2-4

9

10

11

2027-31 AIM

2023-26 AIM

12

$0.5bn

$69bn

$4bn

$1bn

$1bn

BenevolentAl potential

productivity is in line with

medium and large

companies, but at a fraction

of the total cost.

BenevolentAl will aim to

increase the number of INDS

from its Platform with

incremental cost largely from

development through to the

clinic only

Note *IND filing rate is based on Phase I trial starts

with the company as the lead sponsor. Average

adjusted for companies which started clinical

development during time period; ¹ Market cap as

of 30/12/2022 (USD M)

Source: clinicaltrials.gov; Company websites: L.E.K.

research & analysis

Benevolent 16View entire presentation